UPS 2015 Annual Report Download - page 124

Download and view the complete annual report

Please find page 124 of the 2015 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.UNITED PARCEL SERVICE, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

112

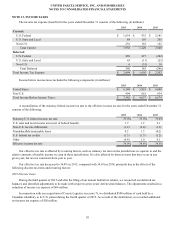

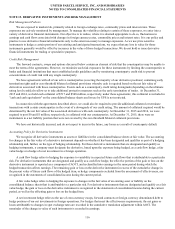

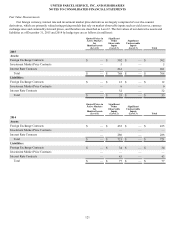

In the fourth quarter of 2015, we recognized an income tax benefit of $39 million related to pre-tax mark-to-market losses

of $118 million on our pension and postretirement defined benefit plans. This income tax benefit was generated at a lower

average statutory tax rate than our U.S. federal statutory tax rate because it was due, in part, to non-U.S. benefit plans.

Other favorable rate impacting items in 2015 include: resolution of several U.S. state and local tax matters; the extension

of favorable U.S. federal tax provisions associated with the Protecting Americans from Tax Hikes Act of 2015 related to

research and development tax credits and work opportunity tax credits; and the execution of two bilateral advance pricing

agreements. These agreements established intercompany transfer pricing arrangements between the U.S. and certain non-U.S.

jurisdictions related to our small package operations for tax years 2010 through 2019.

2014 Discrete Items

In 2014, we recorded a $415 million tax benefit related to a pre-tax charge of $1.102 billion for certain health and welfare

plan changes (see note 5). This income tax benefit was generated at a higher average statutory tax rate than our U.S. federal

statutory tax rate because it included the effect of U.S. state and local taxes.

In the fourth quarter of 2014, we recognized an income tax benefit of $392 million related to pre-tax mark-to-market

losses of $1.062 billion on our pension and postretirement defined benefit plans. This income tax benefit was generated at a

higher average statutory tax rate than the U.S. federal statutory tax rate because it included the effect of U.S. state and local

taxes.

Other Items

Beginning in 2012, we were granted a tax incentive for certain of our non-U.S. operations, which is effective through

December 31, 2017 and may be extended through December 31, 2022 if additional requirements are satisfied. The tax incentive

is conditional upon our meeting specific employment and investment thresholds. The impact of this tax incentive decreased

non-U.S. tax expense by $25, $21 and $20 million for 2015, 2014, and 2013, respectively.