UPS 2015 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2015 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITED PARCEL SERVICE, INC. AND SUBSIDIARIES

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS

47

Liquidity and Capital Resources

Operating Activities

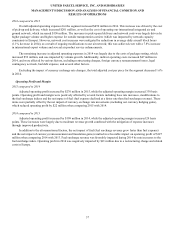

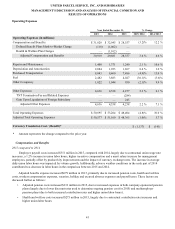

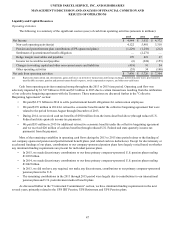

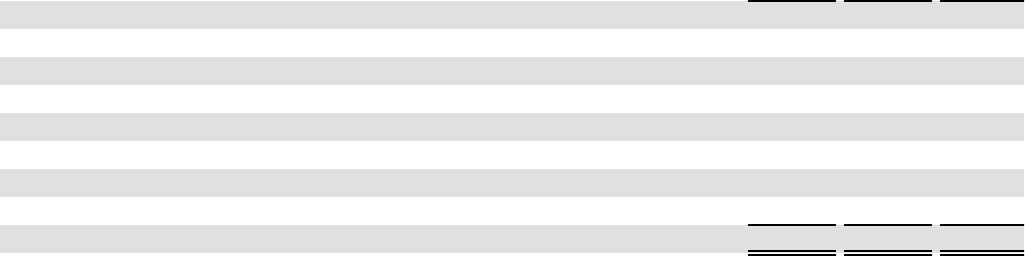

The following is a summary of the significant sources (uses) of cash from operating activities (amounts in millions):

2015 2014 2013

Net Income $ 4,844 $ 3,032 $ 4,372

Non-cash operating activities(a) 4,122 5,901 3,318

Pension and postretirement plan contributions (UPS-sponsored plans) (1,229)(1,258)(212)

Settlement of postretirement benefit obligation — (2,271)—

Hedge margin receivables and payables 170 421 67

Income tax receivables and payables (6)(224)(155)

Changes in working capital and other non-current assets and liabilities (418)9154

Other operating activities (53)34

(140)

Net cash from operating activities $ 7,430 $ 5,726 $ 7,304

(a) Represents depreciation and amortization, gains and losses on derivative transactions and foreign exchange, deferred income taxes, provisions for

uncollectible accounts, pension and postretirement benefit expense, stock compensation expense, and other non-cash items.

Cash from operating activities remained strong throughout the 2013 to 2015 time period. Operating cash flow was

adversely impacted by $1.527 billion in 2014 and $33 million in 2015 due to certain transactions resulting from the ratification

of our collective bargaining agreement with the Teamsters. These transactions are discussed further in the "Collective

Bargaining Agreements" section:

• We paid $2.271 billion in 2014 to settle postretirement benefit obligations for certain union employees.

• We paid $176 million in 2014 for retroactive economic benefits under the collective bargaining agreement that were

related to the period between August through December of 2013.

• During 2014, we received cash tax benefits of $920 million from the items described above (through reduced U.S.

Federal and state quarterly income tax payments).

• We paid $53 million in 2015 for additional retroactive economic benefits under the collective bargaining agreement

and we received $20 million of cash tax benefits (through reduced U.S. Federal and state quarterly income tax

payments) from the payment.

Most of the remaining variability in operating cash flows during the 2013 to 2015 time period relates to the funding of

our company-sponsored pension and postretirement benefit plans (and related cash tax deductions). Except for discretionary or

accelerated fundings of our plans, contributions to our company-sponsored pension plans have largely varied based on whether

any minimum funding requirements are present for individual pension plans.

• In 2015, we made discretionary contributions to our three primary company-sponsored U.S. pension plans totaling

$1.030 billion.

• In 2014, we made discretionary contributions to our three primary company-sponsored U.S. pension plans totaling

$1.042 billion.

• In 2013, we did not have any required, nor make any discretionary, contributions to our primary company-sponsored

pension plans in the U.S.

• The remaining contributions in the 2013 through 2015 period were largely due to contributions to our international

pension plans and U.S. postretirement medical benefit plans.

As discussed further in the “Contractual Commitments” section, we have minimum funding requirements in the next

several years, primarily related to the UPS IBT Pension, UPS Retirement and UPS Pension plans.