UPS 2015 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2015 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148

|

|

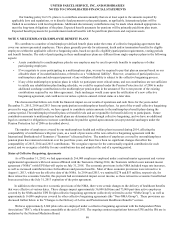

UNITED PARCEL SERVICE, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

80

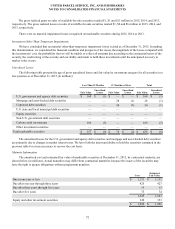

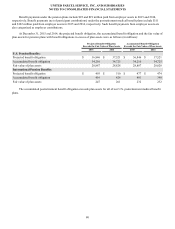

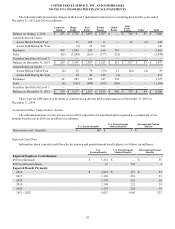

Benefit payments under the pension plans include $22 and $19 million paid from employer assets in 2015 and 2014,

respectively. Benefit payments (net of participant contributions) under the postretirement medical benefit plans include $111

and $122 million paid from employer assets in 2015 and 2014, respectively. Such benefit payments from employer assets are

also categorized as employer contributions.

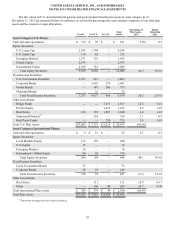

At December 31, 2015 and 2014, the projected benefit obligation, the accumulated benefit obligation and the fair value of

plan assets for pension plans with benefit obligations in excess of plan assets were as follows (in millions):

Projected Benefit Obligation

Exceeds the Fair Value of Plan Assets

Accumulated Benefit Obligation

Exceeds the Fair Value of Plan Assets

2015 2014 2015 2014

U.S. Pension Benefits:

Projected benefit obligation $ 36,846 $ 37,521 $ 36,846 $ 37,521

Accumulated benefit obligation 34,210 34,725 34,210 34,725

Fair value of plan assets 28,887 28,828 28,887 28,828

International Pension Benefits:

Projected benefit obligation $ 493 $ 510 $ 477 $ 474

Accumulated benefit obligation 416 426 401 398

Fair value of plan assets 247 261 232 232

The accumulated postretirement benefit obligation exceeds plan assets for all of our U.S. postretirement medical benefit

plans.