UPS 2015 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2015 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITED PARCEL SERVICE, INC. AND SUBSIDIARIES

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS

51

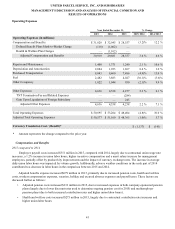

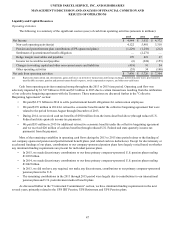

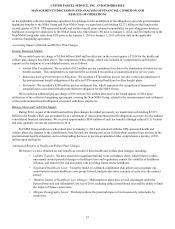

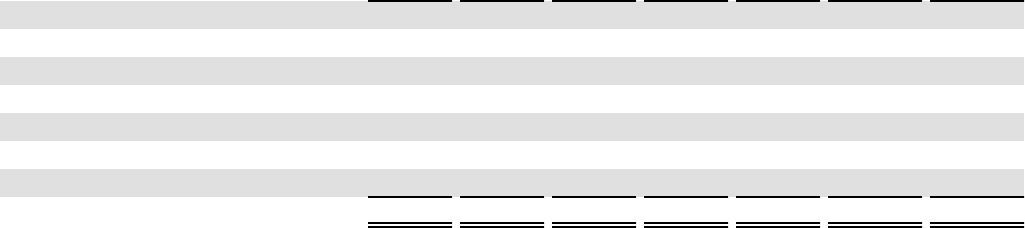

Contractual Commitments

We have contractual obligations and commitments in the form of capital leases, operating leases, debt obligations,

purchase commitments, and certain other liabilities. We intend to satisfy these obligations through the use of cash flow from

operations. The following table summarizes the expected cash outflow to satisfy our contractual obligations and commitments

as of December 31, 2015 (in millions):

Commitment Type 2016 2017 2018 2019 2020 After 2020 Total

Capital Leases $ 72 $ 73 $ 61 $ 59 $ 53 $ 392 $ 710

Operating Leases 324 263 197 125 84 266 1,259

Debt Principal 2,978 377 751 1,000 547 8,039 13,692

Debt Interest 296 296 282 257 231 3,856 5,218

Purchase Commitments 257 119 53 24 15 11 479

Pension Fundings 1,161 — 292 NA NA NA 1,453

Other Liabilities 23 10 5 — — — 38

Total $ 5,111 $ 1,138 $ 1,641 $ 1,465 $ 930 $ 12,564 $ 22,849

Our capital lease obligations relate primarily to leases on aircraft. Capital leases, operating leases, and purchase

commitments, as well as our debt principal obligations, are discussed further in note 8 to our consolidated financial statements.

The amount of interest on our debt was calculated as the contractual interest payments due on our fixed-rate debt, in addition to

interest on variable rate debt that was calculated based on interest rates as of December 31, 2015. The calculations of debt

interest take into account the effect of interest rate swap agreements. For debt denominated in a foreign currency, the

U.S. Dollar equivalent principal amount of the debt at the end of the year was used as the basis to calculate future interest

payments.

Purchase commitments represent contractual agreements to purchase goods or services that are legally binding, the

largest of which are orders for technology equipment and vehicles. As of December 31, 2015, we have no open aircraft orders.

Pension fundings represent a voluntary contribution for 2016 and anticipated required minimum cash contributions that

will be made to our qualified U.S. pension plans during 2017 and 2018 (these plans are discussed further in note 4 to the

consolidated financial statements). The amount of any minimum funding requirement, as applicable, for these plans could

change significantly in future periods, depending on many factors, including future plan asset returns, discount rates, and

changes to pension plan funding regulations. A sustained significant decline in the world equity markets, and the resulting

impact on our pension assets and investment returns, could result in our domestic pension plans being subject to significantly

higher minimum funding requirements. Actual contributions made in future years could materially differ from the amounts

shown in the table above, and consequently required minimum contributions beyond 2018 cannot be reasonably estimated.

As discussed in note 5 to our consolidated financial statements, we are not currently subject to any minimum

contributions or surcharges with respect to the multiemployer pension and health and welfare plans in which we participate.

Contribution rates to these multiemployer pension and health and welfare plans are established through the collective

bargaining process. As we are not subject to any minimum contribution levels, we have not included any amounts in the

contractual commitments table with respect to these multiemployer plans.

The contractual payments due for “other liabilities” primarily include commitment payments related to our investment in

certain partnerships. The table above does not include approximately $207 million of liabilities for uncertain tax positions

because we are uncertain if or when such amounts will ultimately be settled in cash. In addition, we also have recognized assets

associated with uncertain tax positions in excess of the related liabilities such that we do not believe a net contractual obligation

exists to the taxing authorities. Uncertain tax positions are further discussed in note 13 to the consolidated financial statements.

As of December 31, 2015, we had outstanding letters of credit totaling approximately $1.808 billion issued in connection

with our self-insurance reserves and other routine business requirements. We also issue surety bonds as an alternative to letters

of credit in certain instances, and as of December 31, 2015, we had $623 million of surety bonds written. As of December 31,

2015, we had unfunded loan commitments totaling $162 million associated with UPS Capital.