UPS 2015 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2015 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITED PARCEL SERVICE, INC. AND SUBSIDIARIES

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS

49

The proceeds from the disposal of property, plant and equipment were largely due to real estate sales during the 2013

through 2015 period, as well as the proceeds from insurance recoveries in 2013. The net decline in finance receivables in the

2013 through 2015 period was primarily due to customer paydowns and loan sales activity, primarily in our commercial

lending, asset-based lending and leasing portfolios. The purchases and sales of marketable securities are largely determined by

liquidity needs and the periodic rebalancing of investment types, and will therefore fluctuate from period to period.

The cash paid for business acquisitions in the 2013 to 2015 period was largely due to the acquisitions of Cemelog Ltd. in

Hungary (2013), i-parcel LLC in the U.S. (2014), Polar Speed Distribution Limited in the U.K. (2014), Poltraft Sp. z.o.o in

Poland (2015) Parcel Pro, Inc in the U.S. (2015) and Coyote Logistics Midco, Inc (2015), as well as other smaller acquisitions.

Other investing activities are impacted by changes in our restricted cash balances, capital contributions into certain

investment partnerships, and various other items. In 2015, 2014 and 2013, we increased the restricted cash balance associated

with our self-insurance requirements by $0, $17 and $137 million, respectively.

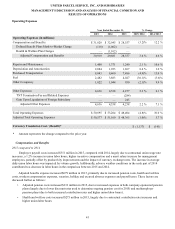

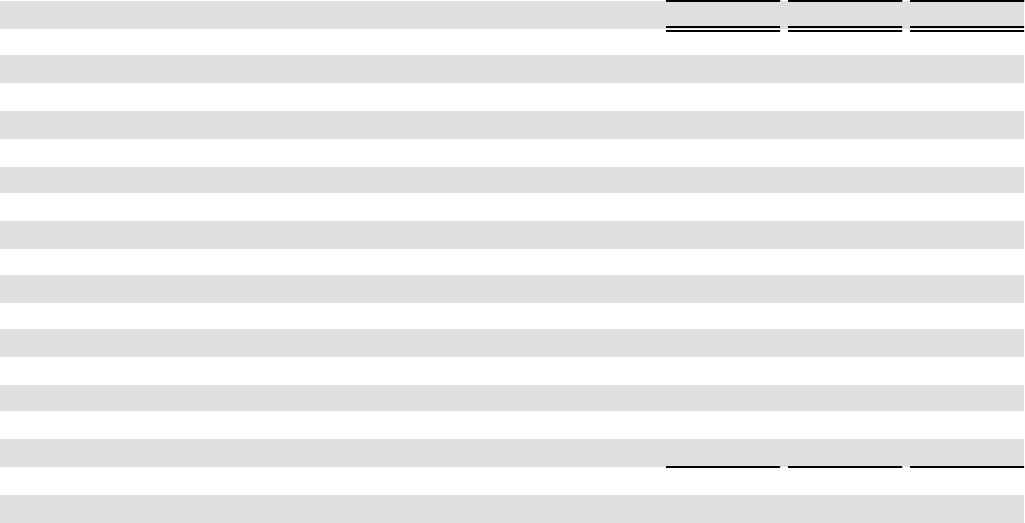

Financing Activities

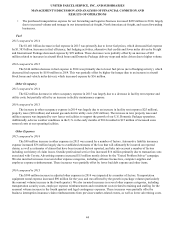

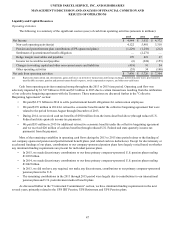

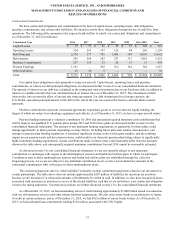

Our primary sources (uses) of cash for financing activities were as follows (amounts in millions, except per share data):

2015 2014 2013

Net cash used in financing activities $ (1,565) $ (5,161) $ (7,807)

Share Repurchases:

Cash expended for shares repurchased $ (2,702) $ (2,695) $ (3,838)

Number of shares repurchased (26.8) (26.4) (43.2)

Shares outstanding at year-end 886 905 923

Percent reduction in shares outstanding (2.1)% (2.0)% (3.1)%

Dividends:

Dividends declared per share $ 2.92 $ 2.68 $ 2.48

Cash expended for dividend payments $ (2,525) $ (2,366) $ (2,260)

Borrowings:

Net borrowings (repayments) of debt principal $ 3,588 $ (169) $ (1,775)

Other Financing Activities:

Cash received for common stock issuances $ 249 $ 274 $ 491

Other financing activities $ (175) $ (205) $ (425)

Capitalization:

Total debt outstanding at year-end $ 14,334 $ 10,779 $ 10,872

Total shareowners’ equity at year-end 2,491 2,158 6,488

Total capitalization $ 16,825 $ 12,937 $ 17,360

Debt to Total Capitalization % 85.2 % 83.3 % 62.6 %

On February 14, 2013, the Board of Directors approved a share repurchase authorization of $10.0 billion, which replaced

an authorization previously announced in 2012. The share repurchase authorization has no expiration date. As of December 31,

2015, we had $1.441 billion of this share repurchase authorization remaining. Share repurchases may take the form of

accelerated share repurchases, open market purchases, or other such methods as we deem appropriate. The timing of our share

repurchases will depend upon market conditions. Unless terminated earlier by the resolution of our Board, the program will

expire when we have purchased all shares authorized for repurchase under the program. We anticipate repurchasing

approximately $2.7 billion of shares in 2016.

The declaration of dividends is subject to the discretion of the Board of Directors and will depend on various factors,

including our net income, financial condition, cash requirements, future prospects, and other relevant factors. We expect to

continue the practice of paying regular cash dividends. In February 2016, we increased our quarterly dividend payment from

$0.73 to $0.78 per share, a 7% increase.