UPS 2015 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2015 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.66

UNITED PARCEL SERVICE, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

NOTE 1. SUMMARY OF ACCOUNTING POLICIES

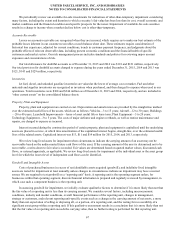

Basis of Financial Statements and Business Activities

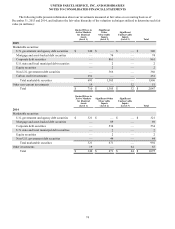

The accompanying consolidated financial statements have been prepared in accordance with accounting principles

generally accepted in the United States (“GAAP”), and include the accounts of United Parcel Service, Inc., and all of its

consolidated subsidiaries (collectively “UPS” or the “Company”). All intercompany balances and transactions have been

eliminated.

UPS concentrates its operations in the field of transportation services, primarily domestic and international letter and

package delivery. Through our Supply Chain & Freight subsidiaries, we are also a global provider of specialized transportation,

logistics and financial services.

Use of Estimates

The preparation of our consolidated financial statements requires the use of estimates and assumptions that affect the

reported amounts of assets and liabilities, the reported amounts of revenues and expenses, and the disclosure of contingencies.

Estimates have been prepared on the basis of the most current and best information, and actual results could differ materially

from those estimates.

Revenue Recognition

U.S. Domestic and International Package Operations—Revenue is recognized upon delivery of a letter or package.

Forwarding and Logistics—Freight forwarding revenue and the expense related to the transportation of freight are

recognized at the time the services are completed. Truckload freight brokerage revenue and related transportation costs are

recognized upon delivery of the shipment by a third party carrier. Material management and distribution revenue is recognized

upon performance of the service provided. Customs brokerage revenue is recognized upon completing documents necessary for

customs entry purposes.

Freight—Revenue is recognized upon delivery of a less-than-truckload (“LTL”) or truckload (“TL”) shipment.

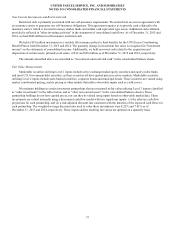

We utilize independent contractors and third-party carriers in the performance of some transportation services. In

situations where we act as principal party to the transaction, we recognize revenue on a gross basis; in circumstances where we

act as an agent, we recognize revenue net of the cost of the purchased transportation.

Financial Services—Income on loans and direct finance leases is recognized on the effective interest method. Accrual of

interest income is suspended at the earlier of the time at which collection of an account becomes doubtful or the account

becomes 90 days delinquent. Income on operating leases is recognized on the straight-line method over the terms of the

underlying leases.

Cash and Cash Equivalents

Cash and cash equivalents consist of highly liquid investments that are readily convertible into cash. We consider

securities with maturities of three months or less, when purchased, to be cash equivalents. The carrying amount of these

securities approximates fair value because of the short-term maturity of these instruments.

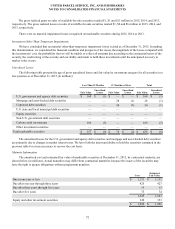

Investments

Marketable securities are either classified as trading or available-for-sale securities and are carried at fair value.

Unrealized gains and losses on trading securities are reported as investment income on the statements of consolidated income.

Unrealized gains and losses on available-for-sale securities are reported as accumulated other comprehensive income

(“AOCI”), a separate component of shareowners’ equity. The amortized cost of debt securities is adjusted for amortization of

premiums and accretion of discounts to maturity. Such amortization and accretion is included in investment income, along with

interest and dividends. The cost of securities sold is based on the specific identification method; realized gains and losses

resulting from such sales are included in investment income.