UPS 2015 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2015 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITED PARCEL SERVICE, INC. AND SUBSIDIARIES

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS

31

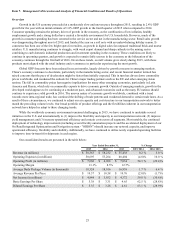

Revenue per piece decreased for our Next Day Air and deferred air products in 2015, as lower fuel surcharge rates more

than offset the positive impact of the base rate increase. Product mix adversely impacted Next Day Air and deferred revenue

per piece, as we experienced relatively stronger growth in our lighter-weight business-to-consumer shipments, which have

lower average yields than our heavier-weight commercial shipments. Customer mix also adversely impacted Next Day Air and

deferred revenue per piece, due to faster volume growth among our larger customers, which typically have a lower average

yield than our small and middle-market customers.

Ground revenue per piece increased in 2015, primarily due to the base rate increase, the dimensional weight pricing

change and product mix. Additionally, the revenue per piece for our traditional ground residential products was positively

impacted by our decision not to pursue certain lower-yielding customer contract renewals. These factors were partially offset

by declines in fuel surcharge rates as well as changes in customer mix, as we experienced faster volume growth among our

larger customers.

2014 compared to 2013

Overall revenue per piece decreased 1.5% in 2014, and was impacted by changes in base rates, customer and product mix,

and fuel surcharge rates.

Revenue per piece for our ground and air products was positively impacted by an increase in base rates that took effect on

December 30, 2013. We implemented an average 4.9% net increase in base and accessorial rates on UPS Next Day Air, UPS

2nd Day Air, UPS 3 Day Select and UPS Ground.

Revenue per piece increased for our Next Day Air products in 2014, largely due to the base rate increase, an increase in

the average weight per package, and a shift in product mix from lower-yielding letters towards higher-yielding packages.

Revenue per piece declined for our deferred products in 2014, as customer and product mix changes more than offset the

increase in base rates. Product mix adversely impacted deferred revenue per piece, as we experienced relatively stronger

growth in our lighter-weight business-to-consumer shipments, which have lower average yields than our heavier-weight

commercial shipments. Customer mix also adversely impacted deferred revenue per piece, due to faster volume growth among

our larger customers, which typically have a lower average yield than our smaller and middle-market customers.

Ground revenue per piece decreased in 2014, as customer and product mix changes more than offset the impact of the

base rate increase. Customer and product mix changes adversely impacted revenue per piece as a greater portion of our overall

volume in 2014, relative to 2013, came from lighter-weight shipments (including more than 45% volume growth in SurePost)

and larger customers.

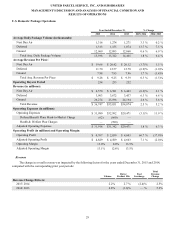

Fuel Surcharges

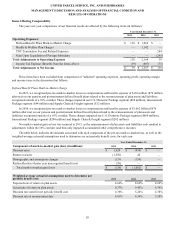

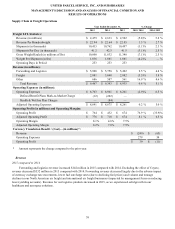

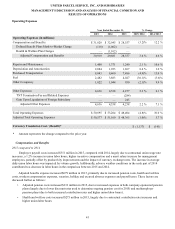

UPS applies a fuel surcharge on our domestic air and ground services. The air fuel surcharge is based on the U.S.

Department of Energy’s (“DOE”) Gulf Coast spot price for a gallon of kerosene-type jet fuel, while the ground fuel surcharge is

based on the DOE’s On-Highway Diesel Fuel Price. Based on published rates, the average fuel surcharge rates for domestic air

and ground products were as follows:

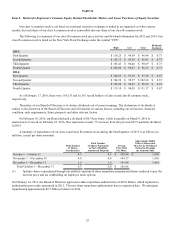

Year Ended December 31, % Point Change

2015 2014 2013 2015/ 2014 2014/ 2013

Next Day Air / Deferred 4.8% 10.2% 10.7% (5.4)% (0.5)%

Ground 5.5% 7.1% 7.2% (1.6)% (0.1)%

Total domestic fuel surcharge revenue decreased by $843 million in 2015 as a result of lower fuel surcharge rates caused

by declining jet and diesel fuel prices; however, the impact of lower fuel prices was partially mitigated by changes to the fuel

surcharge indices, as well as the overall increase in package volume for the period. In 2014, total fuel surcharge revenue

declined by $8 million as lower fuel surcharge rates (driven by lower fuel prices) more than offset the impact of increased air

and ground volume.