UPS 2015 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2015 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.UNITED PARCEL SERVICE, INC. AND SUBSIDIARIES

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS

46

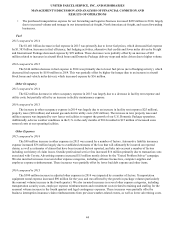

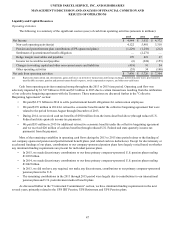

Our effective tax rate is affected by recurring factors, such as statutory tax rates in the jurisdictions we operate in and the

relative amounts of taxable income we earn in those jurisdictions. It is also affected by discrete items that may occur in any

given year but are not consistent from year to year. See note 13 to the audited consolidated financial statements for a more

complete description of the significant recurring and discrete items affecting our effective tax rate. As described in the Items

Affecting Comparability section, certain items have been excluded from comparisons of "adjusted" income taxes in the

discussion that follows.

2015 compared to 2014

Our adjusted effective tax rate decreased to 34.0% in 2015 from 35.5% in 2014 primarily due to favorable discrete tax

adjustments related to: (1) prior years' deferred tax balances; (2) execution of advance pricing agreements with certain foreign

tax jurisdictions; (3) resolution of several U.S. state and local tax matters; and (4) the extension of several previously expired

U.S. tax provisions in 2015. These benefits were partially offset by the additional U.S. tax expense associated with a cash

distribution from a Canadian subsidiary to its U.S. parent.

2014 compared to 2013

Our adjusted effective tax rate increased slightly to 35.5% in 2014 from 35.4% in 2013 due to a decrease in U.S. Federal

and state tax credits relative to total pre-tax income, which was largely offset by favorable changes in the proportion of our

taxable income in certain U.S. and non-U.S. jurisdictions relative to total pre-tax income.