UPS 2015 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2015 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITED PARCEL SERVICE, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

85

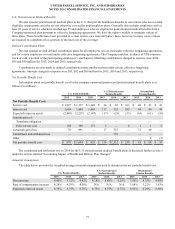

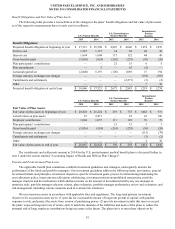

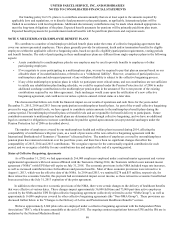

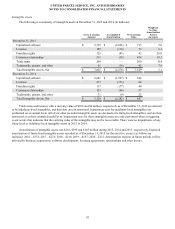

The following table presents the changes in the Level 3 instruments measured on a recurring basis for the years ended

December 31, 2015 and 2014 (in millions).

Corporate

Bonds

Hedge

Funds

Real

Estate

Private

Equity

Global

Bonds

Risk

Parity

Funds Other Total

Balance on January 1, 2014 $ 223 $ 3,738 $ 1,091 $ 1,397 $ — $ 756 $ 55 $ 7,260

Actual Return on Assets:

Assets Held at End of Year — 71 104 11 — 61 (2) 245

Assets Sold During the Year — (9) 23 126 — — — 140

Purchases 108 1,043 350 166 735 — — 2,402

Sales (62) (1,248) (261)(377)(122)— —

(2,070)

Transfers Into (Out of) Level 3 — — — — — — — —

Balance on December 31, 2014 $ 269 $ 3,595 $ 1,307 $ 1,323 $ 613 $ 817 $ 53 $ 7,977

Actual Return on Assets:

Assets Held at End of Year (8) 62 79 (39)11(62)(4)39

Assets Sold During the Year — 39 45 149 (2) — — 231

Purchases 22 283 545 347 130 — — 1,327

Sales (4) (362) (409)(365)(166)— —

(1,306)

Transfers Into (Out of) Level 3 — — — — — — — —

Balance on December 31, 2015 $ 279 $ 3,617 $ 1,567 $ 1,415 $ 586 $ 755 $ 49 $ 8,268

There were no UPS class A or B shares of common stock directly held in plan assets as of December 31, 2015 or

December 31, 2014.

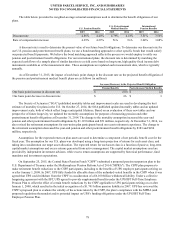

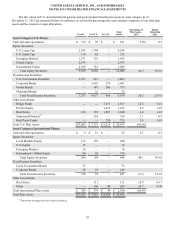

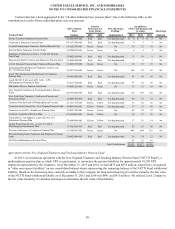

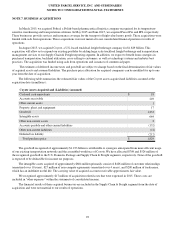

Accumulated Other Comprehensive Income

The estimated amounts of prior service cost in AOCI expected to be amortized and recognized as a component of net

periodic benefit cost in 2016 are as follows (in millions):

U.S. Pension Benefits

U.S. Postretirement

Medical Benefits

International Pension

Benefits

Prior service cost / (benefit) $ 166 $ 5 $ 1

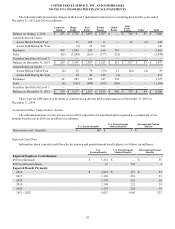

Expected Cash Flows

Information about expected cash flows for the pension and postretirement benefit plans is as follows (in millions):

U.S.

Pension Benefits

U.S. Postretirement

Medical Benefits

International Pension

Benefits

Expected Employer Contributions:

2016 to plan trusts $ 1,161 $ — $ 55

2016 to plan participants 16 101 3

Expected Benefit Payments:

2016 $ 1,067 $ 237 $ 23

2017 1,168 236 23

2018 1,278 232 26

2019 1,398 232 29

2020 1,529 228 32

2021 - 2025 9,822 1,005 222