UPS 2015 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2015 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITED PARCEL SERVICE, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

79

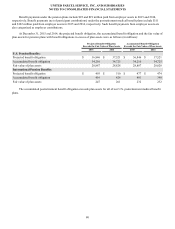

We are vigorously challenging the proposed suspension plan because it does not fully comply with the law and we do not

believe certain actions by the CSPF are valid. Accordingly, we have not assumed or recognized a liability for supplemental

benefits within the UPS/IBT Full-Time Employee Pension Plan due to the submission of the CSPF’s proposed plan to the U.S.

Department of Treasury. Further we are not able to estimate a range of potential additional obligations, if any, or determine

whether any such amounts are material, due to uncertainties regarding the validity of actions taken by the CSPF, incomplete

information regarding the CSPF’s proposed benefit reductions, uncertainties regarding the process and standards under the

MPRA, whether the proposed plan complies with the MPRA (and proposed regulations thereunder) and the effect of various

discount rates and other actuarial assumptions.

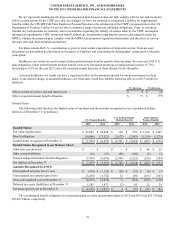

For plans outside the U.S., consideration is given to local market expectations of long-term returns. Strategic asset

allocations are determined by plan based on the nature of liabilities and considering the demographic composition of the plan

participants.

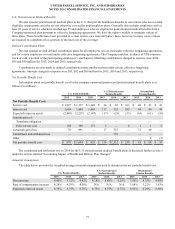

Healthcare cost trends are used to project future postretirement benefits payable from our plans. For year-end 2015 U.S.

plan obligations, future postretirement medical benefit costs were forecasted assuming an initial annual increase of 7.0%,

decreasing to 4.5% by the year 2021 and with consistent annual increases at those ultimate levels thereafter.

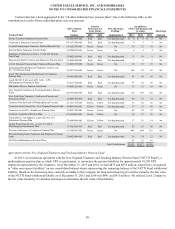

Assumed healthcare cost trends can have a significant effect on the amounts reported for our postretirement medical

plans. A one percent change in assumed healthcare cost trend rates would have had the following effects on 2015 results (in

millions):

1% Increase 1% Decrease

Effect on total of service cost and interest cost $ 4 $ (4)

Effect on postretirement benefit obligation $ 73 $ (79)

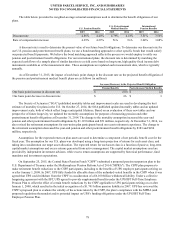

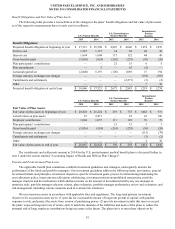

Funded Status

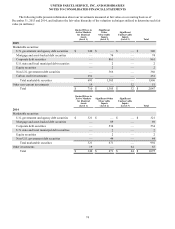

The following table discloses the funded status of our plans and the amounts recognized in our consolidated balance

sheets as of December 31 (in millions):

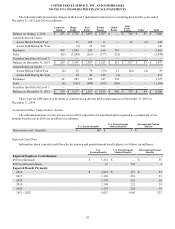

U.S. Pension Benefits

U.S. Postretirement

Medical Benefits

International

Pension Benefits

2015 2014 2015 2014 2015 2014

Funded Status:

Fair value of plan assets $ 28,887 $ 28,828 $ 130 $ 259 $ 1,014 $ 1,042

Benefit obligation (36,846)(37,521)(2,673)(2,883)(1,219)(1,274)

Funded status recognized at December 31 $(7,959)$(8,693)$(2,543)$(2,624)$ (205)$ (232)

Funded Status Recognized in our Balance Sheet:

Other non-current assets $—$—$—$—$48$25

Other current liabilities (16)(17)(98)(102)(3)(3)

Pension and postretirement benefit obligations (7,943)(8,676)(2,445)(2,522)(250)(254)

Net liability at December 31 $(7,959)$(8,693)$(2,543)$(2,624)$ (205)$ (232)

Amounts Recognized in AOCI:

Unrecognized net prior service cost $(954)$(1,122)$ (26)$ (32)$ (4)$ (7)

Unrecognized net actuarial gain (loss) (3,263)(3,752)32(89)(103)(103)

Gross unrecognized cost at December 31 (4,217)(4,874)6

(121)(107)(110)

Deferred tax assets (liabilities) at December 31 1,585 1,833 (2) 452629

Net unrecognized cost at December 31 $(2,632)$(3,041)$ 4 $ (76)$ (81)$ (81)

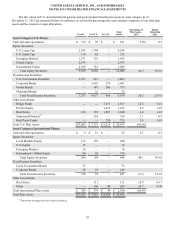

The accumulated benefit obligation for our pension plans as of the measurement dates in 2015 and 2014 was $35.320 and

$35.867 billion, respectively.