UPS 2015 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2015 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

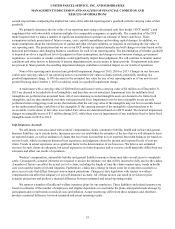

UNITED PARCEL SERVICE, INC. AND SUBSIDIARIES

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS

60

There are certain limitations inherent in the sensitivity analyses presented, primarily due to the assumption that exchange

rates change in a parallel fashion and that interest rates change instantaneously. In addition, the analyses are unable to reflect

the complex market reactions that normally would arise from the market shifts modeled. While this is our best estimate of the

impact of the specified interest rate scenarios, these estimates should not be viewed as forecasts. We adjust the fixed and

floating interest rate mix of our interest rate sensitive assets and liabilities in response to changes in market conditions.

Additionally, changes in the fair value of foreign currency derivatives and commodity derivatives are offset by changes in the

cash flows of the underlying hedged foreign currency and commodity transactions.

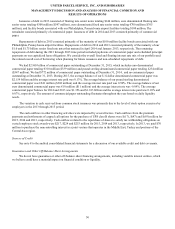

Shock-Test Result

As of December 31,

(in millions) 2015 2014

Change in Fair Value:

Currency Derivatives(1) $(435)$ (229)

Change in Annual Interest Expense:

Variable Rate Debt(2) $44$15

Interest Rate Derivatives(2) $66$81

(1) The potential change in fair value from a hypothetical 10% weakening of the U.S. Dollar against local currency exchange rates across all maturities.

(2) The potential change in annual interest expense resulting from a hypothetical 100 basis point increase in short-term interest rates, applied to our

variable rate debt and swap instruments (excluding hedges of anticipated debt issuances).

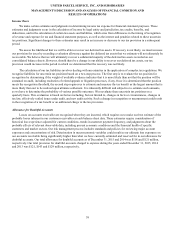

The sensitivity of our pension and postretirement benefit obligations to changes in interest rates is quantified in “Critical

Accounting Policies and Estimates”. The sensitivity in the fair value and interest income of our marketable securities and

finance receivables due to changes in interest rates was not material as of December 31, 2015 and 2014.