UPS 2015 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2015 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITED PARCEL SERVICE, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

96

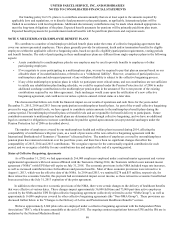

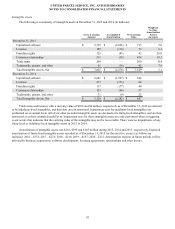

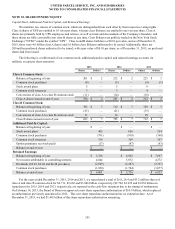

Capital Lease Obligations

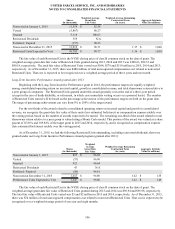

We have certain property, plant and equipment subject to capital leases. Some of the obligations associated with these

capital leases have been legally defeased. The recorded value of our property, plant and equipment subject to capital leases is as

follows as of December 31 (in millions):

2015 2014

Vehicles $74$86

Aircraft 2,289 2,289

Buildings 207 197

Accumulated amortization (849)(781)

Property, plant and equipment subject to capital leases $ 1,721 $ 1,791

These capital lease obligations have principal payments due at various dates from 2016 through 3005.

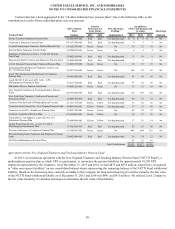

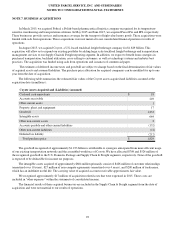

Facility Notes and Bonds

We have entered into agreements with certain municipalities to finance the construction of, or improvements to, facilities

that support our U.S. Domestic Package and Supply Chain & Freight operations in the United States. These facilities are

located around airport properties in Louisville, Kentucky; Dallas, Texas; and Philadelphia, Pennsylvania. Under these

arrangements, we enter into a lease or loan agreement that covers the debt service obligations on the bonds issued by the

municipalities, as follows:

• Bonds with a principal balance of $149 million issued by the Louisville Regional Airport Authority associated with our

Worldport facility in Louisville, Kentucky. The bonds, which are due in January 2029, bear interest at a variable rate,

and the average interest rates for 2015 and 2014 were 0.03% and 0.05%, respectively.

• Bonds with a principal balance of $42 million and due in November 2036 issued by the Louisville Regional Airport

Authority associated with our air freight facility in Louisville, Kentucky. The bonds bear interest at a variable rate, and

the average interest rates for 2015 and 2014 were 0.02% and 0.05%, respectively.

• Bonds with a principal balance of $29 million issued by the Dallas / Fort Worth International Airport Facility

Improvement Corporation associated with our Dallas, Texas airport facilities. The bonds are due in May 2032 and bear

interest at a variable rate, however the variable cash flows on the obligation have been swapped to a fixed 5.11%.

• Bonds with a principal balance of $100 million issued by the Delaware County, Pennsylvania Industrial Development

Authority associated with our Philadelphia, Pennsylvania airport facilities. The bonds, which were due in December

2015, had a variable interest rate, and the average interest rates for 2015 and 2014 were 0.02% and 0.04%,

respectively. As of December 2015, these $100 million bonds were repaid in full.

• In September 2015, we entered into an agreement with the Delaware County, Pennsylvania Industrial Development

Authority, associated with our Philadelphia, Pennsylvania airport facilities, for bonds issued with a principal balance

of $100 million. These bonds, which are due September 2045, bear interest at a variable rate. The average interest rate

for 2015 was 0.00%.

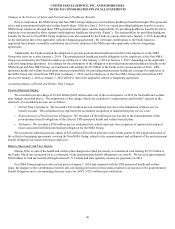

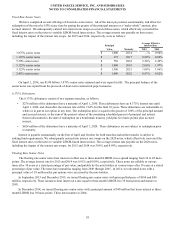

Pound Sterling Notes

The Pound Sterling notes consist of two separate tranches, as follows:

• Notes with a principal amount of £66 million accrue interest at a 5.50% fixed rate, and are due in February 2031.

These notes are not callable.

• Notes with a principal amount of £455 million accrue interest at a 5.125% fixed rate, and are due in February 2050.

These notes are callable at our option at a redemption price equal to the greater of 100% of the principal amount and

accrued interest, or the sum of the present values of the remaining scheduled payout of principal and interest thereon

discounted to the date of redemption at a benchmark U.K. government bond yield plus 15 basis points and accrued

interest.