UPS 2014 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2014 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.UNITED PARCEL SERVICE, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

84

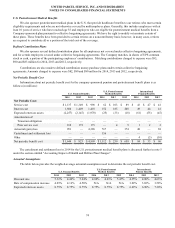

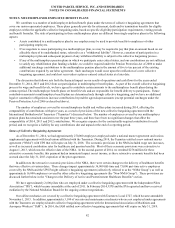

Agreement with the New England Teamsters and Trucking Industry Pension Fund

In 2012, we reached an agreement with the New England Teamsters and Trucking Industry Pension Fund ("NETTI Fund"), a

multiemployer pension plan in which UPS is a participant, to restructure the pension liabilities for approximately 10,200 UPS

employees represented by the Teamsters. The agreement reflected a decision by the NETTI Fund's trustees to restructure the NETTI

Fund through plan amendments to utilize a "two pool approach", which effectively subdivided the plan assets and liabilities between

two groups of beneficiaries. As part of this agreement, UPS agreed to withdraw from the original pool of the NETTI Fund, of which it

had historically been a participant, and reenter the NETTI Fund's newly-established pool as a new employer.

Upon ratification of the agreement by the Teamsters in September 2012, we withdrew from the original pool of the NETTI Fund

and incurred an undiscounted withdrawal liability of $2.162 billion to be paid in equal monthly installments over 50 years. The

undiscounted withdrawal liability was calculated by independent actuaries employed by the NETTI Fund, in accordance with the

governing plan documents and the applicable requirements of the Employee Retirement Income Security Act of 1974. In 2012, we

recorded a charge to expense to establish an $896 million withdrawal liability on our consolidated balance sheet, which represents the

present value of the $2.162 billion future payment obligation discounted at a 4.25% interest rate. This discount rate represents the

estimated credit-adjusted market rate of interest at which we could obtain financing of a similar maturity and seniority. As this

agreement is not a contribution to the plan, the amounts reflected in the previous table do not include this $896 million non-cash

transaction.

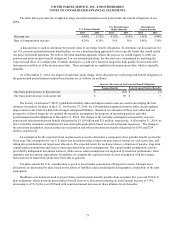

The $896 million charge to expense recorded in 2012 is included in "compensation and benefits" expense in the statements of

consolidated income. We impute interest on the withdrawal liability using the 4.25% discount rate, while the monthly payments made

to the NETTI Fund reduce the remaining balance of the withdrawal liability.

Our status in the newly-established pool of the NETTI Fund is accounted for as the participation in a new multiemployer pension

plan, and therefore we recognize expense based on the contractually-required contribution for each period, and we recognize a liability

for any contributions due and unpaid at the end of a reporting period.

As of December 31, 2014 and 2013, we had $878 and $884 million, respectively, recognized in "other non-current liabilities" on

our consolidated balance sheets representing the remaining balance of the NETTI withdrawal liability. Based on the borrowing rates

currently available to the Company for long-term financing of a similar maturity, the fair value of the NETTI withdrawal liability as of

December 31, 2014 and 2013 was $913 and $783 million. We utilized Level 2 inputs in the fair value hierarchy of valuation

techniques to determine the fair value of this liability.