UPS 2014 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2014 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.UNITED PARCEL SERVICE, INC. AND SUBSIDIARIES

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS

43

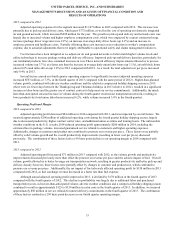

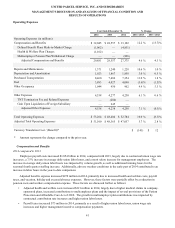

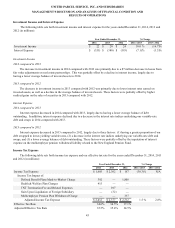

Depreciation and Amortization

2014 compared to 2013

The increase in depreciation and amortization expense in 2014, compared with 2013, was primarily due to a $45 million

increase in the depreciation expense on vehicles, due to the replacement of older, fully-depreciated vehicles, technology

upgrades on vehicles and an overall increase in the size of our vehicle fleet in our U.S. Domestic Package and UPS Freight

operations. Additionally, amortization expense increased $20 million, primarily related to intangible assets resulting from

business acquisitions. These factors were partially offset by a decrease in building and facility depreciation, as several

operating facilities became fully-depreciated.

2013 compared to 2012

The increase in depreciation and amortization expense in 2013, compared with 2012, was primarily due to a $62 million

increase in depreciation expense on vehicles. This increase was driven by the replacement of older, fully-depreciated vehicles,

technology upgrades on new vehicles and an overall increase in the size of our vehicle fleet. This increase was largely offset by

several factors, including lower building and facility depreciation and capitalized software amortization.

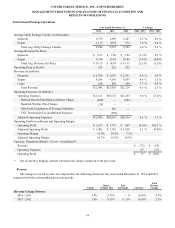

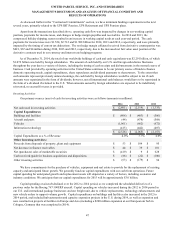

Purchased Transportation

2014 compared to 2013

The $974 million increase in purchased transportation expense charged to us by third-party air, ocean and truck carriers in

2014 was driven by several factors:

• Our U.S. Domestic Package segment incurred a $474 million increase in expense in 2014, primarily due to (1) higher

fees paid to the U.S. Postal Service associated with the volume growth in our SurePost product; (2) the increased use

of, and higher rates passed to us from, rail carriers; and (3) the increased use of outside contract carriers, which was

impacted by volume growth and rail carrier service issues; additionally, adverse weather conditions in the early months

of 2014 resulted in the additional use of outside contract carriers. Approximately $177 million of the increase, or 37%

of the total increase for the year, was attributable to the fourth quarter as a result of high seasonal volume.

• Our International Package segment incurred a $203 million increase in expense in 2014, primarily due to higher costs

incurred for the use of outside transportation providers, which was impacted by strong international volume growth.

• Our UPS Freight business incurred a $68 million increase in expense in 2014, largely due to increased LTL and

brokerage volume, and the resulting increased use of, and higher rates passed to us from, outside transportation

carriers.

• The purchased transportation expense for our forwarding and logistics business increased $229 million in 2014, largely

due to increased volume and tonnage in our international air freight, North American air freight, and ocean forwarding

businesses.

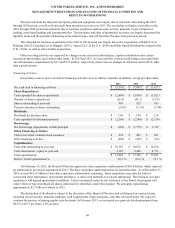

2013 compared to 2012

The increase in purchased transportation expense charged to us by third-party air, ocean and truck carriers in 2013,

compared with 2012, was driven by several factors:

• Our U.S. Domestic Package segment incurred a $154 million expense increase for the year, primarily due to higher

rates passed to us from rail carriers, and higher fees paid to the U.S. Postal Service associated with the volume growth

in our SurePost product. This increase in expense was also impacted by the adverse weather conditions in the fourth

quarter of 2013, as well as the significant increase in volume during the compressed timing of the holiday season.

• Our International Package segment incurred a $144 million expense increase for the year, primarily due to

international volume growth.

• Our UPS Freight business incurred a $70 million increase for the year, largely due to growth in LTL volume and

higher rates passed to us from rail carriers.

• The purchased transportation expense for our forwarding & logistics business declined $236 million for the year,

largely due to lower tonnage and reduced rates from third-party transportation carriers in our international air freight

forwarding business.