UPS 2014 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2014 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITED PARCEL SERVICE, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

97

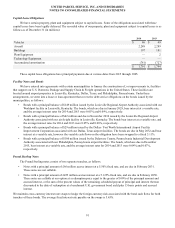

From time to time, we enter into share repurchase programs with large financial institutions to assist in our buyback of

company stock. These programs allow us to repurchase our shares at a price below the weighted average UPS share price for a

given period. During the fourth quarter of 2014, we entered into an accelerated share repurchase program, which allowed us to

repurchase $400 million of shares (3.7 million shares). The program was completed in December 2014.

In order to lower the average cost of acquiring shares in our ongoing share repurchase program, we periodically enter into

structured repurchase agreements involving the use of capped call options for the purchase of UPS class B shares. We pay a

fixed sum of cash upon execution of each agreement in exchange for the right to receive either a pre-determined amount of cash

or stock. Upon expiration of each agreement, if the closing market price of our common stock is above the pre-determined

price, we will have our initial investment returned with a premium in either cash or shares (at our election). If the closing

market price of our common stock is at or below the pre-determined price, we will receive the number of shares specified in the

agreement. We paid net premiums of $47 and $93 million during 2014 and 2013, respectively, related to entering into and

settling capped call options for the purchase of class B shares. As of December 31, 2014, we had outstanding options for the

purchase of 1.7 million shares with an average strike price of $100.01 per share that will settle in the first and second quarters

of 2015.

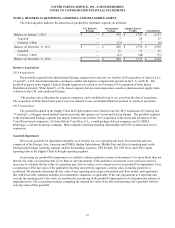

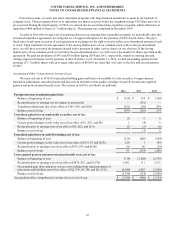

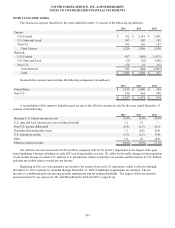

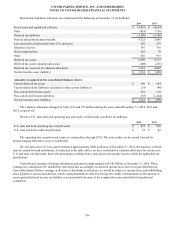

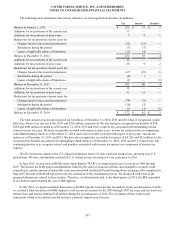

Accumulated Other Comprehensive Income (Loss)

We incur activity in AOCI for unrealized holding gains and losses on available-for-sale securities, foreign currency

translation adjustments, unrealized gains and losses from derivatives that qualify as hedges of cash flows and unrecognized

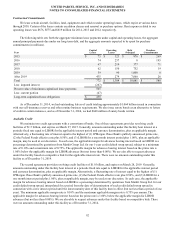

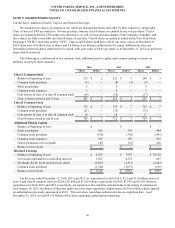

pension and postretirement benefit costs. The activity in AOCI is as follows (in millions):

2014 2013 2012

Foreign currency translation gain (loss):

Balance at beginning of year $ (126) $ 134 $ (160)

Reclassification to earnings (no tax impact in any period) — (161)—

Translation adjustment (net of tax effect of $105, $(5), and $(9)) (331)(99) 294

Balance at end of year (457)(126) 134

Unrealized gain (loss) on marketable securities, net of tax:

Balance at beginning of year (1)6 6

Current period changes in fair value (net of tax effect of $1, $(3), and $4) 2 (4)6

Reclassification to earnings (net of tax effect of $0, $(2), and $(3)) (1)(3)(6)

Balance at end of year — (1)6

Unrealized gain (loss) on cash flow hedges, net of tax:

Balance at beginning of year (219)(286)(204)

Current period changes in fair value (net of tax effect of $133, $1 and $(25)) 220 1 (43)

Reclassification to earnings (net of tax effect of $35, $39, and $(24)) 60 66 (39)

Balance at end of year 61 (219)(286)

Unrecognized pension and postretirement benefit costs, net of tax:

Balance at beginning of year (114)(3,208)(2,745)

Reclassification to earnings (net of tax effect of $870, $67, and $1,876) 1,462 111 3,135

Net actuarial gain (loss) and prior service cost resulting from remeasurements of

plan assets and liabilities (net of tax effect of $(2,714), $1,786, and $(2,151)) (4,546) 2,983 (3,598)

Balance at end of year (3,198)(114)(3,208)

Accumulated other comprehensive income (loss) at end of year $ (3,594)$ (460)$ (3,354)