UPS 2014 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2014 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITED PARCEL SERVICE, INC. AND SUBSIDIARIES

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS

27

• Return on Assets ($42 million pre-tax gain): Our expected rate of return on U.S. pension and postretirement

medical plan assets is developed taking into consideration: (1) historical plan asset returns over long-term periods,

(2) current market conditions, and (3) the mix of asset classes in our investment portfolio. We review the

expected rate of return on an annual basis and revise it as appropriate. In 2014, the actual rate of return on plan

assets of 9.45% exceeded our expected rate of return of 8.66%, primarily due to continued gains in the world

equity markets.

• Demographic Assumptions ($150 million pre-tax loss): The implementation of new U.S. mortality tables in 2014

resulted in an increased participant life expectancy assumption, which increased the overall projected benefit

obligation for our plans.

2012 - $4.831 billion pre-tax mark-to-market loss:

• Discount Rates ($5.530 billion pre-tax loss): The weighted-average discount rate for our U.S. pension and

postretirement medical plans and our international pension plans declined from 5.58% at December 31, 2011 to

4.38% at December 31, 2012, due to two primary factors: (1) The discount rate for our U.S. pension and

postretirement medical plans is determined using a bond matching approach for a portfolio of corporate AA

bonds. In 2012, financial institutions comprised a smaller portion of our corporate AA bond portfolio relative to

2011, largely due to credit downgrades of several large financial institutions in 2012. (2) Credit spreads on AA-

rated 30-year bonds declined in 2012. These changes in the composition of our bond portfolio mix and the

compression in credit spreads were the primary factors resulting in the 120 basis point decline in the weighted-

average discount rate in 2012 relative to 2011.

• Return on Assets ($708 million pre-tax gain): In 2012, the actual rate of return on plan assets of 11.76% exceeded

our expected rate of return of 8.71%, primarily due to strong gains in the world equity markets.

• Demographic Assumptions ($9 million pre-tax loss): This represents the difference between actual and estimated

demographic factors, including items such as health care cost trends, mortality rates and compensation rate

increases.

Health and Welfare Plan Charges

In connection with the ratification of our national master agreement with the International Brotherhood of Teamsters

("Teamsters") in 2014, we incurred pre-tax charges totaling $1.102 billion ($687 million after-tax) associated with changes in

the delivery of healthcare benefits to certain active and retired union employees. These charges are discussed in further detail

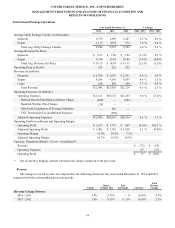

in the "Collective Bargaining Agreements" section. These charges impacted our U.S. Domestic Package segment ($990

million), International Package segment ($28 million) and Supply Chain & Freight segment ($84 million).

TNT Termination Fee and Related Expenses

On January 30, 2013, the European Commission issued a formal decision prohibiting our proposed acquisition of TNT

Express N.V. ("TNT Express"). As a result of the prohibition by the European Commission, the condition of our offer requiring

European Union competition clearance was not fulfilled, and our proposed acquisition of TNT Express could not be completed.

Given this outcome, UPS and TNT Express entered a separate agreement to terminate the merger protocol, and we withdrew

our formal offer for TNT Express. We paid a termination fee to TNT Express of €200 million ($268 million) under this

agreement, and also incurred transaction-related expenses of $16 million during the first quarter of 2013. The combination of

these items resulted in a pre-tax charge of $284 million ($177 million after-tax), which impacted our International Package

segment.

Gain Upon the Liquidation of a Foreign Subsidiary

Subsequent to the termination of the merger protocol, we liquidated a foreign subsidiary that would have been used to

acquire the outstanding shares of TNT Express in connection with the proposed acquisition. Upon the liquidation of this

subsidiary in the first quarter of 2013, we realized a pre-tax foreign currency gain of $245 million ($213 million after-tax),

which impacted our International Package segment.