UPS 2014 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2014 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.UNITED PARCEL SERVICE, INC. AND SUBSIDIARIES

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS

35

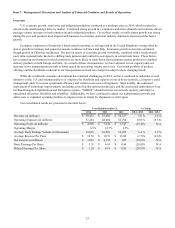

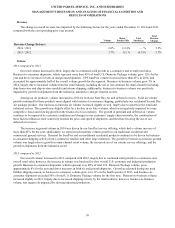

Volume

2014 compared to 2013

Our overall average daily volume increased in 2014, largely due to strong demand from several economic sectors

(including retail, healthcare, industrial and automotive).

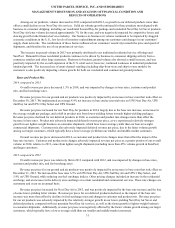

We continued to experience strong export volume growth in 2014, with increases from all regions in the world. European

export volume increased 12% for the year, with particular strength in the intra-European trade lanes and the Europe-to-U.S.

trade lane. Asian export volume increased at a moderate pace (with strength in the Asia-to-U.S. and Asia-to-Europe trade

lanes), and benefited from technology sector product launches. Export volume continued to shift towards our standard

products, such as Transborder Standard and Worldwide Expedited, as compared with our premium express products, such as

Worldwide Express. Our international customers continue to be impacted by economic pressures and changes in their supply

chain networks, and the combination of these factors influences their sensitivity towards the price and speed of shipments.

The strong increase in domestic volume in 2014 was driven by solid volume growth in Canada, Italy, Spain, France and

the United Kingdom.

2013 compared to 2012

Our overall average daily volume increased in 2013 compared with 2012, largely due to growth in key markets in Europe,

as well as Canada and Mexico.

Export volume increased in 2013, and was driven by Europe (largely in the intra-European trade lanes) and the Americas

(particularly in the Canada-to-U.S. and Mexico-to-U.S. trade lanes). Asian export volume grew at a moderate pace due to

continued regional economic growth and expansion of our service offerings, but was negatively impacted by fewer technology

product launches from our customers and a small number of competitive losses. Volume continued to shift towards our

standard products, such as Transborder Standard and Worldwide Expedited, as compared with our premium express products,

such as Worldwide Express.

Domestic volume increased in 2013 compared to 2012, and was driven by solid volume growth in several key markets,

including Italy, Canada, Poland and Turkey.

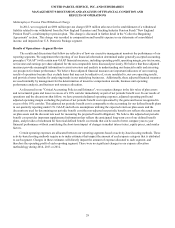

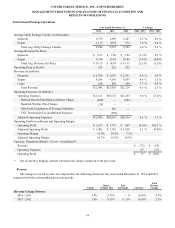

Rates and Product Mix

2014 compared to 2013

Total average revenue per piece decreased 1.5% in 2014 on a currency-adjusted basis, and was impacted by changes in

base rates as well as product mix.

On December 30, 2013, we implemented an average 4.9% net increase in base and accessorial rates for international

shipments originating in the United States (Worldwide Express, Worldwide Saver, UPS Worldwide Expedited and UPS

International Standard service). Rate changes for shipments originating outside the U.S. are made throughout the year and vary

by geographic market.

Currency-adjusted export revenue per piece decreased 3.1% in 2014, as the shift in product mix from our premium

express products to our standard products more than offset the increase in base rates (volume for our standard products

increased 12%, while volume for our premium express products increased 4%). Additionally, currency-adjusted export revenue

per piece was adversely impacted by shorter average trade lanes (due to faster growth in intra-regional shipments) and changes

in customer mix (as export volume growth for larger customers exceeded the volume growth for higher-yielding middle market

customers).

Currency-adjusted domestic revenue per piece increased 0.3% in 2014, and was impacted by base rate increases, as well

as changes in product mix and fuel surcharge rates.