UPS 2014 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2014 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITED PARCEL SERVICE, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

100

NOTE 10. STOCK-BASED COMPENSATION

The UPS Incentive Compensation Plan permits the grant of nonqualified and incentive stock options, stock appreciation

rights, restricted stock and stock units, and restricted performance shares and units, to eligible employees. The number of shares

reserved for issuance under the Incentive Compensation Plan is 27 million. Each share issued pursuant to restricted stock units

and restricted performance units (collectively referred to as "Restricted Units"), stock options and other permitted awards will

reduce the share reserve by one share. We had 16 million shares available to be issued under the Incentive Compensation Plan

as of December 31, 2014.

There are currently three primary awards granted to eligible employees under the UPS Incentive Compensation Plan,

including the Management Incentive Award, Long-Term Incentive Performance Award and Non-Qualified Stock Option Award.

These awards are discussed in the following paragraphs. The total expense recognized in our income statement under all stock

compensation award programs was $536, $513 and $547 million during 2014, 2013 and 2012, respectively. The associated

income tax benefit recognized in our income statement was $199, $190 and $201 million during 2014, 2013 and 2012,

respectively. The cash income tax benefit received from the exercise of stock options and the lapsing of Restricted Units was

$261, $286 and $265 million during 2014, 2013 and 2012, respectively.

Management Incentive Award

Non-executive management earning the right to receive the Management Incentive Award are determined annually by the

Salary Committee, which is comprised of executive officers of the Company. Awards granted to executive officers are

determined annually by the Compensation Committee of the UPS Board of Directors. Our Management Incentive Award

program provides, with certain exceptions, that one-half to two-thirds of the annual Management Incentive Award will be made

in Restricted Units (depending upon the level of management involved). The other one-third to one-half of the award is in the

form of cash or unrestricted shares of class A common stock, and is fully vested at the time of grant.

Upon vesting, Restricted Units result in the issuance of the equivalent number of UPS class A common shares after

required tax withholdings. Except in the case of death, disability, or retirement, Restricted Units granted for our Management

Incentive Award generally vest over a five year period with approximately 20% of the award vesting at each anniversary date of

the grant. The entire grant is expensed on a straight-line basis over the requisite service period. All Restricted Units granted are

subject to earlier cancellation or vesting under certain conditions. Dividends earned on Restricted Units are reinvested in

additional Restricted Units at each dividend payable date.

Long-Term Incentive Performance Award granted prior to 2014

We awarded Restricted Units in conjunction with our Long-Term Incentive Performance Award program to certain

eligible employees. The Restricted Units ultimately granted under the Long-Term Incentive Performance Award program are

based upon the achievement of certain performance measures, including growth in consolidated revenue and operating return

on invested capital, each year during the performance award cycle, and other measures, including the achievement of an

adjusted earnings per share target, over the entire three year performance award cycle. The Restricted Units granted under this

program vest at the end of the three year performance award cycle, except in the case of death disability, or retirement, in which

case immediate vesting occurs.

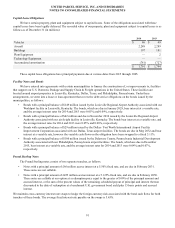

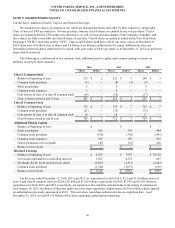

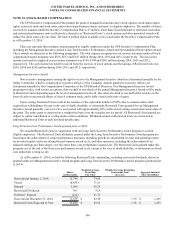

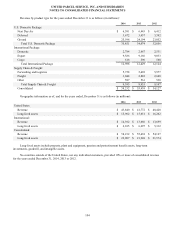

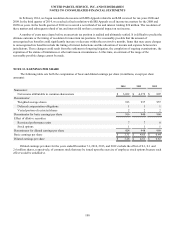

As of December 31, 2014, we had the following Restricted Units outstanding, including reinvested dividends, that were

granted under our Management Incentive Award program and Long-Term Incentive Performance Award program (granted prior

to 2014):

Shares

(in thousands)

Weighted Average

Grant Date

Fair Value

Weighted Average Remaining

Contractual Term

(in years)

Aggregate Intrinsic

Value (in millions)

Nonvested at January 1, 2014 12,748 $ 74.60

Vested (6,455) 71.61

Granted 5,064 92.35

Reinvested Dividends 363 N/A

Forfeited / Expired (161) 81.73

Nonvested at December 31, 2014 11,559 $ 82.58 1.39 $ 1,285

Restricted Units Expected to Vest 11,292 $ 82.62 1.38 $ 1,255