UPS 2014 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2014 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITED PARCEL SERVICE, INC. AND SUBSIDIARIES

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS

52

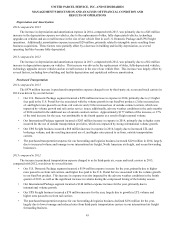

Accounting Impact of Health and Welfare Plan Changes

Income Statement Impact:

We recorded a pre-tax charge of $1.066 billion ($665 million after-tax) in the second quarter of 2014 for the health and

welfare plan changes described above. The components of this charge, which was included in "compensation and benefits"

expense in the statement of consolidated income, are as follows:

• Partial Plan Curtailment: We recorded a $112 million pre-tax curtailment loss due to the elimination of future service

benefit accruals. This curtailment loss represents the accelerated recognition of unamortized prior service costs.

• Remeasurement of Postretirement Obligation: We recorded a $746 million pre-tax loss due to the remeasurement of

the postretirement benefit obligations of the affected UPS-sponsored health and welfare benefit plans.

• Settlement: We recorded a $208 million pre-tax settlement loss, which represents the recognition of unamortized

actuarial losses associated with the postretirement obligation for the NMA Group.

We recorded an additional pre-tax charge of $36 million ($22 million after-tax) in the fourth quarter of 2014 upon

ratification of the collective bargaining agreements covering the Non-NMA Group, related to the remeasurement and settlement

of the postretirement benefit obligation associated with those employees.

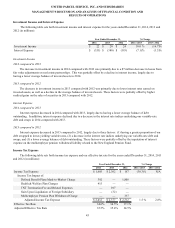

Balance Sheet and Cash Flow Impact:

During 2014, as part of the health and welfare plan changes described previously, we transferred cash totaling $2.271

billion to the Funds, which was accounted for as a settlement of our postretirement benefit obligations (see note 4 to the audited

consolidated financial statements). We received approximately $854 million of cash tax benefits (through reduced U.S. Federal

and state quarterly income tax payments) in 2014.

For NMA Group employees who retired prior to January 1, 2014 and remained with the UPS-sponsored health and

welfare plans, the changes to the contributions, benefits and cost sharing provisions in these plans resulted in an increase in the

postretirement benefit obligation, and a corresponding decrease in pre-tax accumulated other comprehensive income, of $13

million upon ratification.

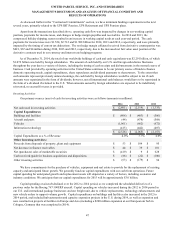

Anticipated Benefits of Health and Welfare Plan Changes

We believe we have obtained several benefits as a result of these health and welfare plan changes, including:

• Liability Transfer: We have removed a significant liability from our balance sheet, which helps to reduce

uncertainty around potential changes to healthcare laws and regulations, control the volatility of healthcare

inflation, and removes the risk associated with providing future retiree healthcare.

• Negotiated Healthcare Costs: Using the model of a defined contribution plan allows us to negotiate our

contributions towards healthcare costs going forward, and provides more certainty of costs over the contract

period.

• Minimize Impact of Healthcare Law Changes: Multiemployer plans have several advantages under the

Patient Protection and Affordable Care Act of 2010, including reduced transitional fees and the ability to limit

the impact of future excise taxes.

• Mitigate Demographic Issues: This helps reduce the potential impact of increased early retirements by

employees.

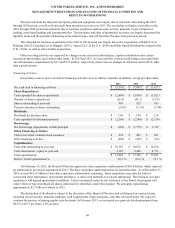

Agreement with the New England Teamsters and Trucking Industry Pension Fund

In the third quarter of 2012, we reached an agreement with the New England Pension Fund, a multiemployer pension

plan in which UPS is a participant, to restructure the pension liabilities for approximately 10,200 UPS employees represented

by the Teamsters. The agreement reflects a decision by the New England Pension Fund's trustees to restructure the fund

through plan amendments to utilize a "two pool approach", which effectively subdivides the plan assets and liabilities between

two groups of beneficiaries. As part of this agreement, UPS agreed to withdraw from the original pool of the New England

Pension Fund of which it had historically been a participant, and reenter the New England Pension Fund's newly-established

pool as a new employer.