UPS 2014 Annual Report Download - page 52

Download and view the complete annual report

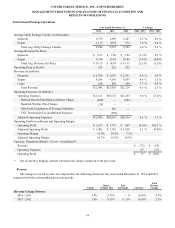

Please find page 52 of the 2014 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.UNITED PARCEL SERVICE, INC. AND SUBSIDIARIES

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS

40

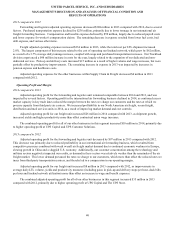

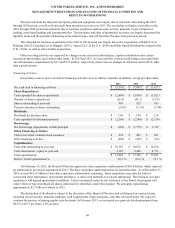

2013 compared to 2012

Forwarding and logistics adjusted operating expenses decreased $388 million in 2013 compared with 2012, due to several

factors. Purchased transportation expense declined by $236 million, primarily due to lower tonnage in our international air

freight forwarding business. Compensation and benefits expense declined by $59 million, largely due to reduced payroll costs

and lower expense for worker's compensation claims. The remaining decrease in expense resulted from lower fuel costs, bad

debt expense, and various other items.

Freight adjusted operating expenses increased $234 million in 2013, while the total cost per LTL shipment increased

2.0%. The largest component of this increase related to the cost of operating our linehaul network, which grew by $62 million,

as a result of a 3.7% average daily tonnage increase, coupled with wage and purchased transportation increases. Our Truckload

division experienced a $48 million increase in costs for the year, largely related to the expansion of our dedicated and non-

dedicated services. Pick-up and delivery costs increased $15 million as a result of higher volume and wage increases, but were

partially offset by productivity improvements. The remaining increase in expense in 2013 was impacted by increases in

pension expense and healthcare costs.

Adjusted operating expenses for the other businesses within Supply Chain & Freight decreased $4 million in 2013

compared with 2012.

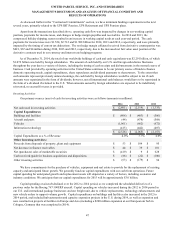

Operating Profit and Margin

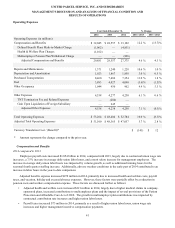

2014 compared to 2013

Adjusted operating profit for the forwarding and logistics unit remained comparable between 2014 and 2013, and was

impacted by several factors. Operating profit in the international air forwarding business declined in 2014, as continued excess

market capacity in key trade lanes reduced the margin between the rates we charge our customers and the rates at which we

procure capacity from third party air carriers. We increased profitability in our North American air freight, ocean freight,

distribution and mail services units in 2014, as a result of improving market demand and cost controls.

Adjusted operating profit for our freight unit increased $26 million in 2014 compared with 2013, as shipment growth,

increased yields and higher productivity more than offset contractual union wage increases.

The combined operating profit for all of our other businesses in this segment increased $18 million in 2014, primarily due

to higher operating profit at UPS Capital and UPS Customer Solutions.

2013 compared to 2012

Adjusted operating profit for the forwarding and logistics unit decreased by $97 million in 2013 compared with 2012.

This decrease was primarily due to reduced profitability in our international air forwarding business, which resulted from

competitive pressures combined with weak overall air freight market demand due to continued economic weakness in Europe,

slowing growth in China and a sluggish U.S. economy. Additionally, our customer concentration among the technology and

military sectors negatively impacted our results, as demand in these sectors was relatively weaker than the remainder of the air

freight market. This lower demand pressured the rates we charge to our customers, which more than offset the reduced rates we

incur from third-party transportation carriers, and thereby led to a compression in our operating margin.

Adjusted operating profit for our freight unit increased $8 million in 2013 compared with 2012, as improvements in

average daily LTL volume, yields and productivity measures (including gains in pick-up and delivery stops per hour, dock bills

per hour and linehaul network utilization) more than offset an increase in wage and benefit expenses.

The combined adjusted operating profit for all of our other businesses in this segment increased $35 million in 2013

compared with 2012, primarily due to higher operating profit at UPS Capital and The UPS Store.