UPS 2014 Annual Report Download - page 126

Download and view the complete annual report

Please find page 126 of the 2014 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITED PARCEL SERVICE, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

114

NOTE 15. TERMINATION OF TNT TRANSACTION

TNT Termination Fee and Related Costs

On January 30, 2013, the European Commission issued a formal decision prohibiting our proposed acquisition of TNT

Express N.V. (“TNT Express”). As a result of the prohibition by the European Commission, the condition of our offer requiring

European Union competition clearance was not fulfilled, and our proposed acquisition of TNT Express could not be completed.

Given this outcome, UPS and TNT Express entered a separate agreement to terminate the merger protocol, and we withdrew

our formal offer for TNT Express. We paid a termination fee to TNT Express of €200 million ($268 million) under this

agreement, and also incurred transaction-related expenses of $16 million during the first quarter of 2013. The combination of

these items resulted in a pre-tax charge of $284 million ($177 million after-tax), which impacted our International Package

segment.

Gain upon the Liquidation of a Foreign Subsidiary

Subsequent to the termination of the merger protocol, we liquidated a foreign subsidiary that would have been used to

acquire the outstanding shares of TNT Express in connection with the proposed acquisition. Upon the liquidation of this

subsidiary in the first quarter of 2013, we realized a pre-tax foreign currency gain of $245 million ($213 million after-tax),

which impacted our International Package segment.

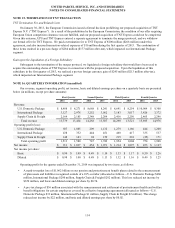

NOTE 16. QUARTERLY INFORMATION (unaudited)

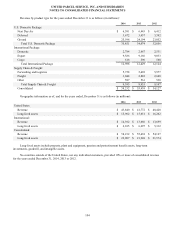

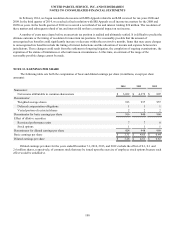

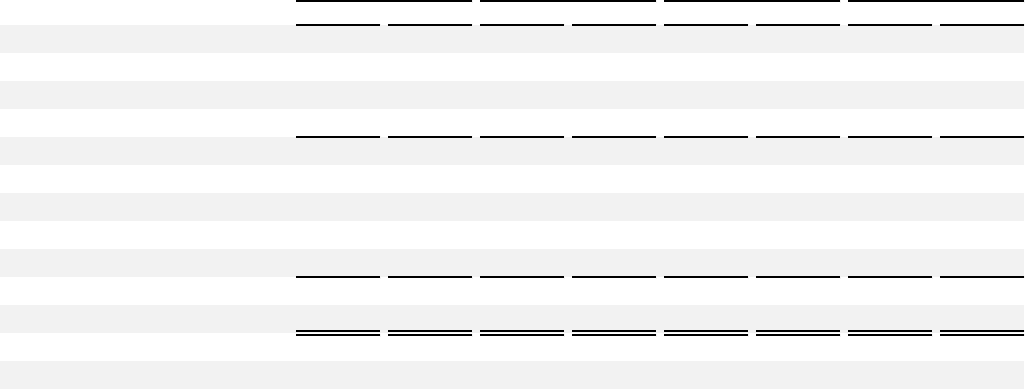

Our revenue, segment operating profit, net income, basic and diluted earnings per share on a quarterly basis are presented

below (in millions, except per share amounts):

First Quarter Second Quarter Third Quarter Fourth Quarter

2014 2013 2014 2013 2014 2013 2014 2013

Revenue:

U.S. Domestic Package $ 8,488 $ 8,271 $ 8,668 $ 8,241 $ 8,691 $ 8,254 $ 10,004 $ 9,308

International Package 3,127 2,978 3,252 3,062 3,183 3,017 3,426 3,372

Supply Chain & Freight 2,164 2,185 2,348 2,204 2,416 2,250 2,465 2,296

Total revenue 13,779 13,434 14,268 13,507 14,290 13,521 15,895 14,976

Operating profit (loss):

U.S. Domestic Package 927 1,085 209 1,132 1,279 1,186 444 1,200

International Package 438 352 444 451 460 417 335 537

Supply Chain & Freight 148 143 94 159 215 201 (25) 171

Total operating profit 1,513 1,580 747 1,742 1,954 1,804 754 1,908

Net income $ 911 $ 1,037 $ 454 $ 1,071 $ 1,214 $ 1,097 $ 453 $ 1,167

Net income per share:

Basic $ 0.99 $ 1.09 $ 0.49 $ 1.14 $ 1.33 $ 1.17 $ 0.50 $ 1.26

Diluted $ 0.98 $ 1.08 $ 0.49 $ 1.13 $ 1.32 $ 1.16 $ 0.49 $ 1.25

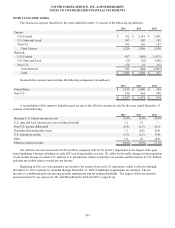

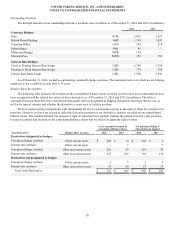

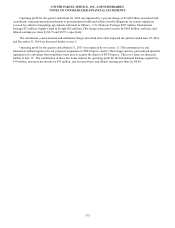

Operating profit for the quarter ended December 31, 2014 was impacted by two items, as follows:

• A mark-to-market loss of $1.062 billion on our pension and postretirement benefit plans related to the remeasurement

of plan assets and liabilities recognized outside of a 10% corridor (allocated as follows—U.S. Domestic Package $660

million, International Package $200 million, Supply Chain & Freight $202 million). This loss reduced net income by

$670 million, and basic and diluted earnings per share by $0.74.

• A pre-tax charge of $36 million associated with the remeasurement and settlement of postretirement health and welfare

benefit obligations for certain employees covered by collective bargaining agreements (allocated as follows—U.S.

Domestic Package $33 million, International Package $1 million, Supply Chain & Freight $2 million). This charge

reduced net income by $22 million, and basic and diluted earnings per share by $0.02.