UPS 2014 Annual Report Download - page 124

Download and view the complete annual report

Please find page 124 of the 2014 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

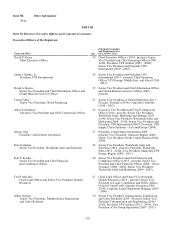

UNITED PARCEL SERVICE, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

112

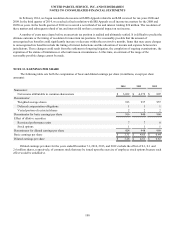

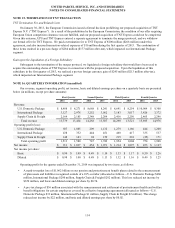

Gross Amounts Presented in

Consolidated Balance Sheets

Net Amounts if Right of

Offset had been Applied

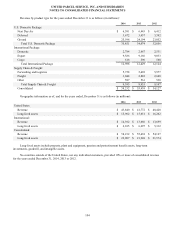

Liability Derivatives Balance Sheet Location 2014 2013 2014 2013

Derivatives designated as hedges:

Foreign exchange contracts Other current liabilities $ — $ 6 $ — $ —

Foreign exchange contracts Other non-current liabilities 34 — 34 —

Interest rate contracts Other non-current liabilities 35 104 2 10

Derivatives not designated as hedges:

Foreign exchange contracts Other current liabilities — 7 — 5

Interest rate contracts Other current liabilities 1111

Interest rate contracts Other non-current liabilities 7 3 5 —

Total Liability Derivatives $ 77 $ 121 $ 42 $ 16

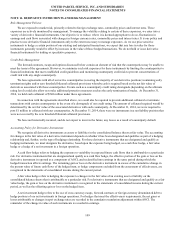

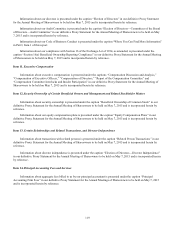

Income Statement and AOCI Recognition

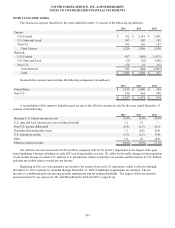

The following table indicates the amount of gains and losses that have been recognized in AOCI for the years ended

December 31, 2014 and 2013 for those derivatives designated as cash flow hedges (in millions):

Derivative Instruments in Cash Flow Hedging Relationships

Amount of Gain (Loss) Recognized in AOCI on

Derivative (Effective Portion)

2014 2013

Interest rate contracts $(5)$ 6

Foreign exchange contracts 358 44

Commodity contracts — (48)

Total $ 353 $ 2

As of December 31, 2014, $135 million of pre-tax gains related to cash flow hedges that are currently deferred in AOCI are

expected to be reclassified to income over the 12 month period ended December 31, 2015. The actual amounts that will be

reclassified to income over the next 12 months will vary from this amount as a result of changes in market conditions.

The amount of ineffectiveness recognized in income on derivative instruments designated in cash flow hedging relationships

was immaterial for the years ended December 31, 2014, 2013 and 2012.

The following table indicates the amount and location in the statements of consolidated income in which derivative gains and

losses, as well as the associated gains and losses on the underlying exposure, have been recognized for those derivatives designated

as fair value hedges for the years ended December 31, 2014 and 2013 (in millions):

Derivative Instruments

in Fair Value Hedging

Relationships

Location of

Gain (Loss)

Recognized in

Income

Amount of Gain (Loss)

Recognized in Income Hedged Items in

Fair Value Hedging

Relationships

Location of

Gain (Loss)

Recognized in

Income

Amount of Gain (Loss)

Recognized in Income

2014 2013 2014 2013

Interest rate

contracts Interest Expense $ 90 $ (306)Fixed-Rate Debt

and Capital Leases Interest Expense $ (90) $ 306

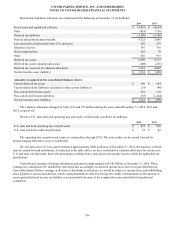

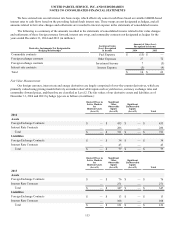

Additionally, we maintain some foreign exchange forward, interest rate swap, and commodity contracts that are not

designated as hedges. These foreign exchange forward contracts are intended to provide an economic offset to foreign currency

remeasurement risks for certain assets and liabilities in our consolidated balance sheets. These interest rate swap contracts are

intended to provide an economic hedge of a portfolio of interest bearing receivables. These commodity contracts are intended to

provide a short-term economic offset to fuel expense changes due to price fluctuations.

We also periodically terminate interest rate swaps and foreign currency options by entering into offsetting swap and foreign

currency positions with different counterparties. As part of this process, we de-designate our original swap and foreign currency

contracts. These transactions provide an economic offset that effectively eliminates the effects of changes in market valuation.