UPS 2014 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2014 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITED PARCEL SERVICE, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

89

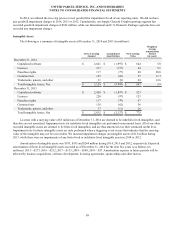

NOTE 7. DEBT AND FINANCING ARRANGEMENTS

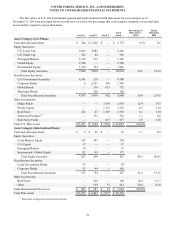

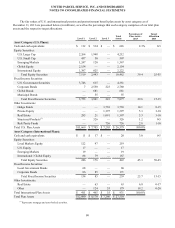

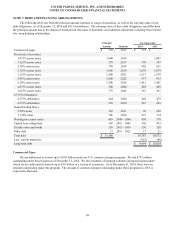

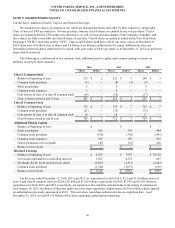

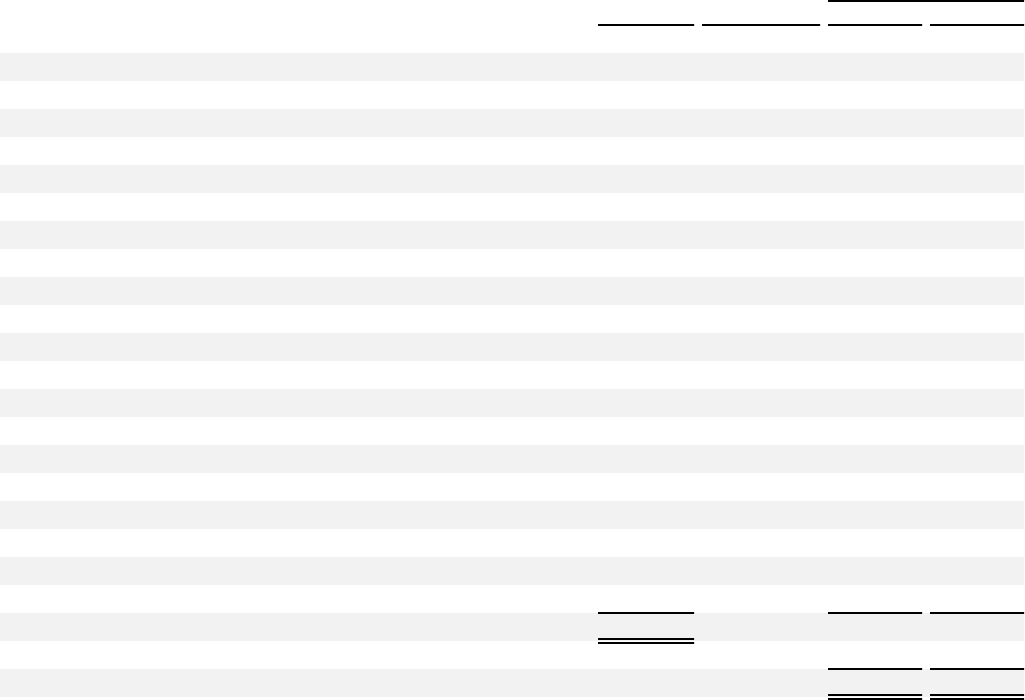

The following table sets forth the principal amount, maturity or range of maturities, as well as the carrying value of our

debt obligations, as of December 31, 2014 and 2013 (in millions). The carrying value of these debt obligations can differ from

the principal amount due to the impact of unamortized discounts or premiums and valuation adjustments resulting from interest

rate swap hedging relationships.

Principal Carrying Value

Amount Maturity 2014 2013

Commercial paper $ 772 2015 $ 772 $ —

Fixed-rate senior notes:

3.875% senior notes 1,000 2014 — 1,007

1.125% senior notes 375 2017 370 367

5.50% senior notes 750 2018 802 821

5.125% senior notes 1,000 2019 1,076 1,079

3.125% senior notes 1,500 2021 1,617 1,579

2.45% senior notes 1,000 2022 977 913

6.20% senior notes 1,500 2038 1,481 1,481

4.875% senior notes 500 2040 489 489

3.625% senior notes 375 2042 367 367

8.375% Debentures:

8.375% debentures 424 2020 480 479

8.375% debentures 276 2030 283 283

Pound Sterling Notes:

5.50% notes 103 2031 99 105

5.125% notes 706 2050 673 714

Floating rate senior notes 463 2049 – 2064 459 370

Capital lease obligations 505 2015 – 3005 505 473

Facility notes and bonds 320 2015 – 2036 320 320

Other debt 17 2015 – 2022 17 25

Total debt $ 11,586 10,787 10,872

Less: current maturities (923)(48)

Long-term debt $ 9,864 $ 10,824

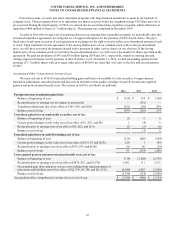

Commercial Paper

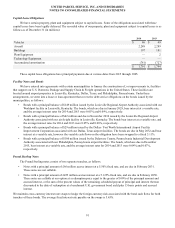

We are authorized to borrow up to $10.0 billion under our U.S. commercial paper program. We had $772 million

outstanding under this program as of December 31, 2014. We also maintain a European commercial paper program under

which we are authorized to borrow up to €5.0 billion in a variety of currencies. As of December 31, 2014, there were no

amounts outstanding under this program. The amount of commercial paper outstanding under these programs in 2015 is

expected to fluctuate.