UPS 2014 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2014 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

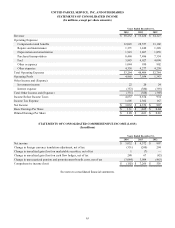

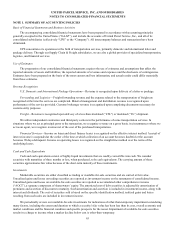

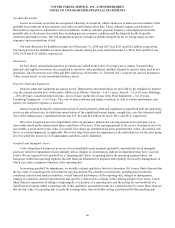

UNITED PARCEL SERVICE, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

69

Accounting Standards Issued But Not Yet Effective

In April 2014, the FASB issued an accounting standards update that changes the requirements for reporting discontinued

operations. This update will have the impact of reducing the frequency of disposals reported as discontinued operations, by

requiring such a disposal to represent a strategic shift that has a major effect on an entity's operations and financial results. This

update also expands the disclosures for discontinued operations, and requires new disclosures related to individually significant

disposals that do not qualify as discontinued operations. This new guidance becomes effective for us prospectively in the first

quarter of 2015. This amended guidance will only have a potential impact to the extent that we discontinue any operations in

future periods.

In May 2014, the FASB issued an accounting standards update that changes the revenue recognition for companies that

enter into contracts with customers to transfer goods or services. This amended guidance requires revenue to be recognized in

an amount that reflects the consideration to which the company expects to be entitled for those goods and services when the

performance obligation has been satisfied. This amended guidance also requires enhanced disclosures regarding the nature,

amount, timing and uncertainty of revenue and related cash flows arising from contracts with customers. This amended

guidance is effective for us beginning in the first quarter of 2017 and early adoption is not permitted. At this time, we do not

expect this new guidance to have a material impact on our consolidated financial position or results of operations.

In June 2014, the FASB issued an accounting standards update for companies that grant their employees share-based

payments in which the terms of the award provide that a performance target that affects vesting could be achieved after the

requisite service period. This new guidance becomes effective for us beginning in the first quarter of 2015, but early adoption is

permitted. This new guidance is not expected to have a material impact on our consolidated financial position or results of

operations.

Other accounting pronouncements issued, but not effective until after December 31, 2014, are not expected to have a

material impact on our consolidated financial position or results of operations.

Changes in Presentation

Certain prior year amounts have been reclassified to conform to the current year presentation. These reclassifications had

no impact on our financial position or results of operations.

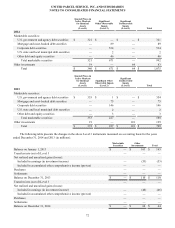

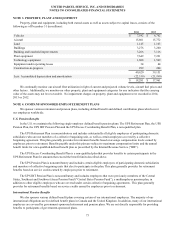

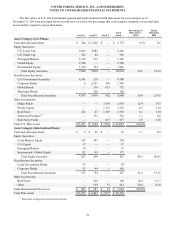

NOTE 2. CASH AND INVESTMENTS

The following is a summary of marketable securities classified as trading and available-for-sale at December 31, 2014

and 2013 (in millions):

Cost

Unrealized

Gains

Unrealized

Losses

Estimated

Fair Value

2014

Current marketable securities:

U.S. government and agency debt securities $ 321 $ 1 $ (1) $ 321

Mortgage and asset-backed debt securities 89 1 (1)89

Corporate debt securities 534 — — 534

U.S. state and local municipal debt securities 2 — — 2

Other debt and equity securities 46 — — 46

Total marketable securities $ 992 $ 2 $ (2) $ 992