UPS 2014 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2014 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITED PARCEL SERVICE, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

90

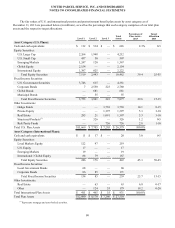

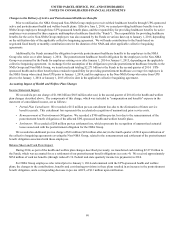

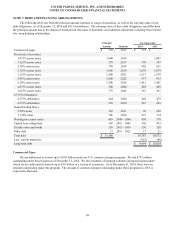

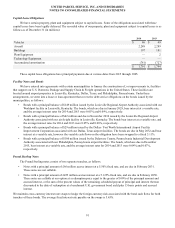

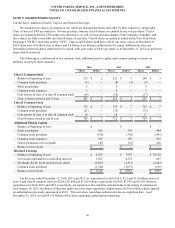

Fixed Rate Senior Notes

We have completed several offerings of fixed rate senior notes. All of the notes pay interest semiannually, and allow for

redemption of the notes by UPS at any time by paying the greater of the principal amount or a “make-whole” amount, plus

accrued interest. We subsequently entered into interest rate swaps on several of these notes, which effectively converted the

fixed interest rates on the notes to variable LIBOR-based interest rates. The average interest rate payable on these notes,

including the impact of the interest rate swaps, for 2014 and 2013, respectively, were as follows:

Principal

Average Effective

Interest Rate

Value Maturity 2014 2013

3.875% senior notes 1,000 2014 0.94% 0.97%

1.125% senior notes 375 2017 0.60% 0.64%

5.50% senior notes 750 2018 2.49% 2.53%

5.125% senior notes 1,000 2019 1.97% 2.01%

3.125% senior notes 1,500 2021 1.06% 1.11%

2.45% senior notes 1,000 2022 0.82% 0.86%

On April 1, 2014, our $1.00 billion 3.875% senior notes matured and were repaid in full. The principal balance of the

senior notes was repaid from the proceeds of short-term commercial paper issuances.

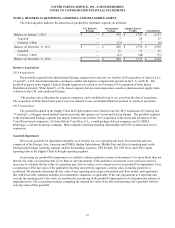

8.375% Debentures

The 8.375% debentures consist of two separate tranches, as follows:

• $276 million of the debentures have a maturity of April 1, 2030. These debentures have an 8.375% interest rate until

April 1, 2020, and, thereafter, the interest rate will be 7.62% for the final 10 years. These debentures are redeemable in

whole or in part at our option at any time. The redemption price is equal to the greater of 100% of the principal amount

and accrued interest, or the sum of the present values of the remaining scheduled payout of principal and interest

thereon discounted to the date of redemption (at a benchmark treasury yield plus five basis points) plus accrued

interest.

• $424 million of the debentures have a maturity of April 1, 2020. These debentures are not subject to redemption prior

to maturity.

Interest is payable semiannually on the first of April and October for both debentures and neither debenture is subject to

sinking fund requirements. We subsequently entered into interest rate swaps on the 2020 notes, which effectively converted the

fixed interest rates on the notes to variable LIBOR-based interest rates. The average interest rate payable on the 2020 notes,

including the impact of the interest rate swaps, for 2014 and 2013 was 4.99% and 5.03%, respectively.

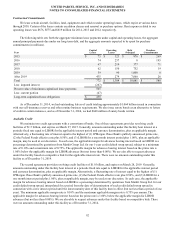

Floating Rate Senior Notes

The floating rate senior notes bear interest at either one or three-month LIBOR, less a spread ranging from 30 to 45 basis

points. The average interest rate for 2014 and 2013 was 0.00% for both years. These notes are callable at various times after 30

years at a stated percentage of par value, and putable by the note holders at various times after 10 years at a stated percentage of

par value. The notes have maturities ranging from 2049 through 2064. In 2014 and 2013, we redeemed notes with a principal

value of $1 and $4 million, respectively, after put options were exercised by the note holders.

In December 2014, we issued a floating rate senior note with a principal balance of $90 million that bears interest at three-

month LIBOR less 30 basis points. This note matures in 2064.