UPS 2014 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2014 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITED PARCEL SERVICE, INC. AND SUBSIDIARIES

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS

49

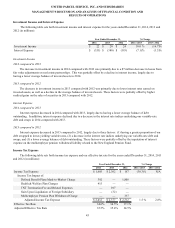

Issuances of debt in 2014 and 2013 consisted primarily of longer-maturity commercial paper. Issuances of debt in 2012

consisted primarily of senior fixed rate note offerings totaling $1.75 billion.

Repayments of debt in 2014 and 2013 consisted primarily of the maturity of our $1.0 and $1.75 billion senior fixed rate

notes that matured in April 2014 and January 2013, respectively. The remaining repayments of debt during the 2012 through

2014 time period included paydowns of commercial paper and scheduled principal payments on our capitalized lease

obligations. We consider the overall fixed and floating interest rate mix of our portfolio and the related overall cost of

borrowing when planning for future issuances and non-scheduled repayments of debt.

We had $772 million of commercial paper outstanding at December 31, 2014, and no commercial paper outstanding at

December 31, 2013 and 2012. The amount of commercial paper outstanding fluctuates throughout each year based on daily

liquidity needs. The average commercial paper balance was $1.356 billion and the average interest rate paid was 0.10% in 2014

($1.013 billion and 0.07% in 2013, and $962 million and 0.07% in 2012, respectively).

The variation in cash received from common stock issuances to employees was primarily due to level of stock option

exercises in the 2012 through 2014 period.

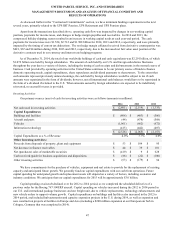

The cash outflows in other financing activities were impacted by several factors. Cash inflows (outflows) from the

premium payments and settlements of capped call options for the purchase of UPS class B shares were $(47), $(93) and $206

million for 2014, 2013 and 2012, respectively. Cash outflows related to the repurchase of shares to satisfy tax withholding

obligations on vested employee stock awards were $224, $253 and $234 million for 2014, 2013 and 2012, respectively. In

2013, we paid $70 million to purchase the noncontrolling interest in a joint venture that operates in the Middle East, Turkey and

portions of the Central Asia region. In 2012, we settled several interest rate derivatives that were designated as hedges of the

senior fixed-rate debt offerings that year, which resulted in a cash outflow of $70 million.

Sources of Credit

See note 7 to the audited consolidated financial statements for a discussion of our available credit and debt covenants.

Guarantees and Other Off-Balance Sheet Arrangements

We do not have guarantees or other off-balance sheet financing arrangements, including variable interest entities, which

we believe could have a material impact on financial condition or liquidity.

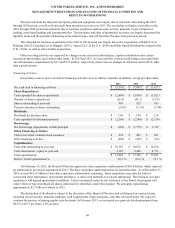

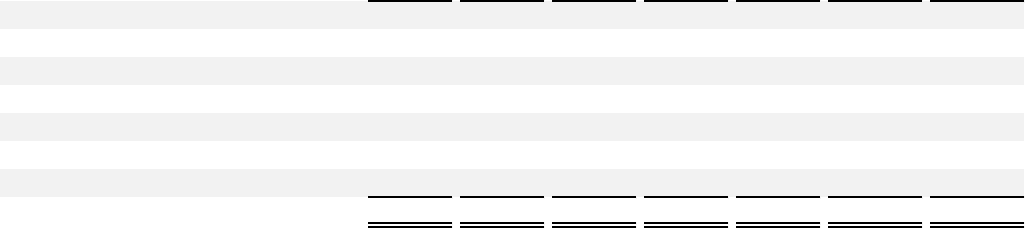

Contractual Commitments

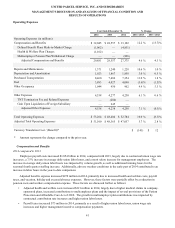

We have contractual obligations and commitments in the form of capital leases, operating leases, debt obligations,

purchase commitments, and certain other liabilities. We intend to satisfy these obligations through the use of cash flow from

operations. The following table summarizes the expected cash outflow to satisfy our contractual obligations and commitments

as of December 31, 2014 (in millions):

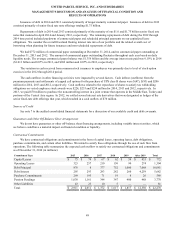

Commitment Type 2015 2016 2017 2018 2019 After 2019 Total

Capital Leases $ 75 $ 74 $ 67 $ 62 $ 59 $ 435 $ 772

Operating Leases 323 257 210 150 90 274 1,304

Debt Principal 876 8 377 752 1,000 7,068 10,081

Debt Interest 295 293 293 282 260 4,259 5,682

Purchase Commitments 269 195 71 19 8 26 588

Pension Fundings 1,030 1,161 344 347 400 488 3,770

Other Liabilities 43 23 10 5 — — 81

Total $ 2,911 $ 2,011 $ 1,372 $ 1,617 $ 1,817 $ 12,550 $ 22,278