UPS 2014 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2014 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Globally,

e-commerce

is expected to grow

at four times the rate

of Gross Domestic

Product.

5

• Further expanding our network and capabilities in

growth markets around the world. We’ve identified and

are implementing strategies in 13 key emerging and growth

markets that present the most opportunity. For instance, in

2015, UPS will begin expanding in 20 new markets across

China, while deepening our presence in the 33 markets

we currently serve today. In addition, we’re adding more

premium services and expanding our focus on key industries

as well as large Asian multinational companies.

• Focusing on fast-growing industries such as healthcare

and e-commerce. Since 2011, we’ve nearly doubled

our healthcare footprint, to 7 million square feet. On the

e-commerce front, we continue to expand the size of our

UPS Access PointTM network, and by the end of 2015 will

have more than 20,000 remote locations where consumers

can pick up packages on their own schedule.

• Reengineering processes and interfaces to generate

greater customer satisfaction. We have more than 20

internal optimization projects underway to streamline our

inside operations, control costs and improve customer

service levels.

We believe these initiatives will enable us to accelerate

growth and generate higher returns. In fact, we’re confident in

our ability to continue to generate returns on invested capital*

in excess of 25 percent.

Fortunately, we are starting from a position of relative strength.

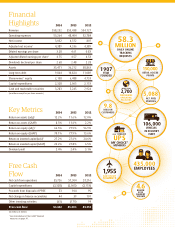

Our free cash flow1 generation remained robust in 2014 at

$3.4 billion, even after making after-tax contributions of

$800 million to company-sponsored pension plans, as well as

$1.5 billion to transfer certain union employees to

multiemployer healthcare plans.

Our robust cash flow enabled UPS to pay dividends of $2.4

billion, an increase of 8 percent per share over the prior year.

Since going public, our efficient use of capital has enabled us

to return $50 billion to shareowners. I expect that we’ll return

more than $30 billion to shareowners over the next five years.

The good news going forward is the global economy is

expected to be modestly stronger in 2015. While parts

of Europe and Asia are expecting slower growth, the U.S.

economy continues to gain momentum. In addition, UPS is

well-positioned to benefit from trends in global economic

activity: e-commerce is expected to grow at four times the

rate of global GDP, and cross-border e-commerce should grow

at seven times that of the global economy.

Of course, we anticipated these trends and have invested not

only in the fastest-growing economies, but in industries like

healthcare and retail that should drive profitable growth for

years to come. I am confident our growth initiatives, along

with our capacity expansion projects and operation technology

implementations, will yield benefits for shareowners.

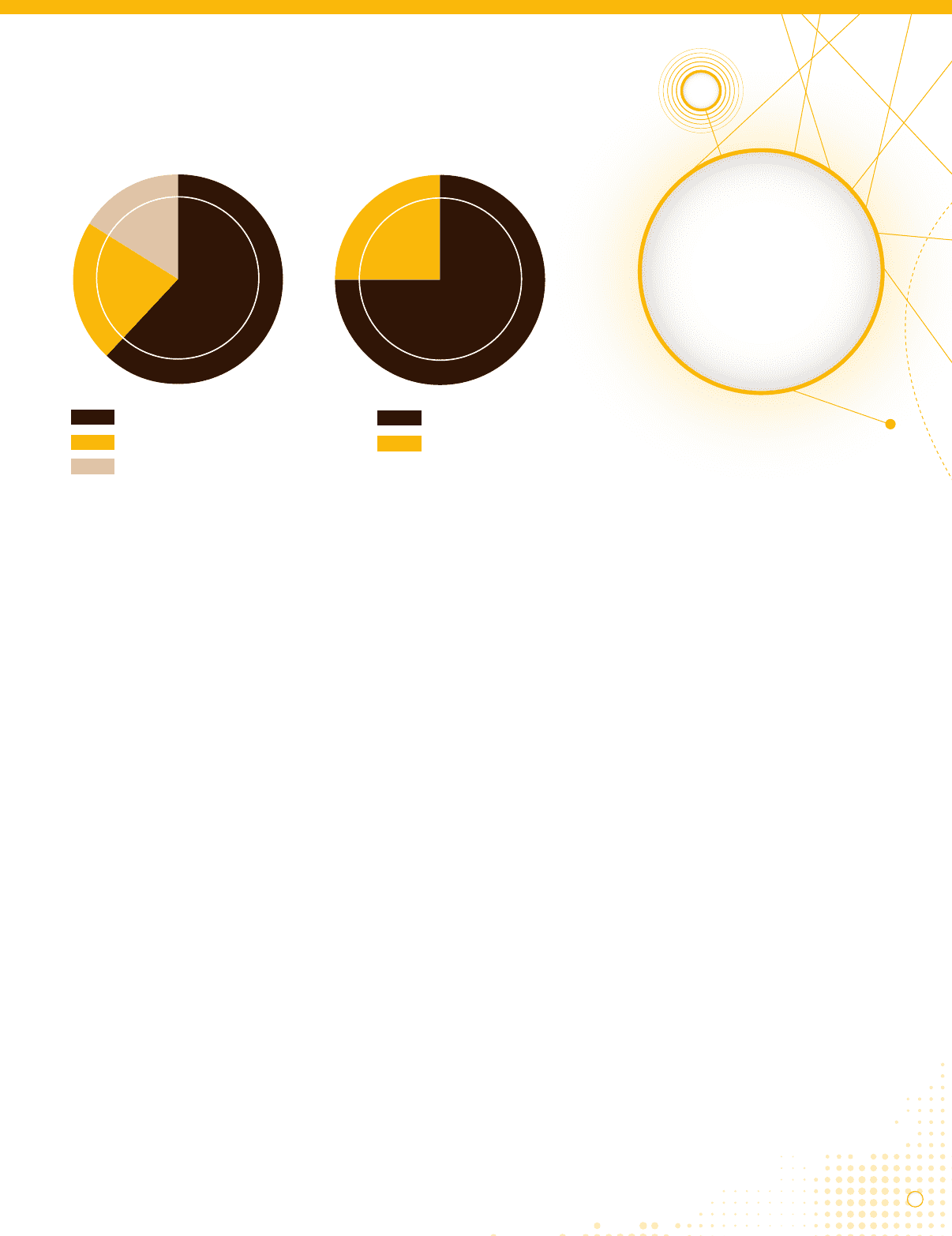

62%

22%

16%

Revenue by Segment

percent

75%

25%

Revenue by Geography

percent

U.S.

International

U.S. Domestic Package

International Package

Supply Chain & Freight

* See reconciliation of Non-GAAP financial measures on page A1.

1 See reconciliation of Free Cash Flow on the inside front cover.