UPS 2014 Annual Report Download - page 40

Download and view the complete annual report

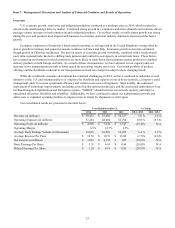

Please find page 40 of the 2014 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.UNITED PARCEL SERVICE, INC. AND SUBSIDIARIES

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS

28

Multiemployer Pension Plan Withdrawal Charge

In 2012, we recognized an $896 million pre-tax charge ($559 million after-tax) for the establishment of a withdrawal

liability related to our withdrawal from the New England Teamsters and Trucking Industry Pension Fund ("New England

Pension Fund"), a multiemployer pension plan. This charge is discussed in further detail in the "Collective Bargaining

Agreements" section. This charge was recorded in compensation and benefits expense in our statements of consolidated

income, and impacted our U.S. Domestic Package segment.

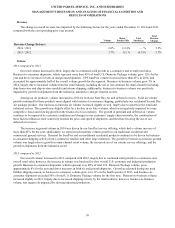

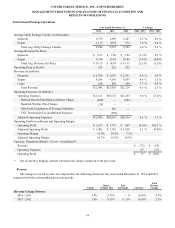

Results of Operations—Segment Review

The results and discussions that follow are reflective of how our executive management monitors the performance of our

reporting segments. We supplement the reporting of our financial information determined under generally accepted accounting

principles (“GAAP”) with certain non-GAAP financial measures, including operating profit, operating margin, pre-tax income,

net income and earnings per share adjusted for the non-comparable items discussed previously. We believe that these adjusted

measures provide meaningful information to assist investors and analysts in understanding our financial results and assessing

our prospects for future performance. We believe these adjusted financial measures are important indicators of our recurring

results of operations because they exclude items that may not be indicative of, or are unrelated to, our core operating results,

and provide a better baseline for analyzing trends in our underlying businesses. Additionally, these adjusted financial measures

are used internally by management for the determination of incentive compensation awards, business unit operating

performance analysis, and business unit resource allocation.

As discussed in our "Critical Accounting Policies and Estimates", we recognize changes in the fair value of plan assets

and net actuarial gains and losses in excess of a 10% corridor immediately as part of net periodic benefit cost. In our results of

operations and the discussions that follow, we have presented adjusted operating expenses, adjusted operating profit and

adjusted operating margin excluding the portion of net periodic benefit cost represented by the gains and losses recognized in

excess of the 10% corridor. This adjusted net periodic benefit cost is comparable to the accounting for our defined benefit plans

in our quarterly reporting under U.S. GAAP, and reflects assumptions utilizing the expected return on plan assets and the

discount rate used for determining net periodic benefit cost (the non-adjusted net periodic benefit cost reflects the actual return

on plan assets and the discount rate used for measuring the projected benefit obligation). We believe this adjusted net periodic

benefit cost provides important supplemental information that reflects the anticipated long-term cost of our defined benefit

plans, and provides a benchmark for historical defined benefit cost trends that can be used to better compare year-to-year

financial performance without considering the short-term impact of changes in market interest rates, equity prices, and similar

factors.

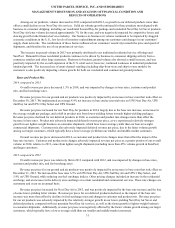

Certain operating expenses are allocated between our reporting segments based on activity-based costing methods. These

activity-based costing methods require us to make estimates that impact the amount of each expense category that is attributed

to each segment. Changes in these estimates will directly impact the amount of expense allocated to each segment, and

therefore the operating profit of each reporting segment. There were no significant changes in our expense allocation

methodology during 2014, 2013 or 2012.