UPS 2014 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2014 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITED PARCEL SERVICE, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

98

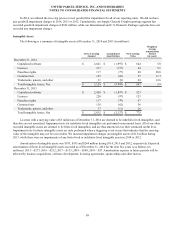

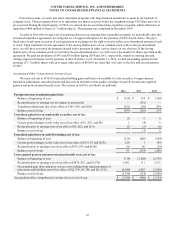

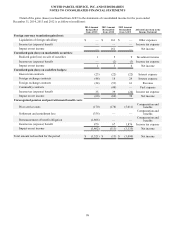

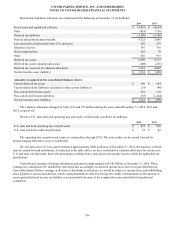

Detail of the gains (losses) reclassified from AOCI to the statements of consolidated income for the years ended

December 31, 2014, 2013 and 2012 is as follows (in millions):

2014 Amount

Reclassified

from AOCI

2013 Amount

Reclassified

from AOCI

2012 Amount

Reclassified

from AOCI

Affected Line Item in the

Income Statement

Foreign currency translation gain (loss):

Liquidation of foreign subsidiary $ — $ 161 $ — Other expenses

Income tax (expense) benefit — — — Income tax expense

Impact on net income — 161 — Net income

Unrealized gain (loss) on marketable securities:

Realized gain (loss) on sale of securities 1 5 9 Investment income

Income tax (expense) benefit — (2)(3) Income tax expense

Impact on net income 1 3 6 Net income

Unrealized gain (loss) on cash flow hedges:

Interest rate contracts (23)(22)(22) Interest expense

Foreign exchange contracts (48) 18 24 Interest expense

Foreign exchange contracts (24)(53) 61 Revenue

Commodity contracts —(48) — Fuel expense

Income tax (expense) benefit 35 39 (24) Income tax expense

Impact on net income (60)(66) 39 Net income

Unrecognized pension and postretirement benefit costs:

Prior service costs (170)(178)(5,011)Compensation and

benefits

Settlement and curtailment loss (356)— —

Compensation and

benefits

Remeasurement of benefit obligation (1,806)— —

Compensation and

benefits

Income tax (expense) benefit 870 67 1,876 Income tax expense

Impact on net income (1,462)(111)(3,135) Net income

Total amount reclassified for the period $(1,521)$ (13)$ (3,090) Net income