UPS 2014 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2014 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.UNITED PARCEL SERVICE, INC. AND SUBSIDIARIES

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS

50

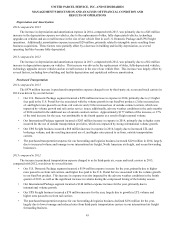

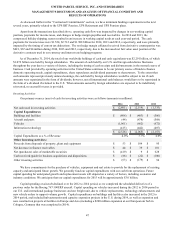

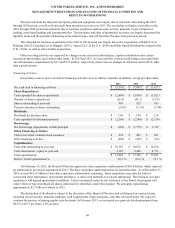

Our capital lease obligations relate primarily to leases on aircraft. Capital leases, operating leases, and purchase

commitments, as well as our debt principal obligations, are discussed further in note 7 to our consolidated financial statements.

The amount of interest on our debt was calculated as the contractual interest payments due on our fixed-rate debt, in addition to

interest on variable rate debt that was calculated based on interest rates as of December 31, 2014. The calculations of debt

interest take into account the effect of interest rate swap agreements. For debt denominated in a foreign currency, the

U.S. Dollar equivalent principal amount of the debt at the end of the year was used as the basis to calculate future interest

payments.

Purchase commitments represent contractual agreements to purchase goods or services that are legally binding, the

largest of which are orders for technology equipment and vehicles. As of December 31, 2014, we have no open aircraft orders.

Pension fundings represent the anticipated required cash contributions that will be made to our qualified U.S. pension

plans (these plans are discussed further in note 4 to the consolidated financial statements). The pension funding requirements

were estimated under the provisions of the Pension Protection Act of 2006 and the Employee Retirement Income Security Act

of 1974, using discount rates, asset returns and other assumptions appropriate for these plans. In July 2012, federal legislation

was signed into law that allows pension plan sponsors to use higher interest rate assumptions (based on a 25-year rate history)

in valuing plan liabilities and determining funding obligations. The amount of any minimum funding requirement, as

applicable, for these plans could change significantly in future periods, depending on many factors, including future plan asset

returns and discount rates. A sustained significant decline in the world equity markets, and the resulting impact on our pension

assets and investment returns, could result in our domestic pension plans being subject to significantly higher minimum

funding requirements. To the extent that the funded status of these plans in future years differs from our current projections, the

actual contributions made in future years could materially differ from the amounts shown in the table above.

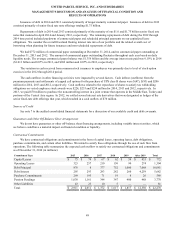

As discussed in note 5 to our consolidated financial statements, we are not currently subject to any minimum

contributions or surcharges with respect to the multiemployer pension and health and welfare plans in which we participate.

Contribution rates to these multiemployer pension and health and welfare plans are established through the collective

bargaining process. As we are not subject to any minimum contribution levels, we have not included any amounts in the

contractual commitments table with respect to these multiemployer plans.

The contractual payments due for “other liabilities” primarily include commitment payments related to our investment in

certain partnerships. The table above does not include approximately $217 million of liabilities for uncertain tax positions

because we are uncertain if or when such amounts will ultimately be settled in cash. In addition, we also have recognized assets

associated with uncertain tax positions in excess of the related liabilities such that we do not believe a net contractual obligation

exists to the taxing authorities. Uncertain tax positions are further discussed in note 12 to the consolidated financial statements.

As of December 31, 2014, we had outstanding letters of credit totaling approximately $1.064 billion issued in connection

with our self-insurance reserves and other routine business requirements. We also issue surety bonds as an alternative to letters

of credit in certain instances, and as of December 31, 2014, we had $640 million of surety bonds written. As of December 31,

2014, we had unfunded loan commitments totaling $136 million associated with our financial business.

We believe that funds from operations and borrowing programs will provide adequate sources of liquidity and capital

resources to meet our expected long-term needs for the operation of our business, including anticipated capital expenditures, for

the foreseeable future.

Contingencies

See note 8 to the audited consolidated financial statements for a discussion of judicial proceedings and other matters

arising from the conduct of our business activities, and note 12 for a discussion of income tax related matters.