UPS 2014 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2014 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITED PARCEL SERVICE, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

73

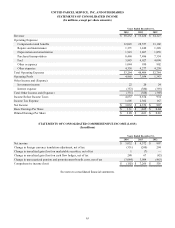

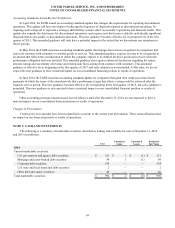

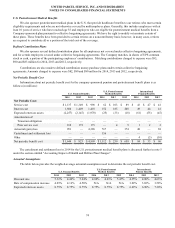

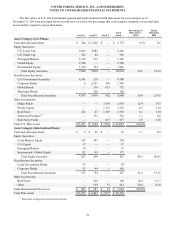

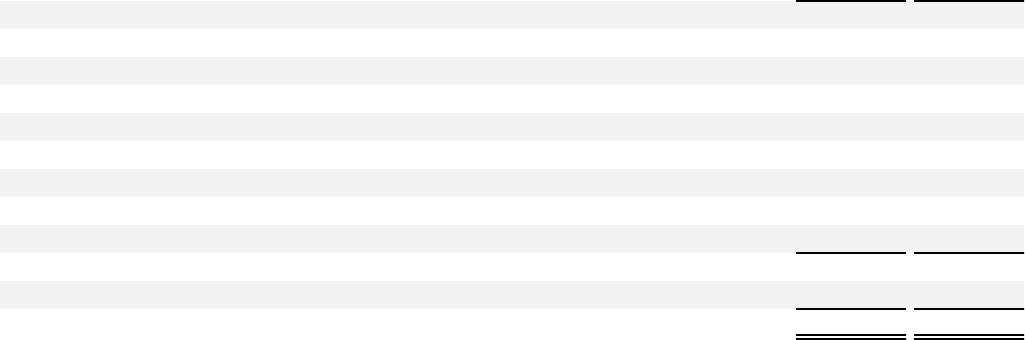

NOTE 3. PROPERTY, PLANT AND EQUIPMENT

Property, plant and equipment, including both owned assets as well as assets subject to capital leases, consists of the

following as of December 31 (in millions):

2014 2013

Vehicles $ 7,542 $ 6,762

Aircraft 15,801 15,772

Land 1,145 1,163

Buildings 3,276 3,260

Building and leasehold improvements 3,266 3,116

Plant equipment 7,649 7,221

Technology equipment 1,608 1,569

Equipment under operating leases 34 44

Construction-in-progress 299 244

40,620 39,151

Less: Accumulated depreciation and amortization (22,339)(21,190)

$ 18,281 $ 17,961

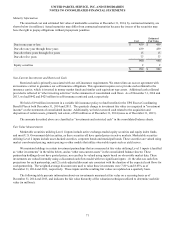

We continually monitor our aircraft fleet utilization in light of current and projected volume levels, aircraft fuel prices and

other factors. Additionally, we monitor our other property, plant and equipment categories for any indicators that the carrying

value of the assets may not be recoverable. No impairment charges on property, plant and equipment were recorded in 2014,

2013 or 2012.

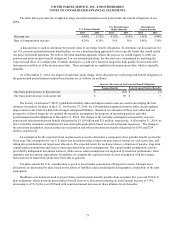

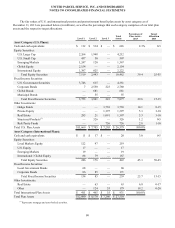

NOTE 4. COMPANY-SPONSORED EMPLOYEE BENEFIT PLANS

We sponsor various retirement and pension plans, including defined benefit and defined contribution plans which cover

our employees worldwide.

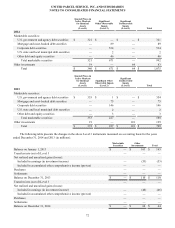

U.S. Pension Benefits

In the U.S. we maintain the following single-employer defined benefit pension plans: The UPS Retirement Plan, the UPS

Pension Plan, the UPS IBT Pension Plan and the UPS Excess Coordinating Benefit Plan, a non-qualified plan.

The UPS Retirement Plan is noncontributory and includes substantially all eligible employees of participating domestic

subsidiaries who are not members of a collective bargaining unit, as well as certain employees covered by a collective

bargaining agreement. This plan generally provides for retirement benefits based on average compensation levels earned by

employees prior to retirement. Benefits payable under this plan are subject to maximum compensation limits and the annual

benefit limits for a tax-qualified defined benefit plan as prescribed by the Internal Revenue Service (“IRS”).

The UPS Excess Coordinating Benefit Plan is a non-qualified plan that provides benefits to certain participants in the

UPS Retirement Plan for amounts that exceed the benefit limits described above.

The UPS Pension Plan is noncontributory and includes certain eligible employees of participating domestic subsidiaries

and members of collective bargaining units that elect to participate in the plan. This plan generally provides for retirement

benefits based on service credits earned by employees prior to retirement.

The UPS IBT Pension Plan is noncontributory and includes employees that were previously members of the Central

States, Southeast and Southwest Areas Pension Fund (“Central States Pension Fund”), a multiemployer pension plan, in

addition to other eligible employees who are covered under certain collective bargaining agreements. This plan generally

provides for retirement benefits based on service credits earned by employees prior to retirement.

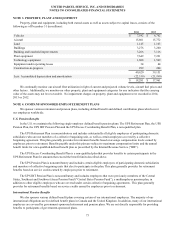

International Pension Benefits

We also sponsor various defined benefit plans covering certain of our international employees. The majority of our

international obligations are for defined benefit plans in Canada and the United Kingdom. In addition, many of our international

employees are covered by government-sponsored retirement and pension plans. We are not directly responsible for providing

benefits to participants of government-sponsored plans.