UPS 2014 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2014 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITED PARCEL SERVICE, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

99

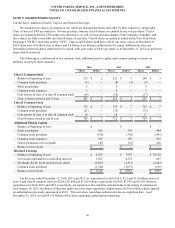

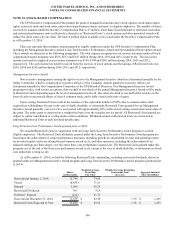

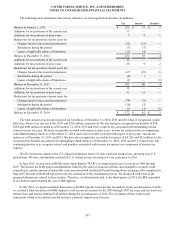

Deferred Compensation Obligations and Treasury Stock

We maintain a deferred compensation plan whereby certain employees were previously able to elect to defer the gains on

stock option exercises by deferring the shares received upon exercise into a rabbi trust. The shares held in this trust are

classified as treasury stock, and the liability to participating employees is classified as “deferred compensation obligations” in

the shareowners’ equity section of the consolidated balance sheets. The number of shares needed to settle the liability for

deferred compensation obligations is included in the denominator in both the basic and diluted earnings per share calculations.

Employees are generally no longer able to defer the gains from stock options exercised subsequent to December 31, 2004.

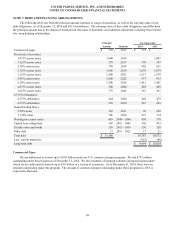

Activity in the deferred compensation program for the years ended December 31, 2014, 2013 and 2012 is as follows (in

millions):

2014 2013 2012

Shares Dollars Shares Dollars Shares Dollars

Deferred Compensation Obligations

Balance at beginning of year $ 69 $ 78 $ 88

Reinvested dividends 2 4 3

Options exercise deferrals — — —

Benefit payments (12)(13)(13)

Balance at end of year $ 59 $ 69 $ 78

Treasury Stock

Balance at beginning of year (1)$ (69)(1)$ (78)(2)$ (88)

Reinvested dividends — (2)— (4)— (3)

Options exercise deferrals ——————

Benefit payments — 12 — 13 1 13

Balance at end of year (1)$ (59)(1)$ (69)(1)$ (78)

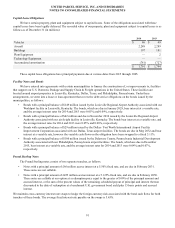

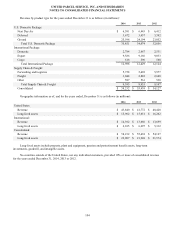

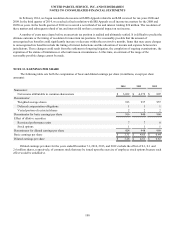

Noncontrolling Interests

We have noncontrolling interests in certain consolidated subsidiaries in our International Package and Supply Chain &

Freight segments, primarily in international locations. The activity related to our noncontrolling interests is presented below (in

millions):

2014 2013 2012

Noncontrolling Interests

Balance at beginning of period $ 14 $ 80 $ 73

Purchase of noncontrolling interests 3 (66)7

Dividends attributable to noncontrolling interests — — —

Net income attributable to noncontrolling interests — — —

Balance at end of period $ 17 $ 14 $ 80

In January 2013, we repurchased the noncontrolling interest in our joint venture that operates in the Middle East, Turkey,

and portions of the Central Asia region for $70 million. After this transaction, we own 100% of this entity.