UPS 2014 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2014 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.UNITED PARCEL SERVICE, INC. AND SUBSIDIARIES

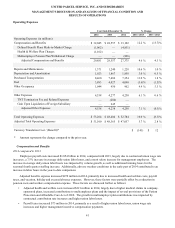

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS

33

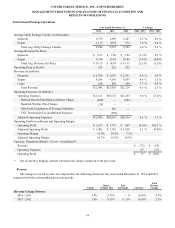

2013 compared to 2012

Adjusted operating expenses for the segment increased $1.147 billion in 2013 compared with 2012. This increase was

primarily due to pick-up and delivery costs, which grew $772 million, as well as the cost of operating our domestic integrated

air and ground network, which increased $290 million for the year. The growth in pick-up and delivery and network costs was

largely due to increased volume and higher employee compensation costs, which were impacted by a union contractual wage

increase (package driver wage rates rose 2.2%), an increase in average daily driver hours (up 2.2%) and an increase in

employee pension and healthcare costs. Partially offsetting these cost increases was a reduction in worker's compensation

expense, due to actuarial adjustments that were largely attributable to operational safety and claims management initiatives.

Cost increases have been mitigated as we adjust our air and ground networks to better match higher volume levels and

utilize technology to increase package sorting and delivery efficiency. Improved pick-up and delivery densities, particularly for

our residential products, have also contained increases in cost. These network efficiency improvements allowed us to process

increased volume (up 3.7%) at a faster rate than the increase in average daily union labor hours (up 3.1%), aircraft block hours

(down 0.6%) and miles driven (up 1.8%) in 2013 compared with 2012. As a result, the total adjusted cost per piece increased

only 0.4% in 2013.

Several factors caused our fourth quarter operating expenses to significantly increase (adjusted operating expenses

increased $553 million, or 7.3%, in the fourth quarter of 2013 compared with the same period of 2012). Higher-than-planned

volume growth, combined with adverse weather conditions and the relatively compressed holiday shipping season in 2013

(there were six fewer days between the Thanksgiving and Christmas holidays in 2013 relative to 2012), resulted in a significant

increase in labor hours and the greater use of contract carriers to help meet our service commitments. Additionally, the much

later-than-anticipated seasonal increase in volume during the fourth quarter strained our transportation network, resulting in

lower productivity (total union labor hours increased 6.2%, while volume increased 5.6% in the fourth quarter).

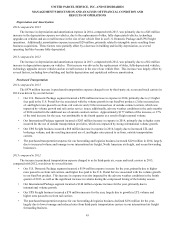

Operating Profit and Margin

2014 compared to 2013

Adjusted operating profit decreased $94 million in 2014 compared with 2013, and was impacted by several factors. We

incurred approximately $200 million of additional operating costs during the fourth quarter holiday shipping season, largely

due to decreased productivity, higher contract carrier rates, and additional union overtime and training hours. The unfavorable

weather conditions in the U.S. in early 2014 reduced operating profit approximately $200 million in 2014, including the

estimated loss in package volume, increased guaranteed service refunds to customers and higher operating expenses.

Additionally, changes in customer and product mix combined to pressure our revenue per piece. These factors were partially

offset by solid volume growth and the overall productivity improvements (resulting in lower cost per piece) discussed

previously. The combination of these factors led to a 90 basis point decline in our operating margin in 2014 compared with

2013.

2013 compared to 2012

Adjusted operating profit increased $71 million in 2013 compared with 2012, as the volume growth and productivity

improvements discussed previously more than offset the pressure on revenue per piece and the adverse impact of fuel. Overall

volume growth allowed us to better leverage our transportation network, resulting in greater productivity and better pick-up and

delivery density; however, these factors were partially offset by changes in customer and product mix, which combined to

pressure our revenue per piece. Additionally, the net impact of fuel adversely affected operating profit by $158 million in 2013

compared with 2012, as fuel surcharge revenue decreased at a faster rate than fuel expense.

Although annual adjusted operating profit improved in 2013, it declined by $178 million in the fourth quarter of 2013

compared with the fourth quarter of 2012. This decline in profitability was largely due to additional labor and purchased

transportation costs, as heavier-than-anticipated volume, adverse weather conditions and a compressed holiday shipping season

combined to result in approximately $125 to $150 million in extra costs in the fourth quarter of 2013. In addition, we incurred

approximately $50 million in service refunds for unmet delivery commitments in the fourth quarter of 2013. The combination

of these factors resulted in a 250 basis point decrease in our fourth quarter operating margin.