UPS 2014 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2014 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITED PARCEL SERVICE, INC. AND SUBSIDIARIES

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS

45

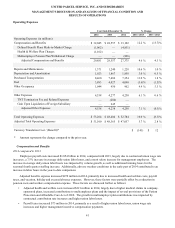

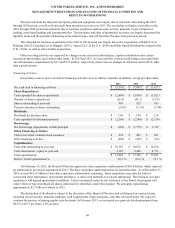

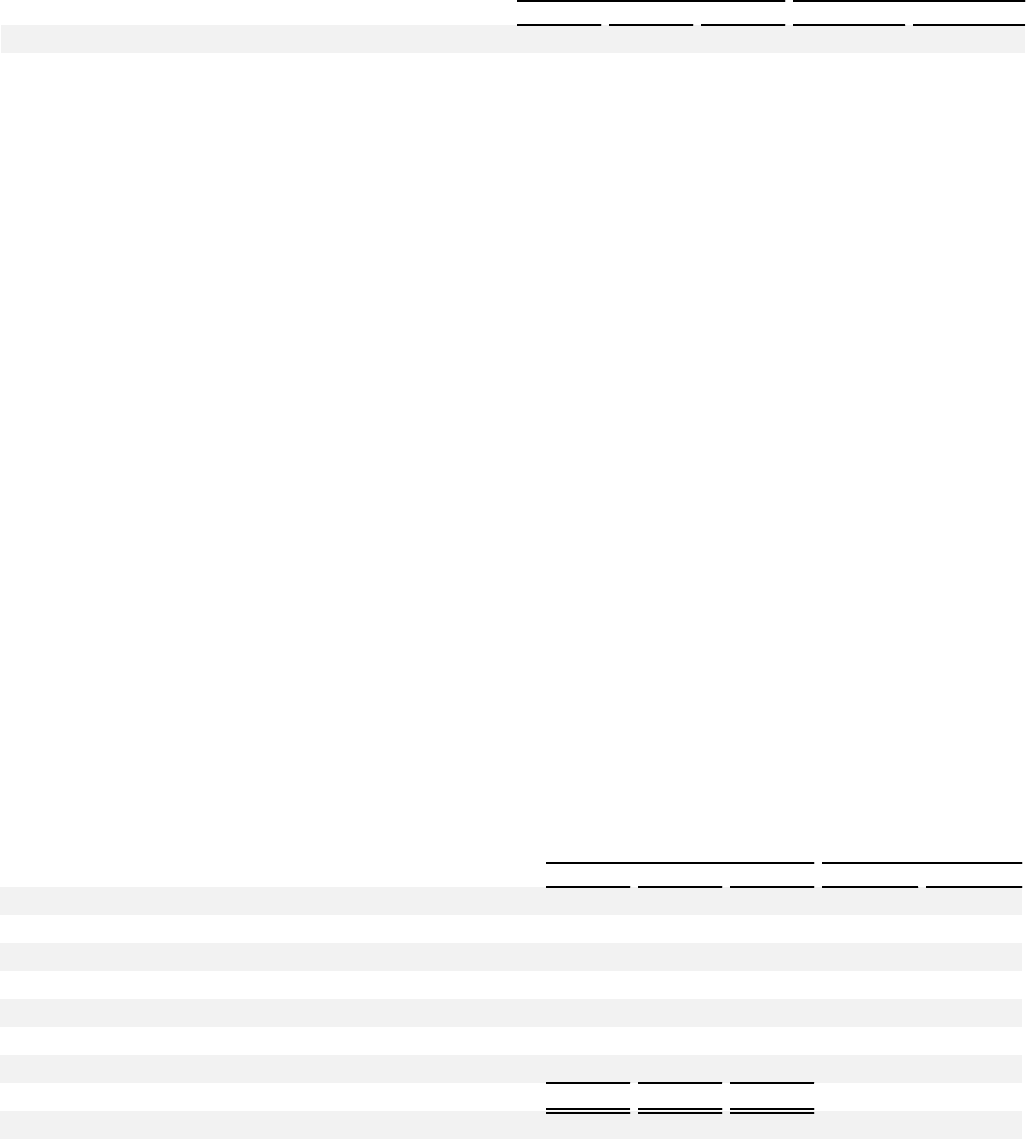

Investment Income and Interest Expense

The following table sets forth investment income and interest expense for the years ended December 31, 2014, 2013 and

2012 (in millions):

Year Ended December 31, % Change

2014 2013 2012 2014 / 2013 2013 / 2012

Investment Income $ 22 $ 20 $ 24 10.0 % (16.7)%

Interest Expense $ (353)$ (380)$ (393) (7.1)% (3.3)%

Investment Income

2014 compared to 2013

The increase in investment income in 2014 compared with 2013 was primarily due to a $7 million decrease in losses from

fair value adjustments on real estate partnerships. This was partially offset by a decline in interest income, largely due to

having a lower average balance of invested assets in 2014.

2013 compared to 2012

The decrease in investment income in 2013 compared with 2012 was primarily due to lower interest rates earned on

invested assets, as well as a decline in the average balance of invested assets. These factors were partially offset by higher

realized gains on the sales of securities in 2013 compared with 2012.

Interest Expense

2014 compared to 2013

Interest expense decreased in 2014 compared with 2013, largely due to having a lower average balance of debt

outstanding. In addition, interest expense declined due to a decrease in the interest rate indices underlying our variable-rate

debt and swaps in 2014 compared with 2013.

2013 compared to 2012

Interest expense decreased in 2013 compared to 2012, largely due to three factors: (1) having a greater proportion of our

debt swapped to lower-yielding variable rates, (2) a decrease in the interest rate indices underlying our variable-rate debt and

swaps, and (3) a lower average balance of debt outstanding. These factors were partially offset by the imputation of interest

expense on the multiemployer pension withdrawal liability related to the New England Pension Fund.

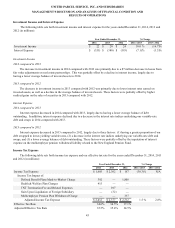

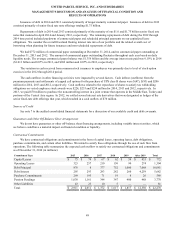

Income Tax Expense

The following table sets forth income tax expense and our effective tax rate for the years ended December 31, 2014, 2013

and 2012 (in millions):

Year Ended December 31, % Change

2014 2013 2012 2014 / 2013 2013 / 2012

Income Tax Expense $ 1,605 $ 2,302 $ 167 (30.3)% N/A

Income Tax Impact of:

Defined Benefit Plans Mark-to-Market Charge 392 — 1,808

Health & Welfare Plan Charges 415 — —

TNT Termination Fee and Related Expenses — 107 —

Gain Upon Liquidation of Foreign Subsidiary — (32)—

Multiemployer Pension Plan Withdrawal Charge — — 337

Adjusted Income Tax Expense $ 2,412 $ 2,377 $ 2,312 1.5 % 2.8%

Effective Tax Rate 34.6% 34.5% 17.1%

Adjusted Effective Tax Rate 35.5% 35.4% 34.5%