UPS 2013 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2013 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITED PARCEL SERVICE, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

86

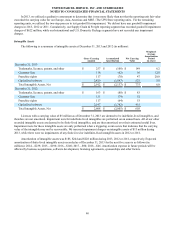

In 2013, we utilized a qualitative assessment to determine that it was more likely than not that the reporting unit fair value

exceeded the carrying value for our Europe, Asia, Americas and MBE / The UPS Store reporting units. For the remaining

reporting units, we utilized the two-step process to test goodwill for impairment. We did not have any goodwill impairment

charges in 2013, 2012 or 2011. Cumulatively, our Supply Chain & Freight reporting segment has recorded goodwill impairment

charges of $622 million, while our International and U.S. Domestic Package segments have not recorded any impairment

charges.

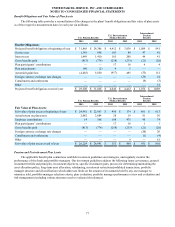

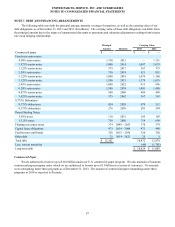

Intangible Assets

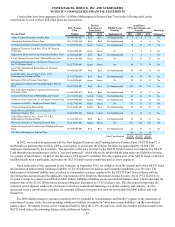

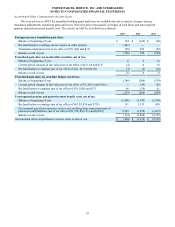

The following is a summary of intangible assets at December 31, 2013 and 2012 (in millions):

Gross Carrying

Amount Accumulated

Amortization Net Carrying

Value

Weighted-

Average

Amortization

Period

(in years)

December 31, 2013

Trademarks, licenses, patents, and other $ 257 $ (108) $ 149 6.2

Customer lists 118 (62) 56 12.8

Franchise rights 117 (70) 47 20.0

Capitalized software 2,420 (1,897) 523 5.0

Total Intangible Assets, Net $ 2,912 $ (2,137) $ 775 6.0

December 31, 2012

Trademarks, licenses, patents, and other $ 163 $ (80) $ 83

Customer lists 131 (79) 52

Franchise rights 117 (64) 53

Capitalized software 2,197 (1,782) 415

Total Intangible Assets, Net $ 2,608 $ (2,005) $ 603

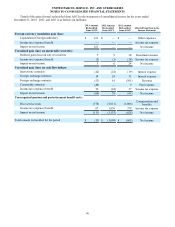

Licenses with a carrying value of $5 million as of December 31, 2013 are deemed to be indefinite-lived intangibles, and

therefore are not amortized. Impairment tests for indefinite-lived intangibles are performed on an annual basis. All of our other

recorded intangible assets are deemed to be finite-lived intangibles, and are thus amortized over their estimated useful lives.

Impairment tests for these intangible assets are only performed when a triggering event occurs that indicates that the carrying

value of the intangible may not be recoverable. We incurred impairment charges on intangible assets of $13 million during

2013, while there were no impairments of any finite-lived or indefinite-lived intangible assets in 2012 or 2011.

Amortization of intangible assets was $185, $244 and $228 million during 2013, 2012 or 2011, respectively. Expected

amortization of finite-lived intangible assets recorded as of December 31, 2013 for the next five years is as follows (in

millions): 2014—$239; 2015—$196; 2016—$140; 2017—$90; 2018—$46. Amortization expense in future periods will be

affected by business acquisitions, software development, licensing agreements, sponsorships and other factors.