UPS 2013 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2013 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITED PARCEL SERVICE, INC. AND SUBSIDIARIES

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS

44

Liquidity and Capital Resources

Operating Activities

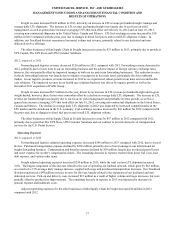

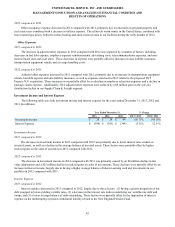

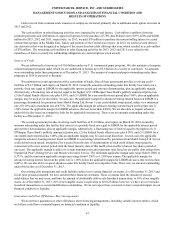

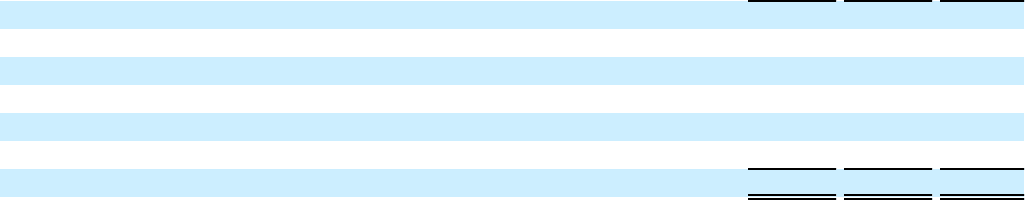

The following is a summary of the significant sources (uses) of cash from operating activities (amounts in millions):

2013 2012 2011

Net income $ 4,372 $ 807 $ 3,804

Non-cash operating activities(a) 3,318 7,313 4,578

Pension and postretirement plan contributions (UPS-sponsored plans) (212)(917)(1,436)

Income tax receivables and payables (155) 280 236

Changes in working capital and other noncurrent assets and liabilities 121 (148)(12)

Other operating activities (140)(119)(97)

Net cash from operating activities $ 7,304 $ 7,216 $ 7,073

(a) Represents depreciation and amortization, gains and losses on derivative and foreign exchange transactions, deferred

income taxes, provisions for uncollectible accounts, pension and postretirement benefit expense, stock compensation

expense, impairment charges and other non-cash items.

Cash from operating activities remained strong throughout the 2011 to 2013 time period. Operating cash flow was

favorably impacted in 2013, compared with 2012, by lower contributions into our defined benefit pension and postretirement

benefit plans; however, this was partially offset by certain TNT Express transaction-related charges, as well as changes in

income tax receivables and payables. We paid a termination fee to TNT Express of €200 million ($268 million) under the

agreement to terminate the merger protocol in the first quarter of 2013. Additionally, the cash payments for income taxes

increased in 2013 compared with 2012, and were impacted by the timing of current tax deductions.

Except for discretionary or accelerated fundings of our plans, contributions to our company-sponsored pension plans

have largely varied based on whether any minimum funding requirements are present for individual pension plans.

• In 2013, we did not have any required, nor make any discretionary, contributions to our primary company-sponsored

pension plans in the U.S.

• In 2012, we made a $355 million required contribution to the UPS IBT Pension Plan.

• In 2011, we made a $1.2 billion contribution to the UPS IBT Pension Plan, which satisfied our 2011 contribution

requirements and also approximately $440 million in contributions that would not have been required until after 2011.

• The remaining contributions in the 2011 through 2013 period were largely due to contributions to our international

pension plans and U.S. postretirement medical benefit plans.

As discussed further in the “Contractual Commitments” section, we have minimum funding requirements in the next

several years, primarily related to the UPS IBT Pension, UPS Retirement and UPS Pension plans.

As of December 31, 2013, the total of our worldwide holdings of cash and cash equivalents was $4.665 billion.

Approximately 45%-55% of cash and cash equivalents was held by foreign subsidiaries throughout the year. The amount of

cash held by our U.S. and foreign subsidiaries fluctuates throughout the year due to a variety of factors, including the timing of

cash receipts and disbursements in the normal course of business. Cash provided by operating activities in the United States

continues to be our primary source of funds to finance domestic operating needs, capital expenditures, share repurchases and

dividend payments to shareowners. To the extent that such amounts represent previously untaxed earnings, the cash held by

foreign subsidiaries would be subject to tax if such amounts were repatriated in the form of dividends; however, not all

international cash balances would have to be repatriated in the form of a dividend if returned to the U.S. When amounts earned

by foreign subsidiaries are expected to be indefinitely reinvested, no accrual for taxes is provided.