UPS 2013 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2013 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

That not only reduces the time and distance in transit, but

also helps merchants capture sales that might be otherwise

lost if their distribution centers are out of stock.

Operating pro t rose 1.6 percent over 2012 adjusted results3

and operating margin dipped slightly from the prior year

adjusted results3, to 13.5 percent. The decline was the result of

high demand for lower-cost residential delivery

products and the higher operating expenses incurred to

honor our service commitments during the holiday season.

As challenging as the fourth quarter was, the e-commerce

revolution shows no signs of slowing. U.S. online retail sales

could top $500 billion by 2020—nearly doubling the

$260 billion in estimated sales in 2013. In addition to our

omni-channel solutions, UPS continues to expand our

popular UPS My Choice service, which gives nearly

7 million subscribers more exibility over when and where

they receive their shipments.

Every January, we conduct a thorough review of our perfor-

mance during the high-volume holiday season, but this year

we conducted an even more exhaustive assessment. We have

already identi ed several areas of improvement that will

strengthen our network in 2014 and beyond. These include:

• Bolstering our network capacity through facility

expansions, process automation, job simpli cation

and faster implementation of technology

• Ramping up our hub modernization e orts

• Developing more predictive volume planning models

that incorporate changing consumer behavior and sales

promotions

• Expediting the rollout of our proprietary On Road,

Integrated, Optimization and Navigation software

(ORION) with the goal of embedding the technology

into 45 percent of our U.S. driver routes by the end of

2014—almost double the original plan

• Improving our collaboration with large customers so we

have better visibility of every incoming package even

before our customers’ trucks arrive at our facilities

04

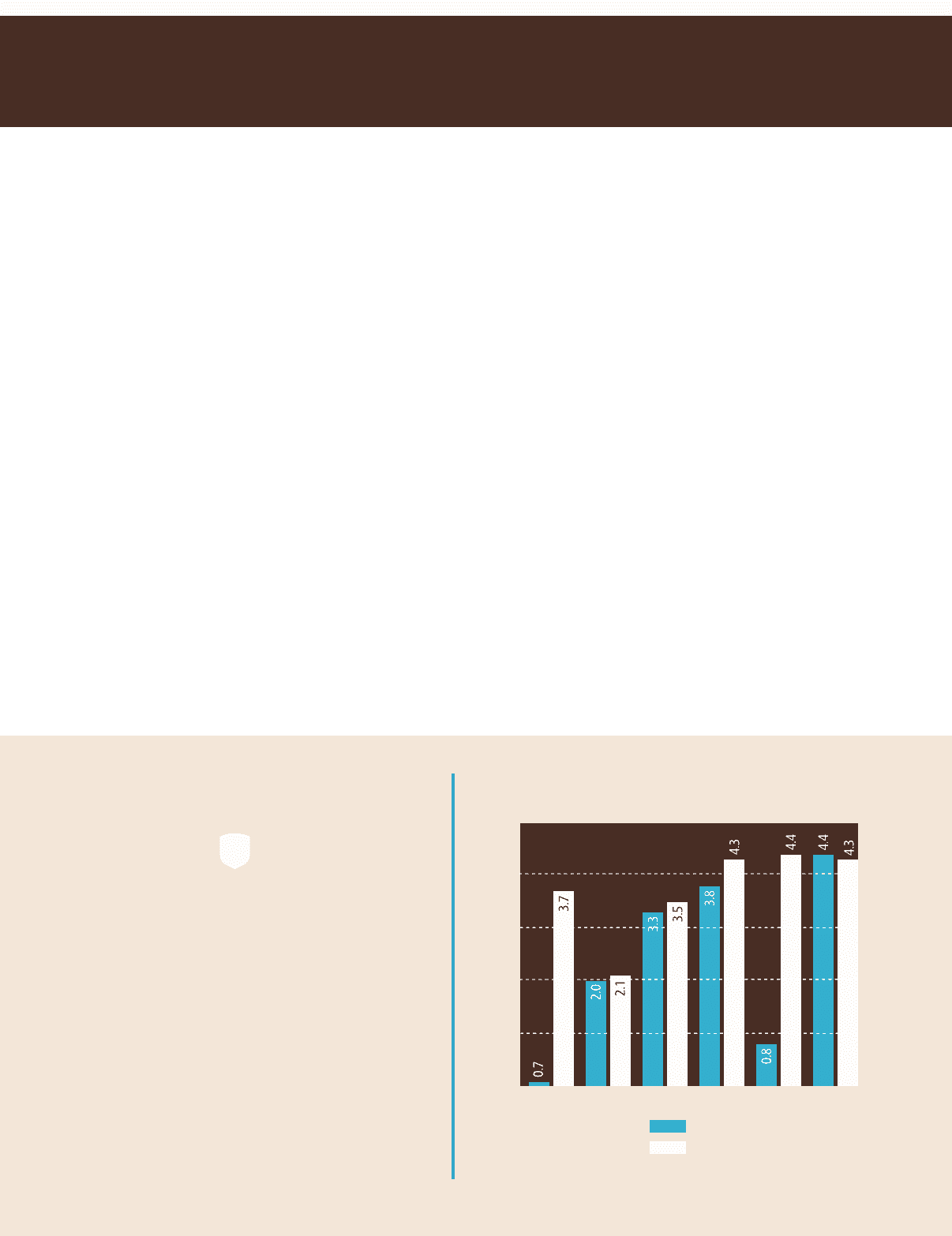

Net Income

in billions of dollars

GAAP

Adjusted3

0

1

2

3

4

5

2008 2009 2010 2011 2012 2013

With ORION technolo ,

a reduction of just one mile a day

per driver ultimately

will save UPS up to

$50 million a year.