UPS 2013 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2013 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITED PARCEL SERVICE, INC. AND SUBSIDIARIES

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS

42

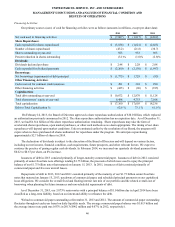

2012 compared to 2011

Other occupancy expense decreased in 2012 compared with 2011, primarily due to reductions in personal property and

real estate taxes combined with a decrease in utilities expense. The relatively warm winter in the United States, combined with

lower natural gas prices, helped to reduce heating and snow removal costs in our facilities during the early months of 2012.

Other Expenses

2013 compared to 2012

The decrease in adjusted other expenses in 2013 compared with 2012 was impacted by a number of factors, including

decreases in bad debt expense, employee expense reimbursements, advertising costs, telecommunications expenses, and non-

income based state and local taxes. These decreases in expense were partially offset by increases in auto liability insurance,

transportation equipment rentals, and air cargo handling costs.

2012 compared to 2011

Adjusted other expenses increased in 2012 compared with 2011, primarily due to an increase in transportation equipment

rentals, bad debt expense and auto liability insurance, as well as expenses incurred in 2012 related to the proposed TNT

Express N.V. acquisition. These increases were partially offset by a reduction in employee relocation expenses and a decline in

package claims expense. Additionally, 2012 adjusted other expenses were reduced by a $9 million gain on the sale of a

distribution facility in our Supply Chain & Freight segment.

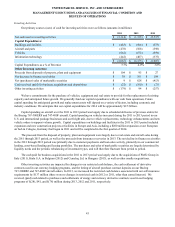

Investment Income and Interest Expense

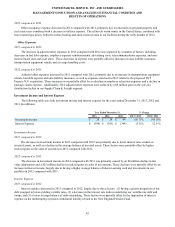

The following table sets forth investment income and interest expense for the years ended December 31, 2013, 2012 and

2011 (in millions):

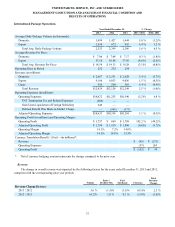

Year Ended December 31, % Change

2013 2012 2011 2013 / 2012 2012 / 2011

Investment Income $ 20 $ 24 $ 44 (16.7)% (45.5)%

Interest Expense $ (380) $ (393) $ (348) (3.3)% 12.9 %

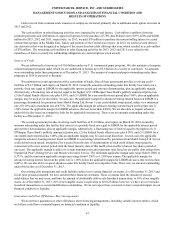

Investment Income

2013 compared to 2012

The decrease in investment income in 2013 compared with 2012 was primarily due to lower interest rates earned on

invested assets, as well as a decline in the average balance of invested assets. These factors were partially offset by higher

realized gains on the sales of securities in 2013 compared with 2012.

2012 compared to 2011

The decrease in investment income in 2012 compared with 2011 was primarily caused by an $8 million decline in fair

value adjustments and a $25 million decline in realized gains on sales of investments. These declines were partially offset by an

increase in interest income, largely due to having a higher average balance of interest-earning cash and investments in our

portfolio in 2012 compared with 2011.

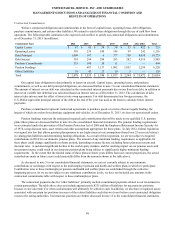

Interest Expense

2013 compared to 2012

Interest expense decreased in 2013 compared to 2012, largely due to three factors: (1) having a greater proportion of our

debt swapped to lower-yielding variable rates, (2) a decrease in the interest rate indices underlying our variable-rate debt and

swaps, and (3) a lower average balance of debt outstanding. These factors were partially offset by the imputation of interest

expense on the multiemployer pension withdrawal liability related to the New England Pension Fund.