UPS 2013 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2013 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITED PARCEL SERVICE, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

102

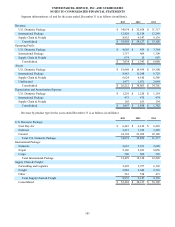

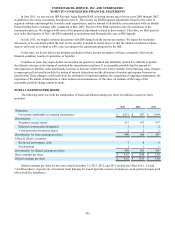

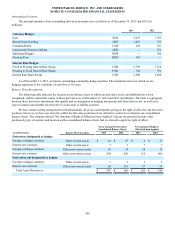

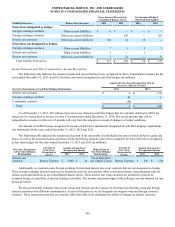

Geographic information as of, and for the years ended, December 31 is as follows (in millions):

2013 2012 2011

United States:

Revenue $ 41,772 $ 40,428 $ 39,347

Long-lived assets $ 15,651 $ 16,262 $ 16,085

International:

Revenue $ 13,666 $ 13,699 $ 13,758

Long-lived assets $ 6,297 $ 5,312 $ 5,220

Consolidated:

Revenue $ 55,438 $ 54,127 $ 53,105

Long-lived assets $ 21,948 $ 21,574 $ 21,305

Long-lived assets include property, plant and equipment, pension and postretirement benefit assets, long-term

investments, goodwill, and intangible assets.

No countries outside of the United States, nor any individual customers, provided 10% or more of consolidated revenue

for the years ended December 31, 2013, 2012 or 2011.

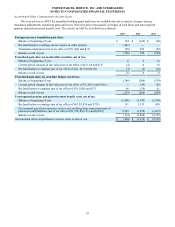

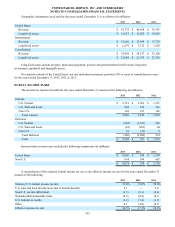

NOTE 12. INCOME TAXES

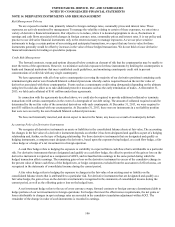

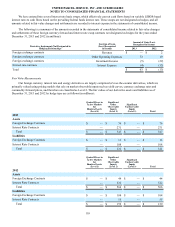

The income tax expense (benefit) for the years ended December 31 consists of the following (in millions):

2013 2012 2011

Current:

U.S. Federal $ 2,181 $ 1,901 $ 1,371

U.S. State and Local 205 182 121

Non-U.S. 162 167 166

Total Current 2,548 2,250 1,658

Deferred:

U.S. Federal (242)(1,871) 262

U.S. State and Local (22)(201) 44

Non-U.S. 18 (11) 8

Total Deferred (246)(2,083) 314

Total $ 2,302 $ 167 $ 1,972

Income before income taxes includes the following components (in millions):

2013 2012 2011

United States $ 6,040 $ 384 $ 5,309

Non-U.S. 634 590 467

$ 6,674 $ 974 $ 5,776

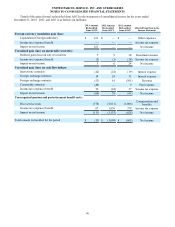

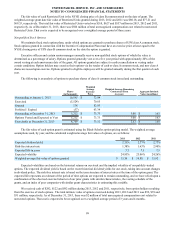

A reconciliation of the statutory federal income tax rate to the effective income tax rate for the years ended December 31

consists of the following:

2013 2012 2011

Statutory U.S. federal income tax rate 35.0% 35.0% 35.0%

U.S. state and local income taxes (net of federal benefit) 2.1 — 2.0

Non-U.S. tax rate differential (1.3)(6.1)(0.4)

Nondeductible/nontaxable items (0.2)(0.4)(0.1)

U.S. federal tax credits (1.2)(7.4)(1.7)

Other 0.1 (4.0)(0.7)

Effective income tax rate 34.5% 17.1% 34.1%