UPS 2013 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2013 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITED PARCEL SERVICE, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

83

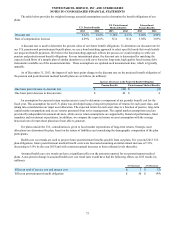

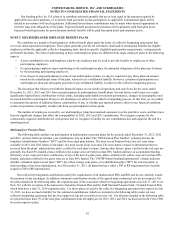

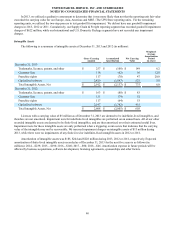

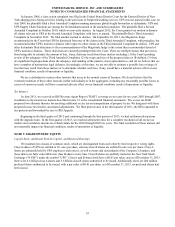

Certain plans have been aggregated in the “All Other Multiemployer Pension Plans” line in the following table, as the

contributions to each of these individual plans are not material.

EIN / Pension

Plan

Pension

Protection Act

Zone Status FIP/RP Status

Pending/

(in millions)

UPS Contributions and

Accruals Surcharge

Pension Fund Number 2013 2012 Implemented 2013 2012 2011 Imposed

Alaska Teamster-Employer Pension Plan 92-6003463-024 Red Red Yes/Implemented $ 5 $ 4 $ 4 No

Automotive Industries Pension Plan 94-1133245-001 Red Red Yes/Implemented 4 4 4 No

Central Pennsylvania Teamsters Defined Benefit Plan 23-6262789-001 Green Yellow Yes/Implemented 30 29 27 No

Employer-Teamsters Local Nos. 175 & 505 Pension

Trust Fund 55-6021850-001 Green Green No 9 9 8 No

Hagerstown Motor Carriers and Teamsters Pension Fund 52-6045424-001 Red Red Yes/Implemented 5 5 5 No

I.A.M. National Pension Fund / National Pension Plan 51-6031295-002 Green Green No 27 24 25 No

International Brotherhood of Teamsters Union Local

No. 710 Pension Fund 36-2377656-001 Green Green No 88 75 74 No

Local 705, International Brotherhood of Teamsters

Pension Plan 36-6492502-001 Red Red Yes/Implemented 68 46 58 No

Local 804 I.B.T. & Local 447 I.A.M.—UPS

Multiemployer Retirement Plan 51-6117726-001 Red Red Yes/Implemented 88 87 84 No

Milwaukee Drivers Pension Trust Fund 39-6045229-001 Green Green No 29 26 26 No

New England Teamsters & Trucking Industry Pension

Fund 04-6372430-001 Red Red Yes/Implemented 102 124 124 No

New York State Teamsters Conference Pension and

Retirement Fund 16-6063585-074 Red Red Yes/Implemented 72 65 57 No

Teamster Pension Fund of Philadelphia and Vicinity 23-1511735-001 Yellow Yellow Yes/Implemented 46 44 41 No

Teamsters Joint Council No. 83 of Virginia Pension Fund 54-6097996-001 Yellow Yellow Yes/Implemented 49 44 41 No

Teamsters Local 639—Employers Pension Trust 53-0237142-001 Green Green No 41 36 33 No

Teamsters Negotiated Pension Plan 43-6196083-001 Yellow Red Yes/Implemented 26 24 22 No

Truck Drivers and Helpers Local Union No. 355

Retirement Pension Plan 52-6043608-001 Yellow Yellow Yes/Implemented 14 14 12 No

United Parcel Service, Inc.—Local 177, I.B.T.

Multiemployer Retirement Plan 13-1426500-419 Red Red Yes/Implemented 68 62 57 No

Western Conference of Teamsters Pension Plan 91-6145047-001 Green Green No 553 520 476 No

Western Pennsylvania Teamsters and Employers Pension

Fund 25-6029946-001 Red Red Yes/Implemented 23 24 21 No

All Other Multiemployer Pension Plans 49 59 44

Total Contributions $1,396 $1,325 $1,243

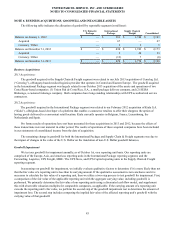

In 2012, we reached an agreement with the New England Teamsters and Trucking Industry Pension Fund ("NETTI Fund"), a

multiemployer pension plan in which UPS is a participant, to restructure the pension liabilities for approximately 10,200 UPS

employees represented by the Teamsters. The agreement reflected a decision by the NETTI Fund's trustees to restructure the NETTI

Fund through plan amendments to utilize a "two pool approach", which effectively subdivided the plan assets and liabilities between

two groups of beneficiaries. As part of this agreement, UPS agreed to withdraw from the original pool of the NETTI Fund, of which it

had historically been a participant, and reenter the NETTI Fund's newly-established pool as a new employer.

Upon ratification of the agreement by the Teamsters in September 2012, we withdrew from the original pool of the NETTI Fund

and incurred an undiscounted withdrawal liability of $2.162 billion to be paid in equal monthly installments over 50 years. The

undiscounted withdrawal liability was calculated by independent actuaries employed by the NETTI Fund, in accordance with the

governing plan documents and the applicable requirements of the Employee Retirement Income Security Act of 1974. In 2012, we

recorded a charge to expense to establish an $896 million withdrawal liability on our consolidated balance sheet, which represents the

present value of the $2.162 billion future payment obligation discounted at a 4.25% interest rate. This discount rate represents the

estimated credit-adjusted market rate of interest at which we could obtain financing of a similar maturity and seniority. As this

agreement is not a contribution to the plan, the amounts reflected in the previous table do not include this $896 million non-cash

transaction.

The $896 million charge to expense recorded in 2012 is included in "compensation and benefits" expense in the statements of

consolidated income, while the corresponding withdrawal liability is included in "other non-current liabilities" on the consolidated

balance sheet. We impute interest on the withdrawal liability using the 4.25% discount rate, while the monthly payments made to the

NETTI Fund reduce the remaining balance of the withdrawal liability.