UPS 2013 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2013 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITED PARCEL SERVICE, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

74

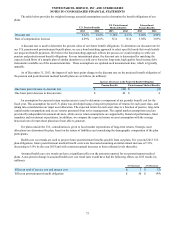

U.S. Postretirement Medical Benefits

We also sponsor postretirement medical plans in the U.S. that provide health care benefits to our retirees who meet certain

eligibility requirements and who are not otherwise covered by multiemployer plans. Generally, this includes employees with at

least 10 years of service who have reached age 55 and employees who are eligible for postretirement medical benefits from a

Company-sponsored plan pursuant to collective bargaining agreements. We have the right to modify or terminate certain of

these plans. These benefits have been provided to certain retirees on a noncontributory basis; however, in many cases, retirees

are required to contribute all or a portion of the total cost of the coverage.

International Pension Benefits

We also sponsor various defined benefit plans covering certain of our international employees. The majority of our

international obligations are for defined benefit plans in Canada and the United Kingdom. In addition, many of our international

employees are covered by government-sponsored retirement and pension plans. We are not directly responsible for providing

benefits to participants of government-sponsored plans.

Defined Contribution Plans

We also sponsor several defined contribution plans for all employees not covered under collective bargaining agreements,

and for certain employees covered under collective bargaining agreements. The Company matches, in shares of UPS common

stock or cash, a portion of the participating employees’ contributions. Matching contributions charged to expense were $90,

$83 and $80 million for 2013, 2012 and 2011, respectively.

Contributions are also made to defined contribution money purchase plans under certain collective bargaining

agreements. Amounts charged to expense were $80, $80 and $76 million for 2013, 2012 and 2011, respectively.

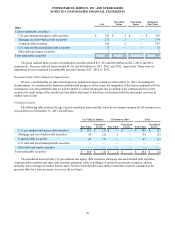

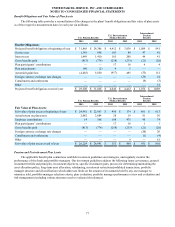

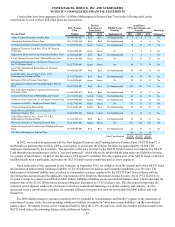

Net Periodic Benefit Cost

Information about net periodic benefit cost for the company-sponsored pension and postretirement benefit plans is as

follows (in millions):

U.S. Pension Benefits U.S. Postretirement

Medical Benefits International

Pension Benefits

2013 2012 2011 2013 2012 2011 2013 2012 2011

Net Periodic Cost:

Service cost $ 1,349 $ 998 $ 870 $ 103 $ 89 $ 89 $ 47 $ 41 $ 34

Interest cost 1,449 1,410 1,309 185 208 207 44 41 39

Expected return on assets (2,147) (1,970) (1,835)(33)(18)(16)(55)(47)(43)

Amortization of:

Transition obligation — — — — — — — — —

Prior service cost 172 173 171 4 5 7 2 2 1

Actuarial (gain) loss — 4,388 736 — 374 — — 69 91

Other — — — — — — (5)(10) —

Net periodic benefit cost $ 823 $ 4,999 $ 1,251 $ 259 $ 658 $ 287 $ 33 $ 96 $ 122

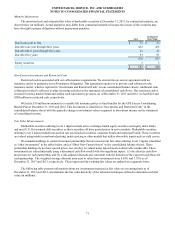

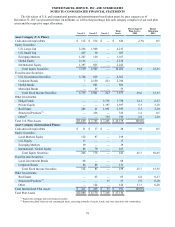

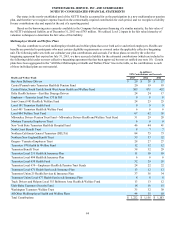

Actuarial Assumptions

The table below provides the weighted-average actuarial assumptions used to determine the net periodic benefit cost.

U.S. Pension Benefits U.S. Postretirement

Medical Benefits International

Pension Benefits

2013 2012 2011 2013 2012 2011 2013 2012 2011

Discount rate 4.42% 5.64% 5.98% 4.21% 5.47% 5.77% 4.00% 4.63% 5.36%

Rate of compensation increase 4.16% 4.50% 4.50% N/A N/A N/A 3.03% 3.58% 3.57%

Expected return on assets 8.75% 8.75% 8.75% 8.75% 8.75% 8.75% 6.90% 7.20% 7.31%