UPS 2013 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2013 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITED PARCEL SERVICE, INC. AND SUBSIDIARIES

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS

48

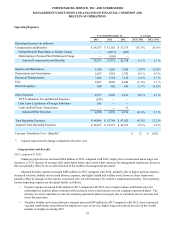

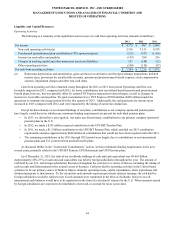

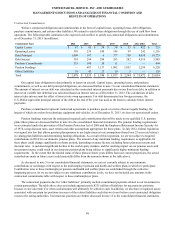

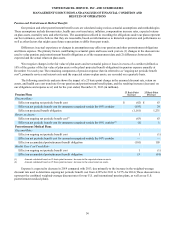

Contractual Commitments

We have contractual obligations and commitments in the form of capital leases, operating leases, debt obligations,

purchase commitments, and certain other liabilities. We intend to satisfy these obligations through the use of cash flow from

operations. The following table summarizes the expected cash outflow to satisfy our contractual obligations and commitments

as of December 31, 2013 (in millions):

Commitment Type 2014 2015 2016 2017 2018 After 2018 Total

Capital Leases $ 67 $ 65 $ 58 $ 58 $ 53 $ 422 $ 723

Operating Leases 310 239 180 146 99 242 1,216

Debt Principal 1,009 107 6 377 750 8,030 10,279

Debt Interest 301 294 294 293 282 4,519 5,983

Purchase Commitments 333 100 50 11 — — 494

Pension Fundings — 687 1,137 1,082 1,055 2,259 6,220

Other Liabilities 58 43 23 10 5 — 139

Total $ 2,078 $ 1,535 $ 1,748 $ 1,977 $ 2,244 $ 15,472 $ 25,054

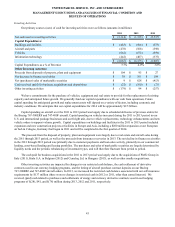

Our capital lease obligations relate primarily to leases on aircraft. Capital leases, operating leases, and purchase

commitments, as well as our debt principal obligations, are discussed further in note 7 to our consolidated financial statements.

The amount of interest on our debt was calculated as the contractual interest payments due on our fixed-rate debt, in addition to

interest on variable rate debt that was calculated based on interest rates as of December 31, 2013. The calculations of debt

interest take into account the effect of interest rate swap agreements. For debt denominated in a foreign currency, the

U.S. Dollar equivalent principal amount of the debt at the end of the year was used as the basis to calculate future interest

payments.

Purchase commitments represent contractual agreements to purchase goods or services that are legally binding, the

largest of which are orders for technology equipment and vehicles. As of December 31, 2013, we have no open aircraft orders.

Pension fundings represent the anticipated required cash contributions that will be made to our qualified U.S. pension

plans (these plans are discussed further in note 4 to the consolidated financial statements). The pension funding requirements

were estimated under the provisions of the Pension Protection Act of 2006 and the Employee Retirement Income Security Act

of 1974, using discount rates, asset returns and other assumptions appropriate for these plans. In July 2012, federal legislation

was signed into law that allows pension plan sponsors to use higher interest rate assumptions (based on a 25-year rate history)

in valuing plan liabilities and determining funding obligations. As a result of this legislation, we are not subject to required

contributions in 2014 for our domestic pension plans. The amount of any minimum funding requirement, as applicable, for

these plans could change significantly in future periods, depending on many factors, including future plan asset returns and

discount rates. A sustained significant decline in the world equity markets, and the resulting impact on our pension assets and

investment returns, could result in our domestic pension plans being subject to significantly higher minimum funding

requirements. To the extent that the funded status of these plans in future years differs from our current projections, the actual

contributions made in future years could materially differ from the amounts shown in the table above.

As discussed in note 5 to our consolidated financial statements, we are not currently subject to any minimum

contributions or surcharges with respect to the multiemployer pension and health and welfare plans in which we participate.

Contribution rates to these multiemployer pension and health and welfare plans are established through the collective

bargaining process. As we are not subject to any minimum contribution levels, we have not included any amounts in the

contractual commitments table with respect to these multiemployer plans.

The contractual payments due for “other liabilities” primarily include commitment payments related to our investment in

certain partnerships. The table above does not include approximately $235 million of liabilities for uncertain tax positions

because we are uncertain if or when such amounts will ultimately be settled in cash. In addition, we also have recognized assets

associated with uncertain tax positions in excess of the related liabilities such that we do not believe a net contractual obligation

exists to the taxing authorities. Uncertain tax positions are further discussed in note 12 to the consolidated financial statements.