UPS 2013 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2013 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.UNITED PARCEL SERVICE, INC. AND SUBSIDIARIES

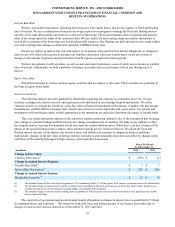

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS

53

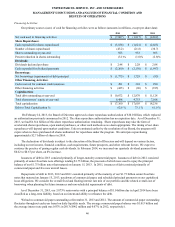

Rate Adjustments

In May 2013, our UPS Freight unit announced a general rate increase averaging 5.9%, covering non-contractual

shipments in the United States, Canada and Mexico. The rate adjustment took effect on June 10, 2013, and applies to minimum

charge, LTL and TL rates and accessorial charges.

In November 2013, we announced an average 4.9% net increase in base and accessorial rates that took effect December

31, 2013, and impacted the following services:

• UPS Ground services;

• UPS Next Day Air, UPS 2nd Day Air, UPS 3 Day Select, and international air shipments originating in the United

States (including Worldwide Express, Worldwide Express Plus, UPS Worldwide Expedited and UPS International

Standard Service);

• UPS Next Day Air Freight, UPS 2nd Day Air Freight, and UPS 3 Day Freight shipments within and between the

U.S., Canada, and Puerto Rico; and

• UPS Express Freight shipments originating in the U.S.

These rate changes are customary and occur on an annual basis. Rate changes for shipments originating outside the U.S. are

made throughout the year and vary by geographic market.

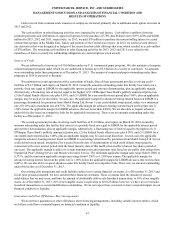

New Accounting Pronouncements

Recently Adopted Accounting Standards

In May 2011, the Financial Accounting Standards Board ("FASB") issued an Accounting Standards Update to disclosure

requirements for fair value measurement. These amendments, which became effective for us in the first quarter of 2012, result

in a common definition of fair value and common measurement and disclosure requirements between U.S. GAAP and IFRS.

Consequently, the amendments change some fair value measurement principles and disclosure requirements. The

implementation of this amended accounting guidance had an immaterial impact on our consolidated financial position and

results of operations.

In June 2011, the FASB issued an Accounting Standards Update that increases the prominence of items reported in other

comprehensive income in the financial statements. This update requires companies to present comprehensive income in a single

statement below net income or in a separate statement of comprehensive income immediately following the income statement.

This requirement became effective for us beginning with the first quarter of 2012, and we have included the required

presentation in all applicable filings since that date.

In December 2011, the FASB issued an Accounting Standards Update that required entities disclose both gross and net

information about instruments and transactions eligible for offset in the statement of financial position, as well as instruments

and transactions subject to a master netting arrangement. In addition, the update requires disclosure of collateral received and

posted in connection with master netting agreements or similar arrangements. This requirement became effective for us

beginning with the first quarter of 2013. This update did not have a material effect on our consolidated financial position or

results of operations, and we have included the required disclosures in all applicable filings since implementation.

In July 2012, the FASB issued an Accounting Standards Update that added an optional qualitative assessment for

determining whether an indefinite-lived intangible asset is impaired. The objective of this update is to reduce the cost and

complexity of performing an impairment test for indefinite-lived intangible assets by allowing an entity the option to make a

qualitative evaluation about the likelihood of an intangible impairment to determine whether it should calculate the fair value of

the asset. This accounting standards update also amends existing guidance by expanding upon the examples of events and

circumstances that an entity should consider between annual impairment tests in determining whether it is more likely than not

that the fair value of the intangible asset is less than its carrying amount. We adopted this accounting standard update and

applied its provisions to certain of our intangible assets for our annual impairment testing as of October 1, 2012.