UPS 2013 Annual Report Download - page 119

Download and view the complete annual report

Please find page 119 of the 2013 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.UNITED PARCEL SERVICE, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

107

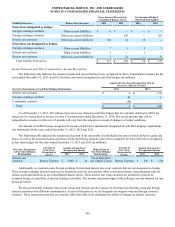

Types of Hedges

Commodity Risk Management

Currently, the fuel surcharges that we apply to our domestic and international package and LTL services are the primary

means of reducing the risk of adverse fuel price changes on our business. We periodically enter into option contracts on energy

commodity products to manage the price risk associated with forecasted transactions involving refined fuels, principally jet-A,

diesel and unleaded gasoline. The objective of the hedges is to reduce the variability of cash flows, due to changing fuel prices,

associated with the forecasted transactions involving those products. We designate and account for these contracts as cash flow

hedges of the underlying forecasted transactions involving these fuel products and, therefore, the resulting gains and losses from

these hedges are recognized as a component of fuel expense or revenue when the underlying transactions occur.

Foreign Currency Risk Management

To protect against the reduction in value of forecasted foreign currency cash flows from our international package business,

we maintain a foreign currency cash flow hedging program. Our most significant foreign currency exposures relate to the Euro,

British Pound Sterling, Canadian Dollar, Chinese Renminbi and Hong Kong Dollar. We hedge portions of our forecasted revenue

denominated in foreign currencies with option contracts. We have designated and account for these contracts as cash flow hedges of

anticipated foreign currency denominated revenue and, therefore, the resulting gains and losses from these hedges are recognized as

a component of international package revenue when the underlying sales transactions occur.

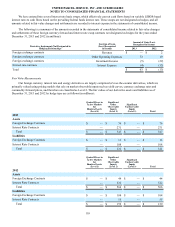

We also hedge portions of our anticipated cash settlements of intercompany transactions subject to foreign currency

remeasurement using foreign currency forward contracts. We have designated and account for these contracts as cash flow hedges

of forecasted foreign currency denominated transactions, and therefore the resulting gains and losses from these hedges are

recognized as a component of other operating expense when the underlying transactions are subject to currency remeasurement.

We have foreign currency denominated debt obligations and capital lease obligations associated with our aircraft. For some of

these debt obligations and leases, we hedge the foreign currency denominated contractual payments using cross-currency interest

rate swaps, which effectively convert the foreign currency denominated contractual payments into U.S. Dollar denominated

payments. We have designated and account for these swaps as cash flow hedges of the forecasted contractual payments and,

therefore, the resulting gains and losses from these hedges are recognized in the statements of consolidated income when the

currency remeasurement gains and losses on the underlying debt obligations and leases are incurred.

Interest Rate Risk Management

Our indebtedness under our various financing arrangements creates interest rate risk. We use a combination of derivative

instruments, including interest rate swaps and cross-currency interest rate swaps, as part of our program to manage the fixed and

floating interest rate mix of our total debt portfolio and related overall cost of borrowing. The notional amount, interest payment and

maturity dates of the swaps match the terms of the associated debt being hedged. Interest rate swaps allow us to maintain a target

range of floating rate debt within our capital structure.

We have designated and account for interest rate swaps that convert fixed rate interest payments into floating rate interest

payments as hedges of the fair value of the associated debt instruments. Therefore, the gains and losses resulting from fair value

adjustments to the interest rate swaps and fair value adjustments to the associated debt instruments are recorded to interest expense

in the period in which the gains and losses occur. We have designated and account for interest rate swaps that convert floating rate

interest payments into fixed rate interest payments as cash flow hedges of the forecasted payment obligations. The gains and losses

resulting from fair value adjustments to the interest rate swap are recorded to AOCI.

We periodically hedge the forecasted fixed-coupon interest payments associated with anticipated debt offerings, using forward

starting interest rate swaps, interest rate locks or similar derivatives. These agreements effectively lock a portion of our interest rate

exposure between the time the agreement is entered into and the date when the debt offering is completed, thereby mitigating the

impact of interest rate changes on future interest expense. These derivatives are settled commensurate with the issuance of the debt,

and any gain or loss upon settlement is amortized as an adjustment to the effective interest yield on the debt.