UPS 2013 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2013 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITED PARCEL SERVICE, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

71

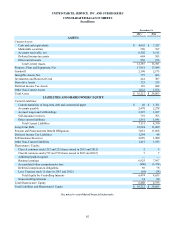

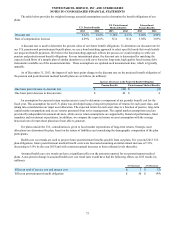

Maturity Information

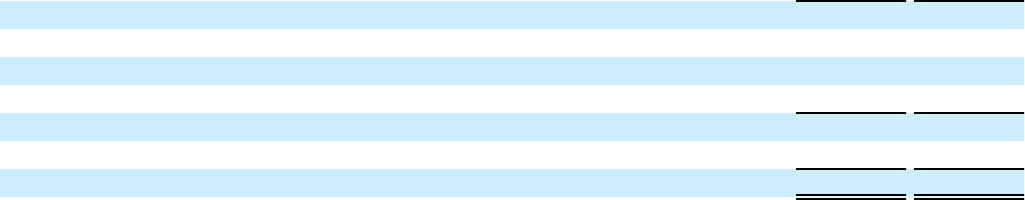

The amortized cost and estimated fair value of marketable securities at December 31, 2013, by contractual maturity, are

shown below (in millions). Actual maturities may differ from contractual maturities because the issuers of the securities may

have the right to prepay obligations without prepayment penalties.

Cost Estimated

Fair Value

Due in one year or less $ 33 $ 33

Due after one year through three years 432 432

Due after three years through five years 21 21

Due after five years 93 91

579 577

Equity securities 3 3

$ 582 $ 580

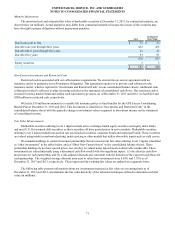

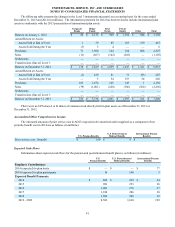

Non-Current Investments and Restricted Cash

Restricted cash is associated with our self-insurance requirements. We entered into an escrow agreement with an

insurance carrier to guarantee our self-insurance obligations. This agreement requires us to provide cash collateral to the

insurance carrier, which is reported in “Investments and Restricted Cash” on our consolidated balance sheets. Additional cash

collateral provided is reflected in other investing activities in the statements of consolidated cash flows. This restricted cash is

invested in money market funds and similar cash equivalent type assets. As of December 31, 2013 and 2012, we had $425 and

$288 million in restricted cash, respectively.

We held a $19 million investment in a variable life insurance policy to fund benefits for the UPS Excess Coordinating

Benefit Plan at December 31, 2013 and 2012. This investment is classified as “Investments and Restricted Cash” in the

consolidated balance sheets with the quarterly change in investment value recognized in investment income on the statements

of consolidated income.

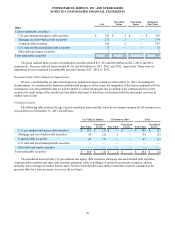

Fair Value Measurements

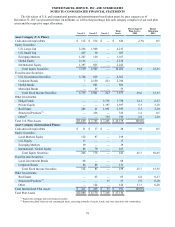

Marketable securities utilizing Level 1 inputs include active exchange-traded equity securities and equity index funds,

and most U.S. Government debt securities, as these securities all have quoted prices in active markets. Marketable securities

utilizing Level 2 inputs include non-auction rate asset-backed securities, corporate bonds and municipal bonds. These securities

are valued using market corroborated pricing, matrix pricing or other models that utilize observable inputs such as yield curves.

We maintain holdings in certain investment partnerships that are measured at fair value utilizing Level 3 inputs (classified

as “other investments” in the tables below, and as “Other Non-Current Assets” in the consolidated balance sheets). These

partnership holdings do not have quoted prices, nor can they be valued using inputs based on observable market data. These

investments are valued internally using a discounted cash flow model with two significant inputs: (1) the after-tax cash flow

projections for each partnership, and (2) a risk-adjusted discount rate consistent with the duration of the expected cash flows for

each partnership. The weighted-average discount rates used to value these investments were 8.65% and 7.75% as of

December 31, 2013 and 2012, respectively. These inputs and the resulting fair values are updated on a quarterly basis.

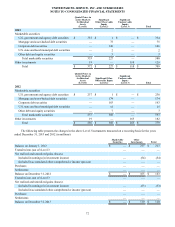

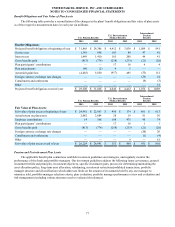

The following table presents information about our investments measured at fair value on a recurring basis as of

December 31, 2013 and 2012, and indicates the fair value hierarchy of the valuation techniques utilized to determine such fair

value (in millions):