UPS 2013 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2013 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITED PARCEL SERVICE, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

103

Our effective tax rate increased to 34.5% in 2013, compared with 17.1% in 2012, primarily due to an increase in total

pre-tax income and the decrease in U.S. Federal and state tax credits relative to total pre-tax income. The impact of these

factors was partially offset by a portion of the gain from liquidating a foreign subsidiary in early 2013 not being taxable (see

note 15).

Beginning in 2012, we were granted a tax incentive for certain of our non-U.S. operations, which is effective through

December 31, 2017 and may be extended through December 31, 2022 if additional requirements are satisfied. The tax

incentive is conditional upon our meeting specific employment and investment thresholds. The impact of this tax incentive

decreased non-U.S. tax expense by $20 million ($0.02 per share) and $22 million ($0.02 per share) for 2013 and 2012,

respectively.

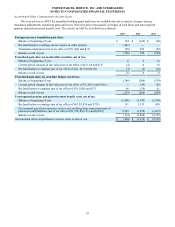

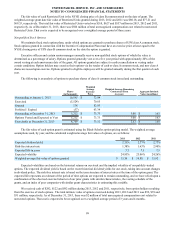

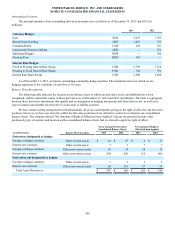

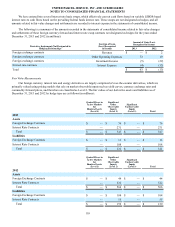

Deferred tax liabilities and assets are comprised of the following at December 31 (in millions):

2013 2012

Property, plant and equipment $ (3,613) $ (3,624)

Goodwill and intangible assets (1,116)(1,035)

Other (651)(617)

Deferred tax liabilities (5,380)(5,276)

Pension and postretirement benefits 3,086 4,608

Loss and credit carryforwards (non-U.S. and state) 279 258

Insurance reserves 765 737

Vacation pay accrual 224 209

Stock compensation 70 159

Other 709 708

Deferred tax assets 5,133 6,679

Deferred tax assets valuation allowance (251)(220)

Deferred tax asset (net of valuation allowance) 4,882 6,459

Net deferred tax asset (liability) $ (498) $ 1,183

Amounts recognized in the consolidated balance sheets:

Current deferred tax assets $ 684 $ 583

Current deferred tax liabilities (included in other current liabilities) (48)(36)

Non-current deferred tax assets 110 684

Non-current deferred tax liabilities (1,244)(48)

Net deferred tax asset (liability) $ (498) $ 1,183

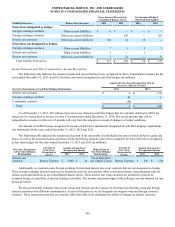

The valuation allowance increased by $31, $15 and $2 million during the years ended December 31, 2013, 2012 and

2011, respectively.

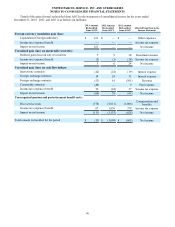

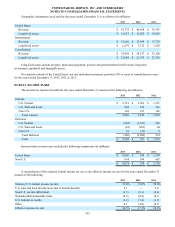

We have U.S. state and local operating loss and credit carryforwards as follows (in millions):

2013 2012

U.S. state and local operating loss carryforwards $ 546 $ 608

U.S. state and local credit carryforwards $ 42 $ 61

The operating loss carryforwards expire at varying dates through 2033. The state credits can be carried forward for

periods ranging from three years to indefinitely.