UPS 2013 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2013 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITED PARCEL SERVICE, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

77

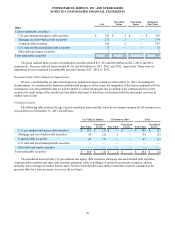

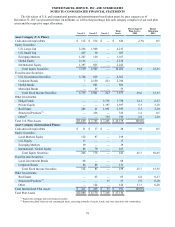

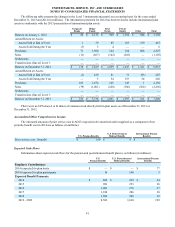

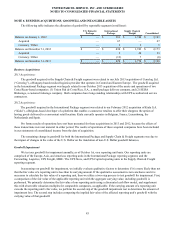

Benefit Obligations and Fair Value of Plan Assets

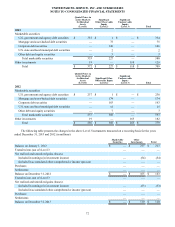

The following table provides a reconciliation of the changes in the plans’ benefit obligations and fair value of plan assets

as of the respective measurement dates in each year (in millions).

U.S. Pension Benefits U.S. Postretirement

Medical Benefits

International

Pension

Benefits

2013 2012 2013 2012 2013 2012

Benefit Obligations:

Projected benefit obligation at beginning of year $ 31,868 $ 24,386 $ 4,412 $ 3,836 $ 1,089 $ 841

Service cost 1,349 998 103 89 47 41

Interest cost 1,449 1,410 185 208 44 41

Gross benefits paid (813) (774)(258)(233)(21)(20)

Plan participants’ contributions — — 17 16 4 4

Plan amendments 140 (2) 4 1 — —

Actuarial (gain)/loss (4,485) 5,850 (417) 495 (55) 112

Foreign currency exchange rate changes — — — — (26) 24

Curtailments and settlements — — — — (6)(5)

Other — — — — — 51

Projected benefit obligation at end of year $ 29,508 $ 31,868 $ 4,046 $ 4,412 $ 1,076 $ 1,089

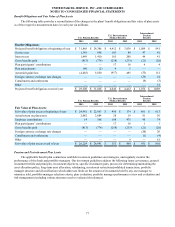

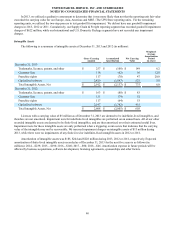

U.S. Pension Benefits U.S. Postretirement

Medical Benefits

International

Pension

Benefits

2013 2012 2013 2012 2013 2012

Fair Value of Plan Assets:

Fair value of plan assets at beginning of year $ 24,941 $ 22,663 $ 460 $ 174 $ 801 $ 613

Actual return on plan assets 2,082 2,684 28 19 81 56

Employer contributions 14 368 108 475 90 74

Plan participants’ contributions — — 17 16 1 1

Gross benefits paid (813) (774)(258)(233)(21)(20)

Foreign currency exchange rate changes — — — — (20) 20

Curtailments and settlements — — — — (1)(4)

Other — — — 9 — 61

Fair value of plan assets at end of year $ 26,224 $ 24,941 $ 355 $ 460 $ 931 $ 801

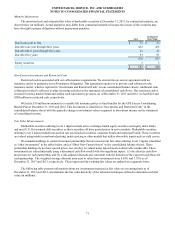

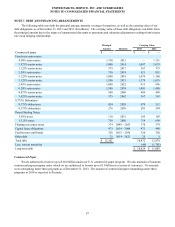

Pension and Postretirement Plan Assets

The applicable benefit plan committees establish investment guidelines and strategies, and regularly monitor the

performance of the funds and portfolio managers. Our investment guidelines address the following items: governance, general

investment beliefs and principles, investment objectives, specific investment goals, process for determining/maintaining the

asset allocation policy, long-term asset allocation, rebalancing, investment restrictions/prohibited transactions, portfolio

manager structure and diversification (which addresses limits on the amount of investments held by any one manager to

minimize risk), portfolio manager selection criteria, plan evaluation, portfolio manager performance review and evaluation and

risk management (including various measures used to evaluate risk tolerance).