UPS 2013 Annual Report Download - page 122

Download and view the complete annual report

Please find page 122 of the 2013 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITED PARCEL SERVICE, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

110

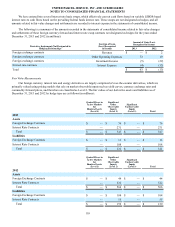

We have entered into several interest rate basis swaps, which effectively convert cash flows based on variable LIBOR-based

interest rates to cash flows based on the prevailing federal funds interest rate. These swaps are not designated as hedges, and all

amounts related to fair value changes and settlements are recorded to interest expense in the statements of consolidated income.

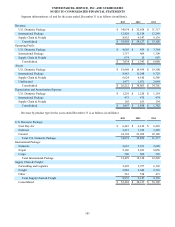

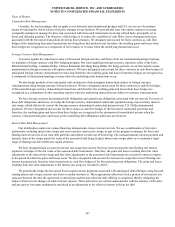

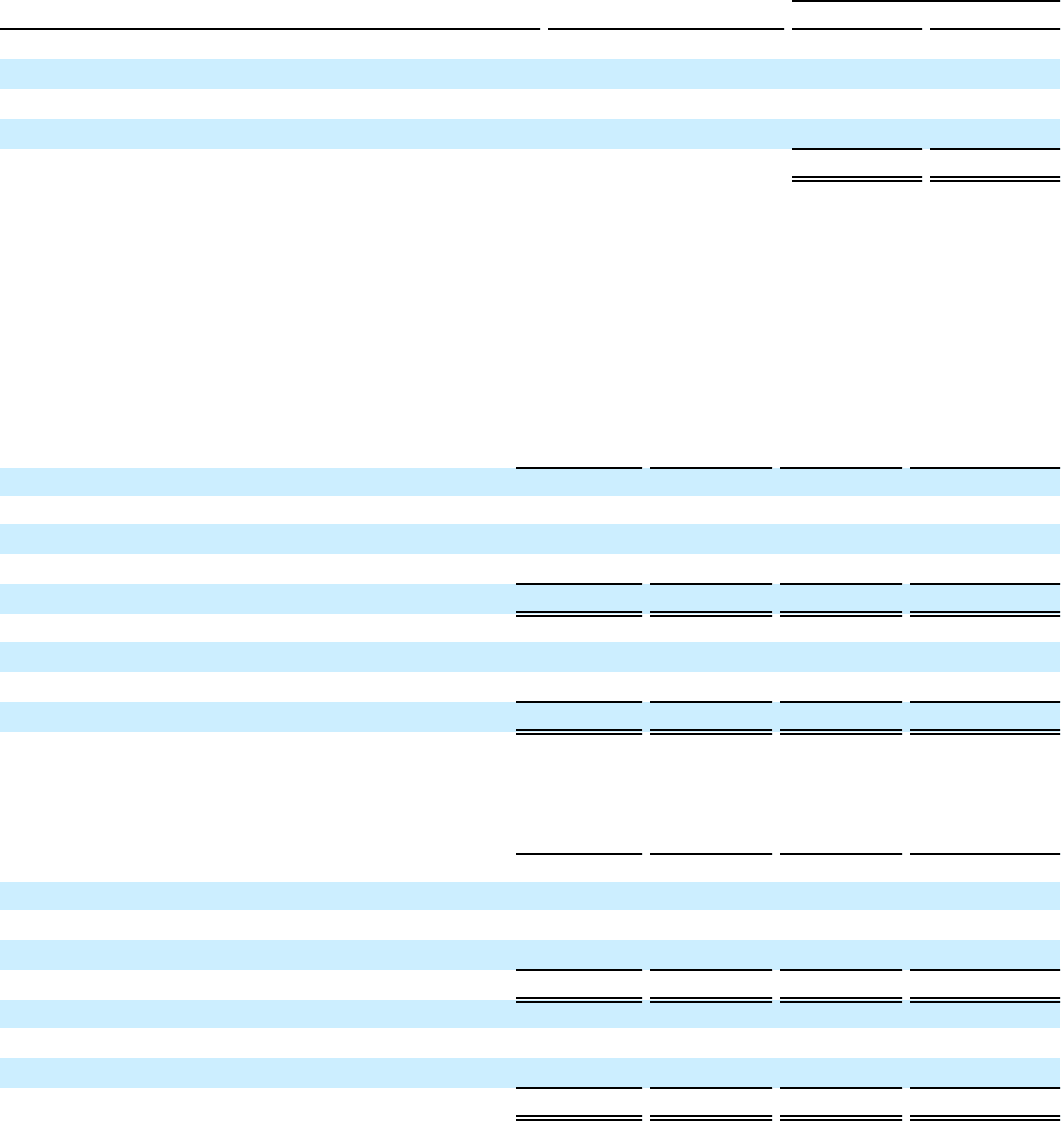

The following is a summary of the amounts recorded in the statements of consolidated income related to fair value changes

and settlements of these foreign currency forward and interest rate swap contracts not designated as hedges for the years ended

December 31, 2013 and 2012 (in millions):

Derivative Instruments Not Designated in

Hedging Relationships

Location of Gain

(Loss) Recognized

in Income

Amount of Gain (Loss)

Recognized in Income

2013 2012

Foreign exchange contracts Revenue $ — $ 2

Foreign exchange contracts Other Operating Expenses 72 19

Foreign exchange contracts Investment Income (5) (22)

Interest rate contracts Interest Expense (4) (12)

Total $ 63 $ (13)

Fair Value Measurements

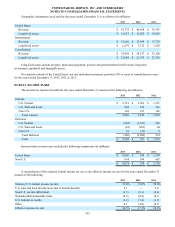

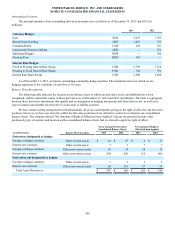

Our foreign currency, interest rate and energy derivatives are largely comprised of over-the-counter derivatives, which are

primarily valued using pricing models that rely on market observable inputs such as yield curves, currency exchange rates and

commodity forward prices, and therefore are classified as Level 2. The fair values of our derivative assets and liabilities as of

December 31, 2013 and 2012 by hedge type are as follows (in millions):

Quoted Prices in

Active Markets

for

Identical Assets

(Level 1)

Significant

Other

Observable

Inputs

(Level 2)

Significant

Unobservable

Inputs

(Level 3) Total

2013

Assets

Foreign Exchange Contracts $ — $ 76 $ — $ 76

Interest Rate Contracts — 271 — 271

Total $ — $ 347 $ — $ 347

Liabilities

Foreign Exchange Contracts $ — $ 13 $ — $ 13

Interest Rate Contracts — 108 — 108

Total $ — $ 121 $ — $ 121

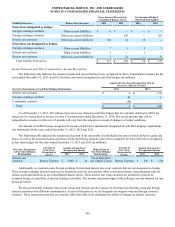

Quoted Prices in

Active Markets

for

Identical Assets

(Level 1)

Significant

Other

Observable

Inputs

(Level 2)

Significant

Unobservable

Inputs

(Level 3) Total

2012

Assets

Foreign Exchange Contracts $ — $ 44 $ — $ 44

Interest Rate Contracts — 522 — 522

Total $ — $ 566 $ — $ 566

Liabilities

Foreign Exchange Contracts $ — $ 104 $ — $ 104

Interest Rate Contracts — 55 — 55

Total $ — $ 159 $ — $ 159