UPS 2013 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2013 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITED PARCEL SERVICE, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

94

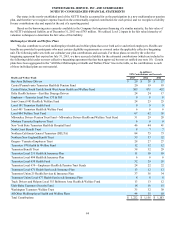

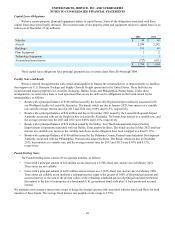

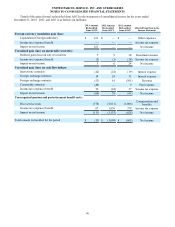

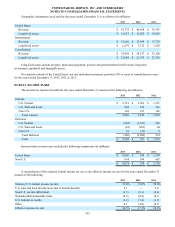

The following is a rollforward of our common stock, additional paid-in capital, and retained earnings accounts (in

millions, except per share amounts):

2013 2012 2011

Shares Dollars Shares Dollars Shares Dollars

Class A Common Stock

Balance at beginning of year 225 $ 3 240 $ 3 258 $ 3

Common stock purchases (8)(1)(9) — (7) —

Stock award plans 9 — 8 — 7 —

Common stock issuances 4 — 3 — 3 —

Conversions of class A to class B common stock (18) — (17) — (21) —

Class A shares issued at end of year 212 $ 2 225 $ 3 240 $ 3

Class B Common Stock

Balance at beginning of year 729 $ 7 725 $ 7 735 $ 7

Common stock purchases (35) — (13) — (31) —

Conversions of class A to class B common stock 18 — 17 — 21 —

Class B shares issued at end of year 712 $ 7 729 $ 7 725 $ 7

Additional Paid-In Capital

Balance at beginning of year $ — $ — $ —

Stock award plans 554 444 388

Common stock purchases (768)(943)(475)

Common stock issuances 307 293 287

Option Premiums Received (Paid) (93) 206 (200)

Balance at end of year $ — $ — $ —

Retained Earnings

Balance at beginning of year $ 7,997 $ 10,128 $ 10,604

Net income attributable to controlling interests 4,372 807 3,804

Dividends ($2.48, $2.28 and $2.08 per share) (2,367)(2,243)(2,086)

Common stock purchases (3,077)(695)(2,194)

Balance at end of year $ 6,925 $ 7,997 $ 10,128

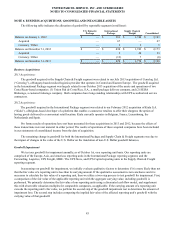

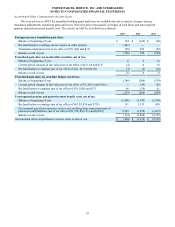

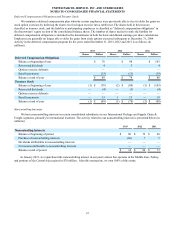

For the years ended December 31, 2013, 2012 and 2011, we repurchased a total of 43.2, 21.8 and 38.7 million shares of

class A and class B common stock for $3.846 billion, $1.638 billion and $2.669 billion, respectively. On February 14, 2013, the

Board of Directors approved a new share repurchase authorization of $10.0 billion, which replaced the 2012 authorization.

This new share repurchase authorization has no expiration date. As of December 31, 2013, we had $6.814 billion of this share

repurchase authorization remaining.

From time to time, we enter into share repurchase programs with large financial institutions to assist in our buyback of

company stock. These programs allow us to repurchase our shares at a price below the weighted average UPS share price for a

given period. During the fourth quarter of 2013, we entered into an accelerated share repurchase program, which allowed us to

repurchase $600 million of shares (5.9 million shares). The program was completed in December 2013.

In order to lower the average cost of acquiring shares in our ongoing share repurchase program, we periodically enter into

structured repurchase agreements involving the use of capped call options for the purchase of UPS class B shares. We pay a

fixed sum of cash upon execution of each agreement in exchange for the right to receive either a pre-determined amount of cash

or stock. Upon expiration of each agreement, if the closing market price of our common stock is above the pre-determined

price, we will have our initial investment returned with a premium in either cash or shares (at our election). If the closing

market price of our common stock is at or below the pre-determined price, we will receive the number of shares specified in the

agreement. As of December 31, 2013, we paid net premiums of $100 million on options for the purchase of 1.1 million shares

with a strike price of $88.54 per share that will settle in the first quarter of 2014. During 2013, we settled options that resulted

in $7 million in premiums (in excess of our initial investment). During 2012, we did not pay premiums on options for the

purchase of shares; however, we received $206 million in premiums for options that were entered into during 2011 that expired

during 2012.