UPS 2013 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2013 UPS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITED PARCEL SERVICE, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

76

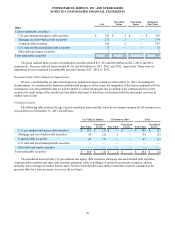

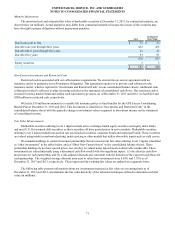

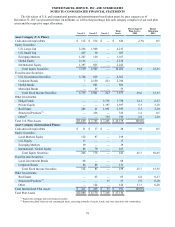

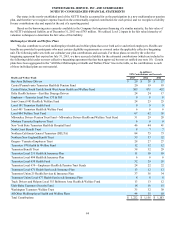

Funded Status

The following table discloses the funded status of our plans and the amounts recognized in our balance sheet as of

December 31 (in millions):

U.S. Pension Benefits U.S. Postretirement

Medical Benefits

International

Pension

Benefits

2013 2012 2013 2012 2013 2012

Funded Status:

Fair value of plan assets $ 26,224 $ 24,941 $ 355 $ 460 $ 931 $ 801

Benefit obligation (29,508)(31,868)(4,046)(4,412)(1,076)(1,089)

Funded status recognized at December 31 $(3,284) $ (6,927) $ (3,691) $ (3,952) $ (145) $ (288)

Funded Status Amounts Recognized in our Balance

Sheet:

Other non-current assets $ — $ — $ — $ — $ 47 $ 26

Other current liabilities (16)(14)(97)(108)(3)(3)

Pension and postretirement benefit obligations (3,268)(6,913)(3,594)(3,844)(189)(311)

Net liability at December 31 $(3,284) $ (6,927) $ (3,691) $ (3,952) $ (145) $ (288)

Amounts Recognized in AOCI:

Unrecognized net prior service cost $(1,286) $ (1,318) $ (79) $ (79) $ (9) $ (13)

Unrecognized net actuarial gain (loss) 1,233 (3,187)(29)(441)(7)(86)

Gross unrecognized cost at December 31 (53)(4,505)(108)(520)(16)(99)

Deferred tax asset at December 31 20 1,694 41 196 2 26

Net unrecognized cost at December 31 $(33) $ (2,811) $ (67) $ (324) $ (14) $ (73)

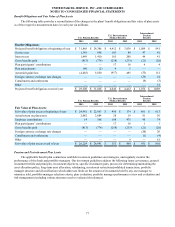

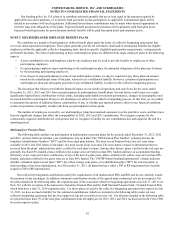

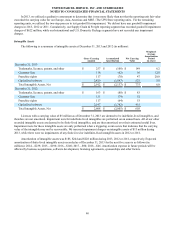

The accumulated benefit obligation for our pension plans as of the measurement dates in 2013 and 2012 was $28.586 and

$30.350 billion, respectively.

Benefit payments under the pension plans include $16 million paid from employer assets in both 2013 and 2012. Benefit

payments (net of participant contributions) under the postretirement medical benefit plans include $108 and $110 million paid

from employer assets in 2013 and 2012, respectively. Such benefit payments from employer assets are also categorized as

employer contributions.

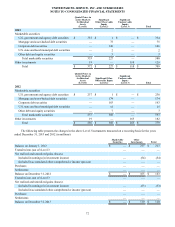

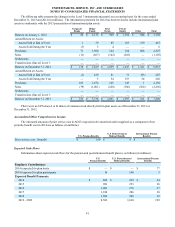

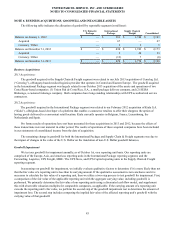

At December 31, 2013 and 2012, the projected benefit obligation, the accumulated benefit obligation, and the fair value

of plan assets for pension plans with benefit obligations in excess of plan assets were as follows (in millions):

Projected Benefit Obligation

Exceeds the Fair Value of Plan

Assets

Accumulated Benefit Obligation

Exceeds the Fair Value of Plan

Assets

2013 2012 2013 2012

U.S. Pension Benefits

Projected benefit obligation $ 29,508 $ 31,868 $ 29,508 $ 31,868

Accumulated benefit obligation 27,623 29,382 27,623 29,382

Fair value of plan assets 26,224 24,941 26,224 24,941

International Pension Benefits

Projected benefit obligation $ 764 $ 1,028 $ 361 $ 678

Accumulated benefit obligation 658 917 301 606

Fair value of plan assets 580 723 184 388

The accumulated postretirement benefit obligation exceeds plan assets for all of our U.S. postretirement medical benefit

plans.